The founders of analytics agency Glassnode are predicting that Bitcoin (BTC) will quickly print contemporary all-time highs for one key motive.

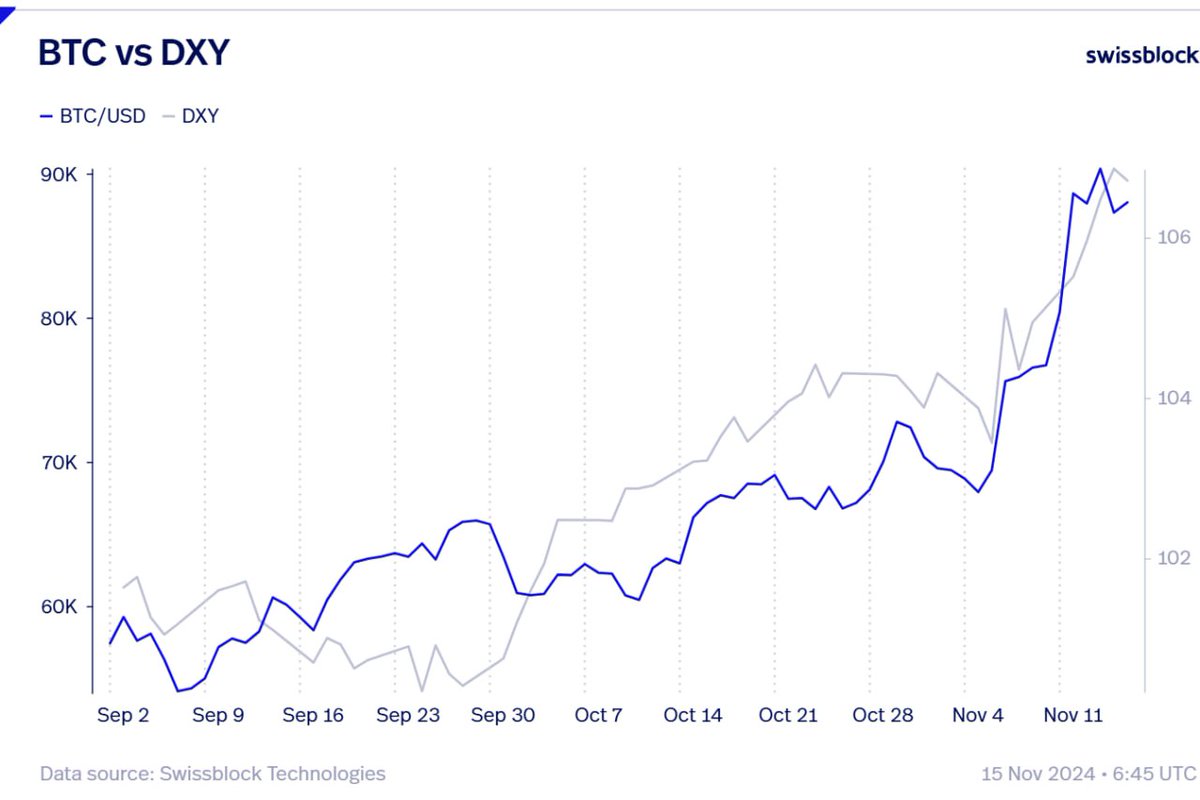

Jan Happel and Yann Allemann, who go by the deal with Negentropic, inform their 63,200 followers on the social media platform X that Bitcoin could surge if the US Greenback Index (DXY) begins to say no because of the Fed’s rate-cutting cycle and quantitative easing (QE).

The DXY is a measure of the worth of the US greenback in opposition to a basket of six main currencies. Merchants preserve an in depth watch on the DXY as a weak index means that traders are favoring danger property like shares and crypto over the greenback.

“Bitcoin and DXY: a decent dance. Bitcoin has carefully tracked the DXY for weeks, particularly post-US elections, because the greenback hit new yearly highs. However with easing insurance policies in play, what occurs when the DXY weakens and decoupling begins? Indicators level to Bitcoin smashing new all-time highs with ease.”

Bitcoin is buying and selling for $89,200 at time of writing, down almost 5% from its all-time excessive of about $93,500.

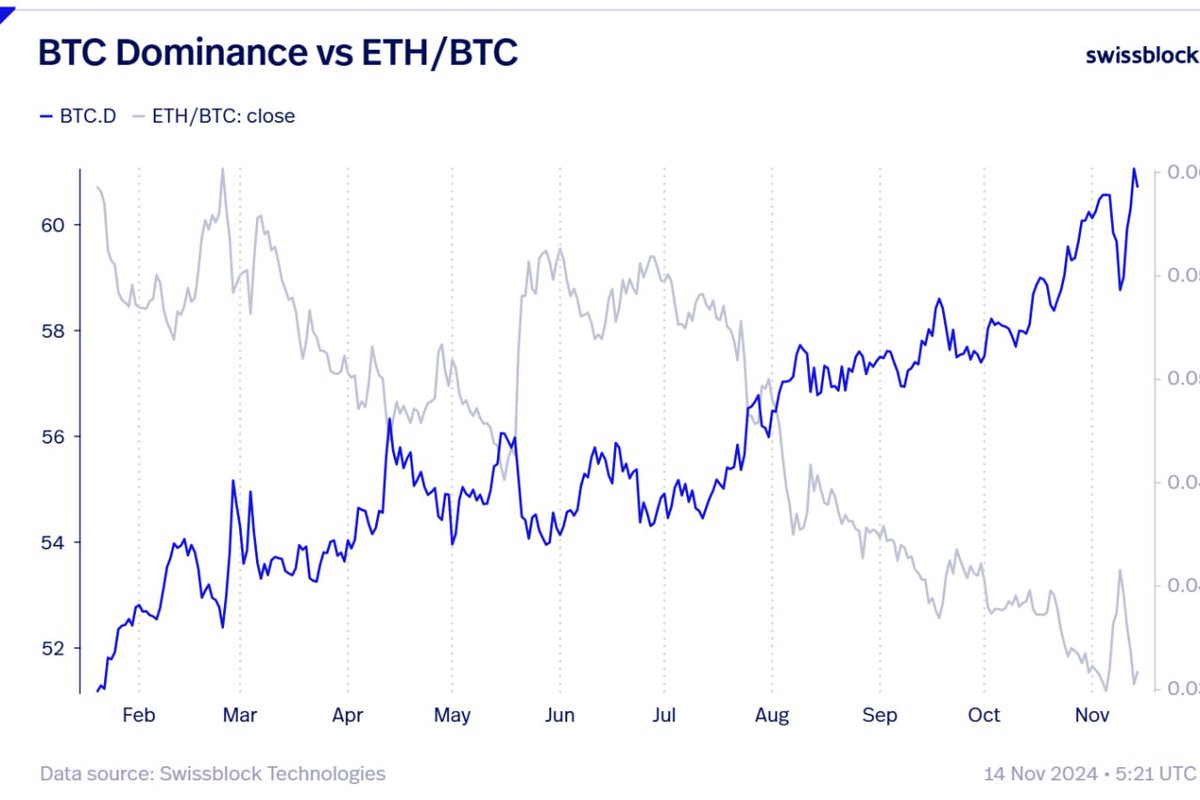

Subsequent up, the analysts say Ethereum (ETH) is displaying market energy regardless of declining in opposition to Bitcoin (ETH/BTC).

