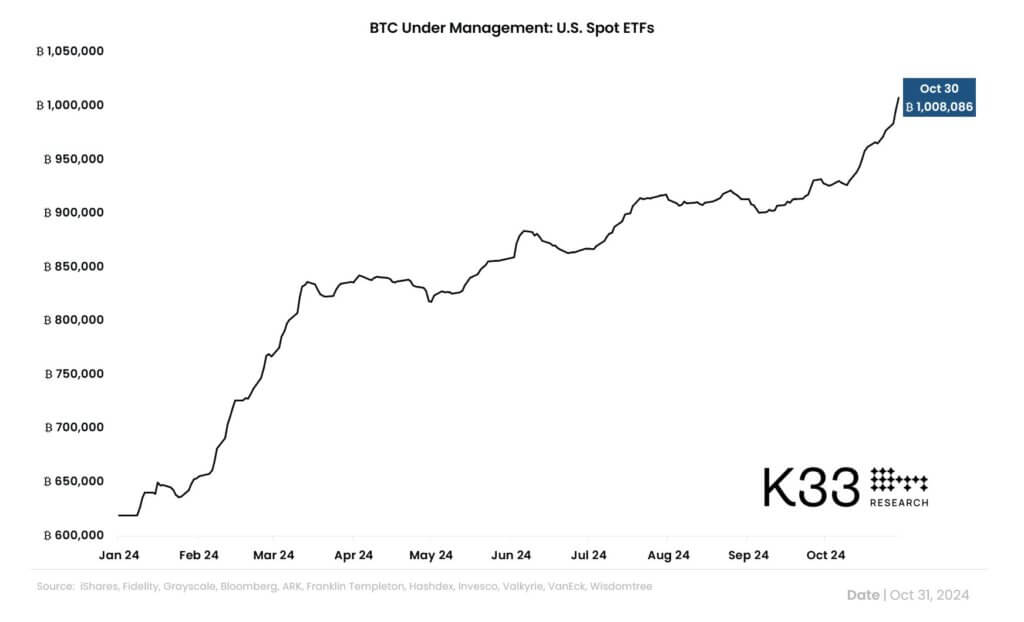

In accordance with K33 Analysis, the mixed on-chain property underneath administration (AUM) of all spot Bitcoin ETFs have surpassed 1 million Bitcoin. This milestone signifies rising investor confidence within the digital asset.

CryptoSlate has corroborated the information by Coinglass and CryptoQuant knowledge, which point out that the AUM stood at 995,000 BTC earlier than yesterday’s large influx of over 10,000 BTC. Nonetheless, numbers throughout totally different knowledge suppliers are surprisingly inconsistent, probably because of the omission by a few of Grayscale’s mini-BTC fund.

To push the funds over the landmark, spot Bitcoin ETFs recorded complete inflows of $893.3 million on Oct. 30, with the iShares Bitcoin Belief (IBIT) main at $872 million. Different ETFs like Invesco’s BTCO and Valkyrie’s BRRR contributed $7.2 million and $6.1 million, respectively, whereas Bitwise’s BITB noticed an outflow of $23.9 million, in line with Farside Buyers.

These inflows adopted Bitcoin’s worth reaching $73,500 on Oct. 29, simply shy of its all-time excessive of $73,700.

The substantial inflows into IBIT counsel that conventional funding autos have gotten a most popular technique for a lot of US traders to realize publicity to Bitcoin.