In a dramatic flip of occasions, the Bitcoin worth has breached the $64,000 threshold once more after a 7.7% improve from a low of $59,400 in 4 days. This sudden worth bounce has despatched shockwaves by the crypto market, with information from Coinglass revealing a big wave of liquidations following the surprising rally. Brief sellers, who had been anticipating a decline, discovered themselves in a troublesome spot as Bitcoin defied their expectations.

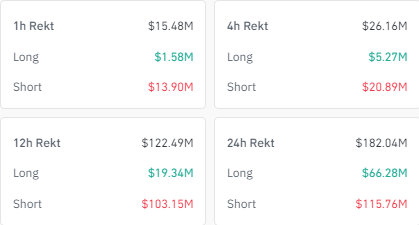

Notably, liquidation information from Coinglass reveals that over $182 million price of positions have been liquidated throughout varied exchanges up to now 24 hours, with a majority being brief positions.

Bitcoin Value Breaks Above $64,000 Once more

Bitcoin rose above $64,000 within the early hours of Monday, October 14, after breaking above a good vary over the weekend and gaining 2.53% up to now 24 hours. Bitcoin reached as excessive as $64,500 up to now few hours, which is its highest level to date in October. As such, the Bitcoin worth has now crossed above its open for the month, with the October month-to-month return lastly turning inexperienced for the primary time.

Associated Studying

The value motion, nonetheless, wasn’t as optimistic for everybody. In line with the information proven within the image beneath, the sudden rise has been expensive for a lot of merchants holding brief positions. Bears who wager on a continued decline had been hit laborious as Bitcoin’s continued rally triggered a wave of liquidations.

Of the $182 million price of liquidations recorded throughout varied exchanges, a staggering $115.76 million got here from brief positions, whereas $66.28 million had been from lengthy positions.

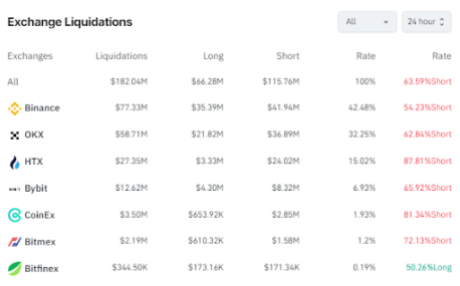

Binance has led the crypto trade market in liquidations over the previous 24 hours, accounting for 42.48% of the full liquidations. On Binance alone, roughly $77.33 million price of positions had been worn out, with 54.23% being brief positions. OKX follows intently, with $58.71 million in liquidations, the place a good bigger share of 62.84% had been brief positions.

HTX, Bybit, and CoinEx additionally noticed important liquidations, although on a smaller scale. HTX recorded $27.35 million in liquidations, a staggering 87.81% of which had been brief positions. Bybit got here subsequent with $12.62 million in liquidations and a brief fee of 65.92%, whereas CoinEx rounded out the checklist with $3.50 million liquidated, 81.34% of which was from shorts.

Associated Studying

Extra Liquidations Forward?

Bitcoin’s latest uptick brings again the likelihood of a declining Uptober sentiment. This attention-grabbing rally might set the stage for a surge within the second half of October, just like what was witnessed in September.

If this rally had been to proceed for the remainder of the month, we might see extra brief positions liquidated within the subsequent few hours. Bears, who’ve been betting in opposition to Bitcoin’s rise, could rush to shut their positions to reduce losses. The lower in promoting stress from brief sellers exiting the market might additional gasoline Bitcoin’s ascent.

Featured picture created with Dall.E, chart from Tradingview.com