The co-founders of the crypto analytics platform Glassnode are issuing a warning that Bitcoin (BTC) could also be heading for a extreme correction after its historic $100,000 breakthrough.

Jan Happel and Yann Allemann, who go by the deal with Negentropic, inform their 63,200 followers on the social media platform X that the Bitcoin Elementary Index (BFI) metric is singling a weakening market.

The BFI evaluates a number of elements of the Bitcoin market, together with pockets exercise and transaction quantity. When it declines, the chance of a market correction will increase.

“To not rain on the parade, however Bitcoin has crossed $100,000, but the Bitcoin Elementary Index (BFI) is beginning to weaken. Ought to we be involved? This indicator typically sends early warning indicators, and as soon as confirmed, they’re exhausting to disregard. Take the market peak in Q1 this 12 months for example: the BFI confirmed the exit level forward of a major correction. For now, we’ll maintain monitoring, however the bull run nonetheless has gasoline left.”

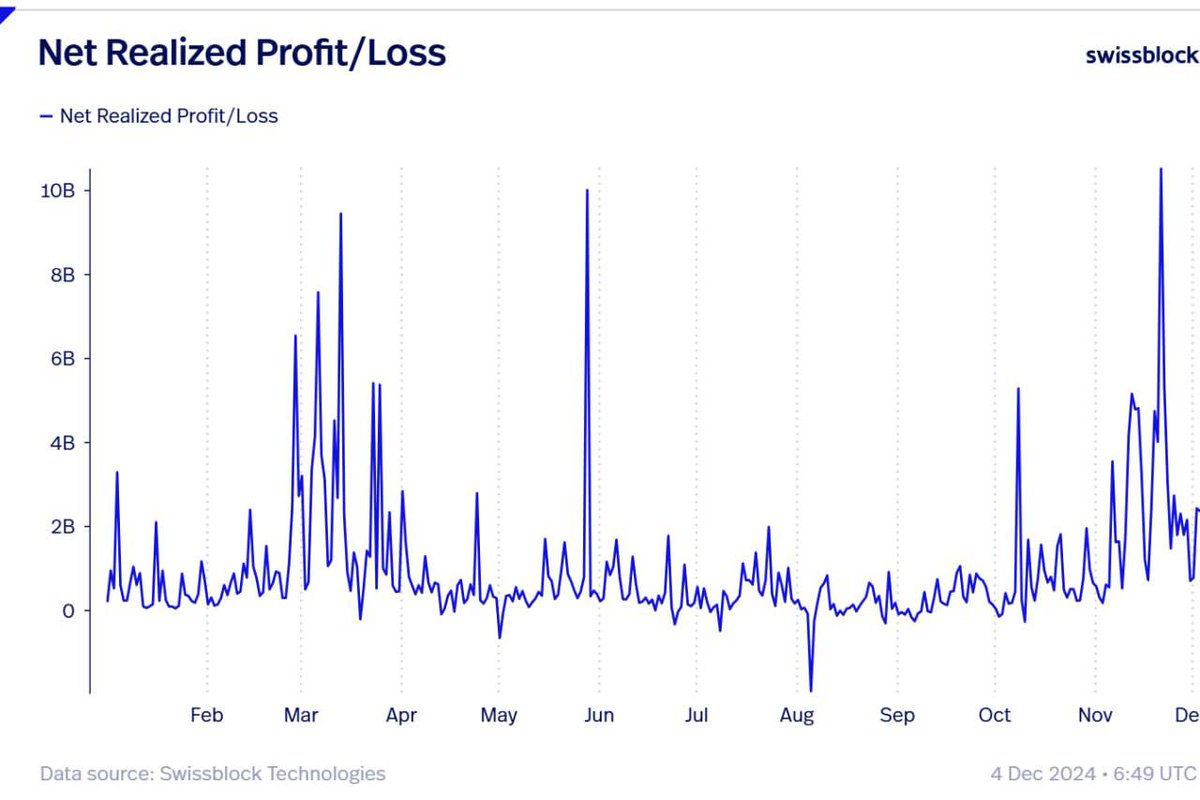

Previous to Bitcoin breaking the $100,000 resistance degree, the analysts stated the web realized revenue/loss metric, which tracks whether or not Bitcoin holders are promoting at a loss or a revenue, indicated holders had been ready for larger worth targets earlier than they’d probably begin taking earnings.

“Bitcoin merchants maintain out for larger ranges. One other signal of Bitcoin’s worth consolidation is merchants’ reluctance to take earnings on this vary. They’re aiming for larger ranges, anticipating beneficial properties as soon as Bitcoin begins difficult key resistances. As soon as Bitcoin overcomes its resistance and establishes itself above $100,000, we’ll probably witness spikes to the upside on this chart, signaling dealer confidence turning into motion.”

Bitcoin is buying and selling for $96,579 at time of writing, down 6.8% from its new all-time excessive of $103,679.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney