Fast Take

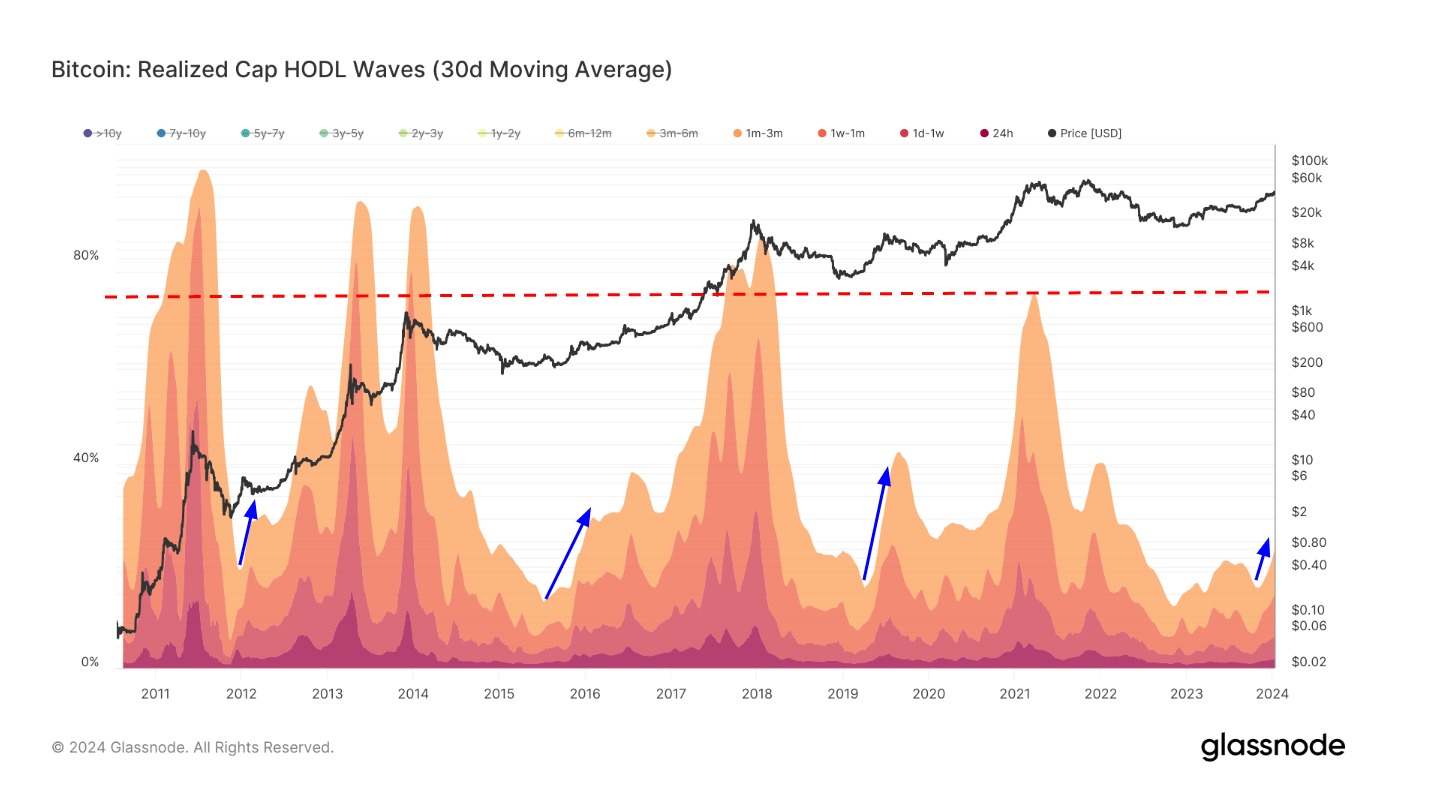

HODL waves, a visible depiction of Bitcoin’s provide primarily based on when it final moved, are revealing a budding cohort within the digital asset area.

Quick-term holders, outlined as these retaining Bitcoin for a most of 155 days. Wanting particularly at buyers who’ve held for 3 months or much less are growing in quantity and presently account for 14% of the Bitcoin provide. These buyers, typically speculative, maintain the potential to both liquidate their positions after a number of months or mature into long-term holders, retaining their Bitcoin for 155 days or longer.

An fascinating pattern emerges as we delve deeper into the HODL waves. When the short-term holder proportion reaches sure ranges, these buyers typically metamorphose into longer-term holders, a sample indicated by earlier cycles. This transformation leads to a bigger proportion of Bitcoin provide being held by these buyers.

Nonetheless, the cycle peak happens when short-term holders develop into the dominant buyers, controlling about 80% of the availability. This usually corresponds with market tops, as these buyers are inclined to drive the value up in a ‘Worry of Lacking Out’ (FOMO) euphoria, with long-term holders offloading their holdings.

The submit Bitcoin “HODL wave” patterns sign potential FOMO-driven value climbs appeared first on CryptoSlate.