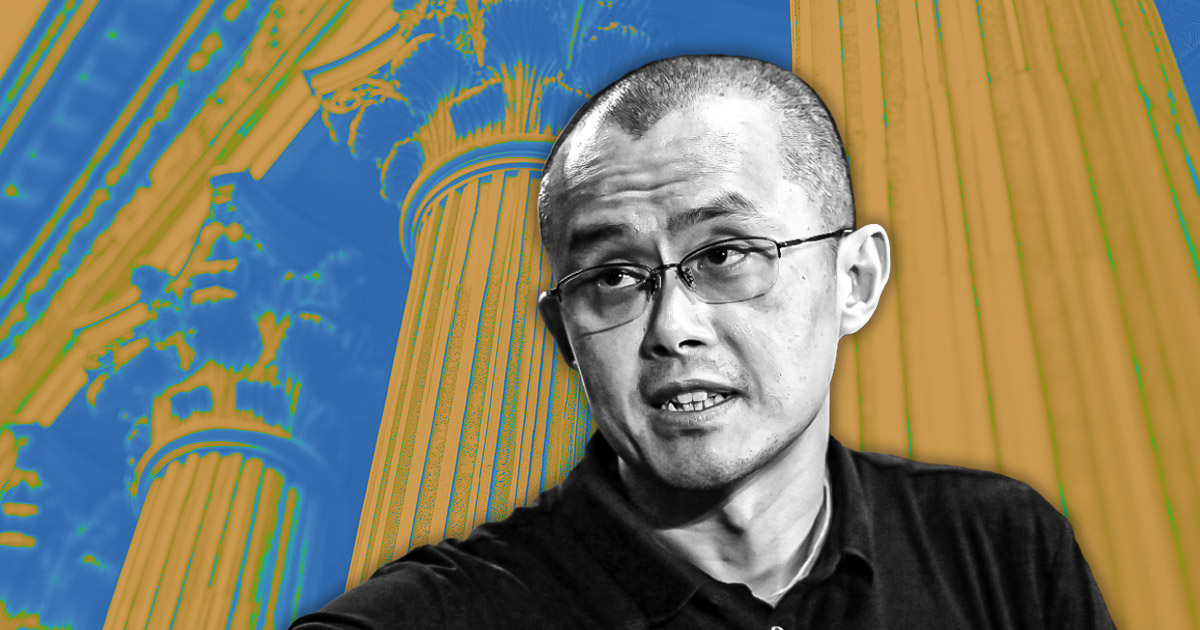

Binance and its founder, Changpeng Zhao, have filed a movement to dismiss the US Securities and Alternate Fee’s (SEC) amended grievance.

In a Nov. 4 courtroom submitting, Binance and Zhao’s authorized staff argued that the SEC has solely superficially acknowledged a previous courtroom ruling, which clarified that crypto just isn’t inherently labeled as a safety.

Based on them, the SEC’s expanded lawsuit contradicts an present courtroom ruling that distinguished crypto from securities. The change highlighted that the SEC’s place disregards the logical implications of that ruling, which means that secondary market resales of digital property don’t represent securities transactions after their builders initially distributed the property.

The defendants additional argued that the amended grievance lacks a transparent authorized basis to tell apart between property concerned in funding contracts and the funding contracts themselves.

The submitting said:

“Belongings—whether or not oranges, Beanie Infants, or crypto property—don’t develop into funding contracts in perpetuity just because they have been initially supplied and offered to clients as a part of a bundle of guarantees and expectations that collectively qualify as ‘funding contracts’ underneath the Howey check.”

Binance additional defined that token gross sales over exchanges are typically impersonal. When one get together locations an order to purchase and one other locations an order to promote, the transaction is accomplished by matching software program with out direct interplay. In these instances, consumers lack any cheap expectation that their funds are invested right into a joint enterprise aimed toward producing earnings. With out this expectation, the transaction fails to fulfill the necessities of an funding contract underneath securities regulation.

So, Binance is in search of the dismissal of the amended grievance and needs particular parts of the SEC’s requested reduction faraway from consideration.

Blind gross sales

Moreover, Binance and Zhao contested the SEC’s classification of alleged blind gross sales of BNB by Binance Holdings Restricted (BHL) as funding contracts. They argued that these gross sales resemble resales, the place consumers had minimal details about the vendor, making them unlikely to qualify as funding contracts.

In the meantime, Binance’s movement to dismiss additionally features a request to reject the monetary regulator’s request for disgorgement and efforts to bar Zhao from taking part within the securities market. The submitting said:

“After an in depth pre-suit investigation and 16 months of ‘expedited uncover’ into BAM’s custody of buyer wallets and property, ECF 71 at 9, the Amended Grievance nonetheless conspicuously lacks any allegations that the challenged conduct by BHL or Mr. Zhao harmed clients, as is required for the SEC to hunt disgorgement.”

Earlier within the yr, the SEC expanded its authentic lawsuit towards Binance to embody extra digital property. Within the modification, the SEC additionally maintained that almost all crypto transactions, together with secondary market trades, qualify as securities transactions.

This improvement happens amid ongoing debate in regards to the SEC’s inconsistent strategy to defining the safety standing of digital property. Over time, the SEC has confronted criticism for its conflicting stances and perceived contradictions with courtroom rulings.