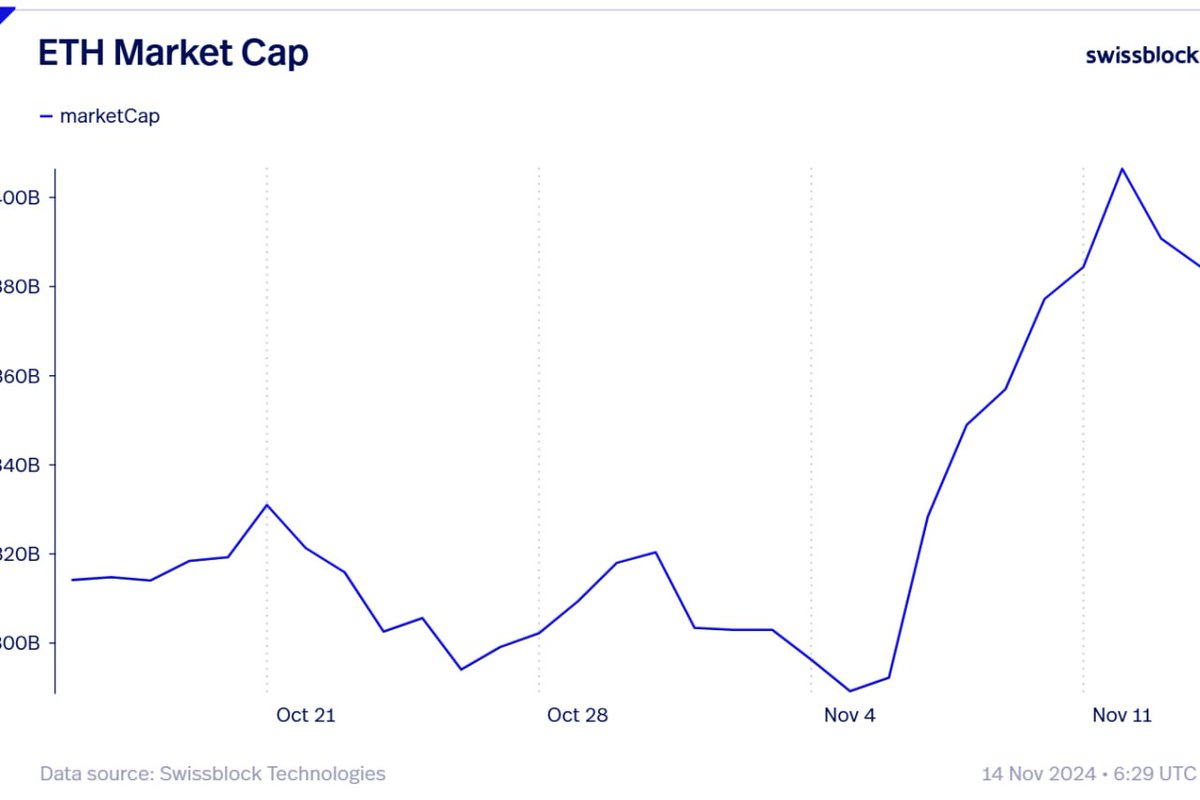

“Throughout this Bitcoin rally, Ethereum took off, and as BTC hit $74,000 with a drop in dominance, the ETH/BTC pair eased its strain. However after Bitcoin’s weekend pump, pushing it to $93,000, BTC dominance has surged, whereas the ETH/BTC pair slumped – with out Ethereum’s value dropping considerably. What does this sign? A Bitcoin dominance rebound or ETH holders dumping on the pump? Having a look at Ethereum’s market cap: after ‘Tremendous Tuesday,’ it rose from $290 billion to only over $400 billion, Throughout this ETH/BTC pullback and BTC dominance surge, ETH’s market cap solely dipped to $380 billion. This means no dumping, simply Bitcoin’s energy outshining different market forces.”

Bitcoin’s dominance degree (BTC.D) is the ratio between the market cap of BTC versus the market cap of all crypto property mixed. At time of writing, BTC.D is at 61%.

ETH/BTC is buying and selling for 0.03398 BTC ($3,035) at time of writing, down 4.39% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you might incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Sol Invictus/IvaFoto