Knowledge reveals the Bitcoin correlation to the Nasdaq has continued to be damaging since December. Right here’s what this implies for the cryptocurrency.

Bitcoin 60-Day Correlation To Nasdaq 100 Is Unfavourable Proper Now

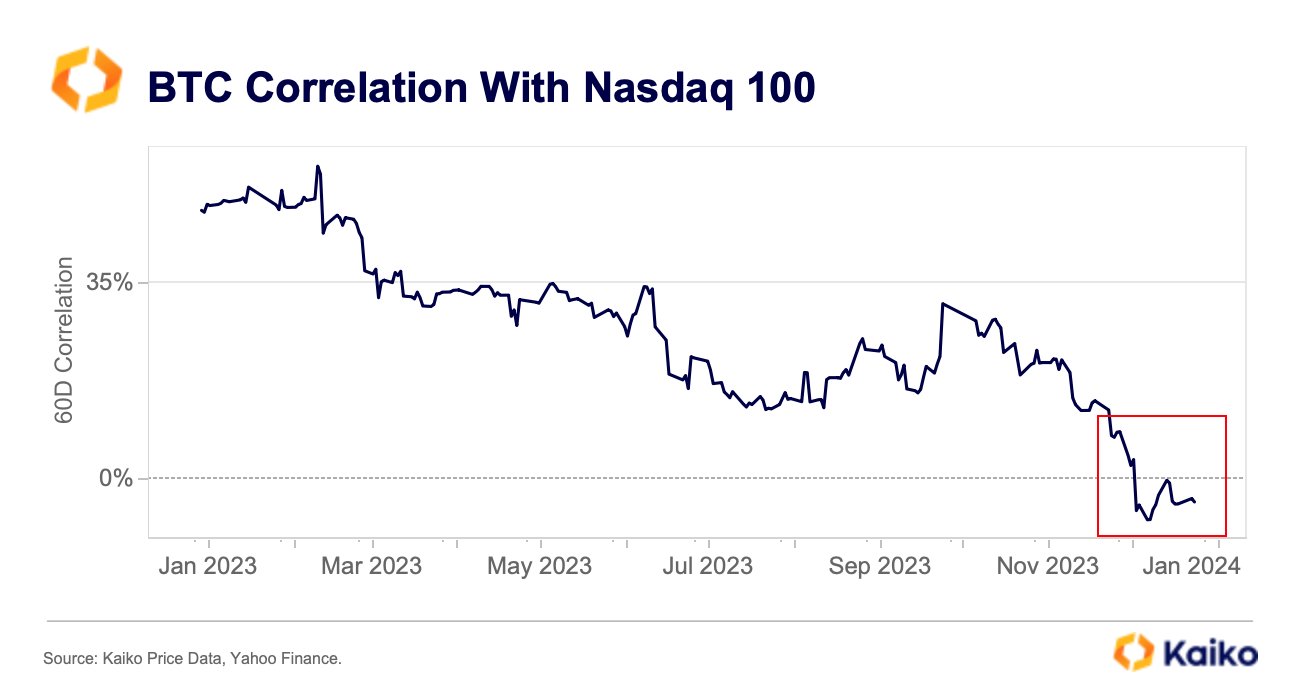

In a brand new submit on X, the analytics agency Kaiko has mentioned what the pattern within the correlation between BTC and Nasdaq has seemed like just lately. The “correlation” right here refers to a metric that retains observe of how tied collectively the costs of two commodities have been over a given interval.

This era can naturally be of any size, however within the context of the present matter, the 60-day correlation is of curiosity. This indicator model measures the costs’ dependence on one another through the previous two months.

When the worth of this metric is bigger than zero, it signifies that the worth of 1 asset has been reacting to the opposite by shifting in the identical route. The nearer the indicator is to at least one, the stronger this relationship.

Alternatively, values underneath zero recommend some correlation between the 2 belongings, but it surely has been a damaging one. Because of this the belongings have reacted to one another by shifting in the wrong way. On this case, the intense level is -1, so the nearer the indicator is to this mark, the stronger the correlation between the costs.

Lastly, the correlation being precisely zero implies that there is no such thing as a correlation in any way between the 2 belongings. In arithmetic, such a situation happens when two variables are impartial.

Now, here’s a chart that reveals the pattern within the 60-day correlation between Bitcoin and Nasdaq 100 over the previous 12 months:

The worth of the metric seems to have taken a plunge in current weeks | Supply: Kaiko on X

Because the above graph reveals, the 60-day correlation between Bitcoin and Nasdaq is proven in proportion right here, with 100% comparable to a price of 1.

From the chart, it’s obvious that the metric’s worth was in a state of general gradual decline throughout 2023, up till the ultimate couple of months of the 12 months, when the metric took an particularly sharp dive.

Some quantity of constructive correlation had existed between the 2 belongings earlier than this plummet, however following it, the 60-day correlation took to damaging values. Nonetheless, the indicator remained near the 0% mark, implying that the 2 solely had a slight damaging relationship.

The correlation had began surging and reached nearly precisely 0% for a short interval simply earlier, however the metric has since once more come down and assumed slight damaging values.

It could seem that BTC has kicked off 2024 barely, shifting towards the conventional markets, which might set the stage for the cryptocurrency to go on and discover its territories this 12 months.

BTC Worth

On the time of writing, Bitcoin is buying and selling across the $44,800 mark, up over 5% over the previous week.

Appears like the worth of the coin has shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Kaiko.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.