In a current interview with Bloomberg, Reggie Browne, Co-World Head of ETF Buying and selling and Gross sales at GTS, shared insightful predictions relating to the potential buying and selling dynamics of spot Bitcoin exchange-traded funds (ETFs). Browne foresees these ETFs buying and selling at a big premium, estimating as excessive as 8% above their web asset worth (NAV).

Why Spot Bitcoin ETFs May Commerce At A 8% Premium To NAV

“I feel the spreads shall be very aggressive and tight. The market maker group is resilient and ready to supply a whole lot of liquidity,” Browne said. Nevertheless, he highlighted a important concern, saying, “I feel it’s going to be the premium to NAV… US dealer sellers can’t commerce Bitcoin money inside their dealer sellers. So that you’re going to must commerce hedges over futures and commerce it on a premium, after which take that off, and I feel there’s a whole lot of complexity there.”

This complexity, in accordance with Browne, arises from the money creation mannequin compelled by the SEC and regulatory constraints that restrict direct Bitcoin buying and selling inside US dealer sellers, compelling them to depend on futures for hedging. He expressed, “What I feel, doubtlessly, you may see 8% of premium above truthful worth. It’s an enormous quantity, however let’s see the way it performs out.”

Moreover, Browne touched upon the topic of in-kind creations and redemptions, facets that have been factors of rivalry throughout negotiations with the Securities and Trade Fee (SEC). Regardless of the challenges, he stays optimistic about their future implementation. “Completely, I feel this was actually simply to get the ball shifting… the in-kind will come after we climb a few mountains,” Browne remarked.

Echoing Browne’s sentiments, Eric Balchunas, a Bloomberg ETF knowledgeable, commented on the potential premium, expressing shock on the anticipated excessive price. He drew a comparability with Canada’s spot ETFs, that are additionally money creations however have a lot smaller premiums, regardless of occasional spikes.

[Browne] thinks bid-ask spreads on spot ETFs shall be tight however (thx to money solely creations) premiums might be as excessive as 8%. That’s actually excessive and I’m a bit shocked tbh. For context Canada spot ETFs are money creations and their premiums are very small.. albeit the occasional 2% day.

The crypto group is carefully monitoring the SEC because it approaches a important deadline to resolve on the primary batch of a number of spot Bitcoin ETF purposes by tomorrow, January 10. Outstanding asset managers resembling BlackRock, Constancy, Ark Make investments, Bitwise, Franklin Templeton, Grayscale, WisdomTree, and Valkyrie are amongst these with pending purposes.

Browne believes that the approval of spot Bitcoin ETFs might appeal to substantial investor curiosity, projecting huge inflows over the primary 12 months. “I anticipate buyers so as to add no less than $2 billion to identify Bitcoin ETFs inside the first 30 days they commerce, if accredited. For the complete 12 months, I see $10 billion-$20 billion within the funds,” he famous. This prediction underscores the numerous curiosity and potential market affect of spot Bitcoin ETFs.

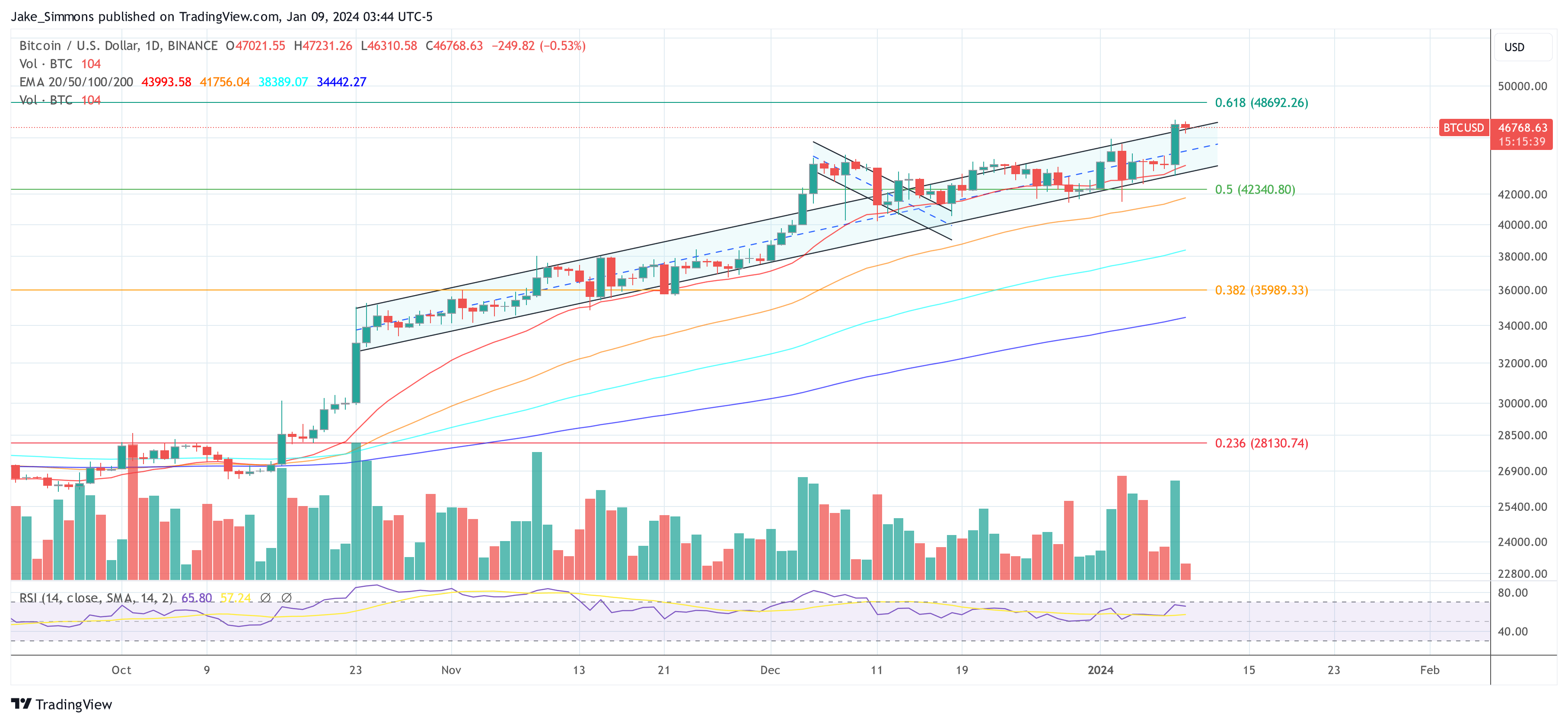

At press time, BTC traded at $46,768.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual danger.