The Synthetix Reboot is accelerating with the re-launch of Synthetix Trade, the discharge of Multi-Collateral Perps on Base, a brand new web site, and the upcoming launch of Synthetix Leveraged Tokens. Base Multi-Collateral Perps on the brand new Synthetix Trade allows Perps merchants to make use of quite a lot of new collateral sorts and preserve their publicity to favorites like BTC and ETH.

Getting ready for this main launch, we kicked off the Decembrrrr Base LP Incentives, a four-week promotion for Base LPs with 80,000 SNX and 100,000 USDC rewards working from December tenth via January seventh. We’ve additionally elevated the buying and selling charge distribution on V3 by 50%, additional boosting LP incentives with SCCP-373. Early customers of each Synthetix Trade and the upcoming Synthetix Leverage Tokens can look ahead to new incentive applications deliberate for January.

After two profitable acquisitions, Synthetix now has two new buying and selling merchandise for customers, a daring departure from the earlier technique of offering back-end liquidity and infrastructure to derivatives platforms. Lower than a month in the past, Synthetix acquired their ecosystem-leading Perps DEX Kwenta after a profitable vote by each DAOs.

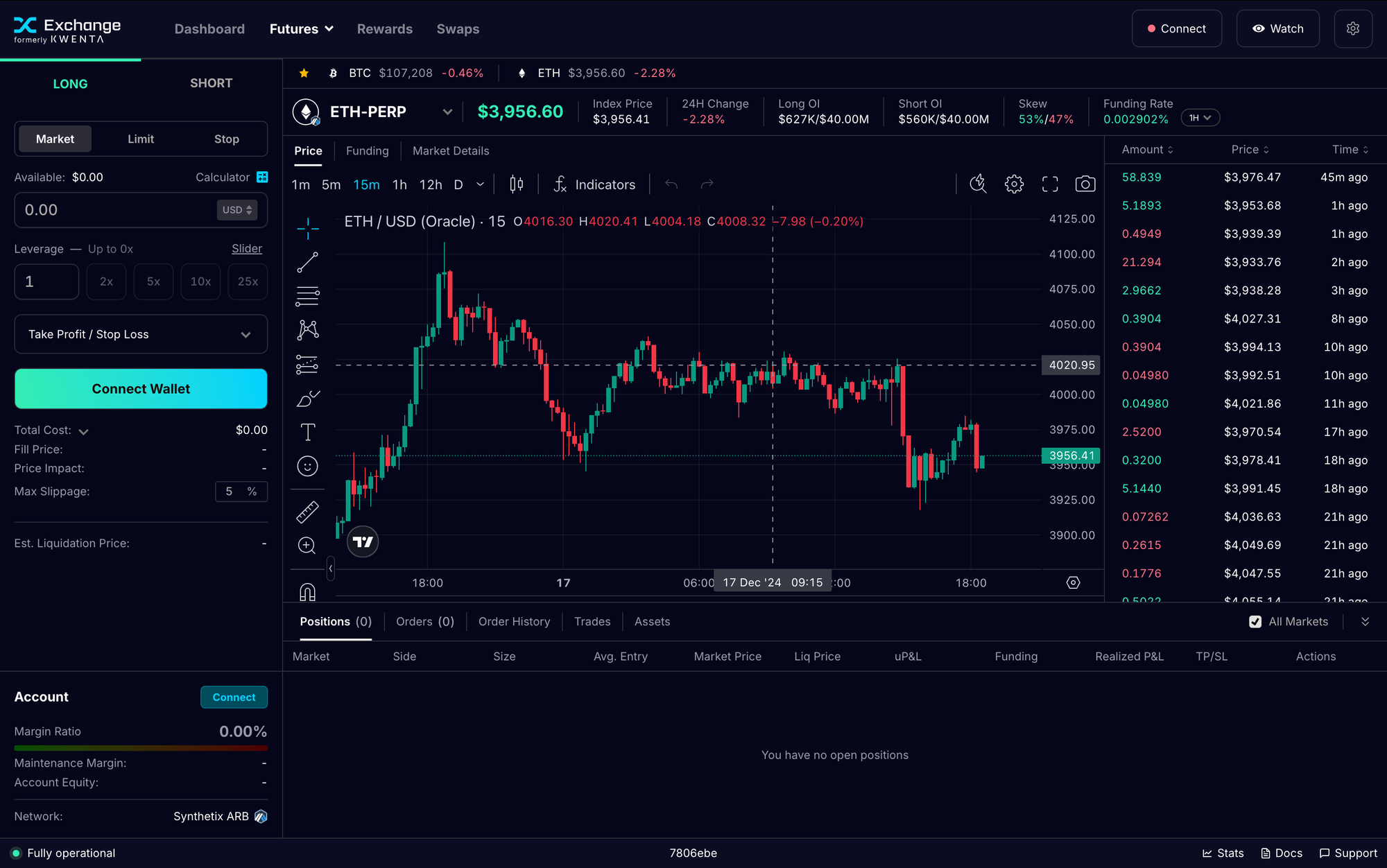

As we speak marks the re-launch of Synthetix Trade with an up to date UI and, most significantly, Multi-Collateral Perps on the Base community. Whereas Synthetix will proceed to assist and welcome builders of derivatives merchandise and exchanges, Synthetix Trade will turn out to be considered one of our new flagship merchandise alongside Synthetix Leverage Tokens, offering a world-class buying and selling expertise with low charges and deep liquidity.

Since our preliminary Base deployment with assist for less than USDC as margin, we’ve listened to the group’s demand for higher asset flexibility. With this launch, Perps V3 on Base now helps a number of new collateral sorts that includes:

cbBTC

Coinbase’s wrapped Bitcoin, cbBTC, is backed 1:1 by BTC and held in custody by Coinbase, which has a ten+ yr document of securely custodying billions in Bitcoin for establishments and prospects. Utilized throughout dozens of DeFi platforms, cbBTC offers Bitcoin holders extra flexibility.

Coinbase prospects in choose geos can use the ship & obtain function to maneuver their BTC on and offchain seamlessly. When customers ship their BTC from Coinbase to Base, Solana, or Ethereum, it is going to routinely be transformed 1:1 to cbBTC. When customers obtain cbBTC of their Coinbase accounts, it is going to be transformed 1:1 from cbBTC to BTC.

cbETH

Coinbase’s liquid staking model of ETH, cbETH, is a token that represents staked ETH. It’s designed for use all through the onchain ecosystem, enabling participation in dozens of DeFi integrations with out lockups.

Staked ETH may be wrapped into cbETH in just some steps and with zero charges on the Coinbase platform, in addition to unwrapped at any time.

wstETH

Lido’s wrapped staked ETH (wstETH) is by far the most well-liked liquid staking token for Ethereum, with a staggering 72% market share and market capitalization of over $25 billion in keeping with Dune. Lido’s wstETH boasts over 100+ integrations with vast adoption throughout DeFi protocols and wallets. Non-custodial and battle-tested, wstETH represents staked ETH in a decentralized community of validators.

wETH

Final however not least, wrapped ETH (wETH) is Ethereum that can be utilized in quite a lot of DeFi purposes on the Base chain. Backed 1:1 with ETH, it may be exchanged for ETH at any time and is equal in worth. Whereas liquid staking variations of ETH could also be most well-liked by some customers, there are lots of preferring ETH with out extra staking or re-staking smart-contract danger to make use of in DeFi purposes.

For extra particulars on these new collateral sorts, see SCCP-357.

This collateral growth lets merchants preserve direct publicity to fashionable crypto property like BTC and staked ETH with out requiring stablecoin collateral for Perps buying and selling. This provides them extra management over margin positions and simpler entry to hedging, diversification, and development. By providing numerous collateral choices, the market opens as much as those that favor restricted stablecoin publicity, enabling merchants to make use of their crypto holdings as collateral somewhat than stablecoins.

Multi-collateral assist can be designed to present merchants, liquidity suppliers, and integrators the flexibleness to make use of extra superior methods, akin to delta-neutral positioning and diverse danger exposures. We’re excited to see this expanded collateral performance unlock much more potential for development throughout the Synthetix ecosystem on Base.

With the doorways now open for Multi-Collateral Perps on Base, it’s the proper time to discover this new option to commerce. Go to Synthetix Trade to get began right this moment, and be sure you comply with the SNX Trade Twitter for all associated updates, together with particulars on the upcoming buying and selling competitors!