Crypto buying and selling agency QCP Capital says the “shallow sell-off” in crypto markets following Iran’s latest assault on Israel signifies wholesome market demand for risk-on belongings.

Crypto Market Stays Properly Bid For Threat Belongings

Regardless of Iran launching over 180 missiles towards Israel yesterday, the sell-off in conventional monetary (TradFi) belongings was comparatively muted. The S&P 500 closed 1% decrease, whereas U.S. benchmark West Texas Intermediate (WTI) oil costs rose 2%.

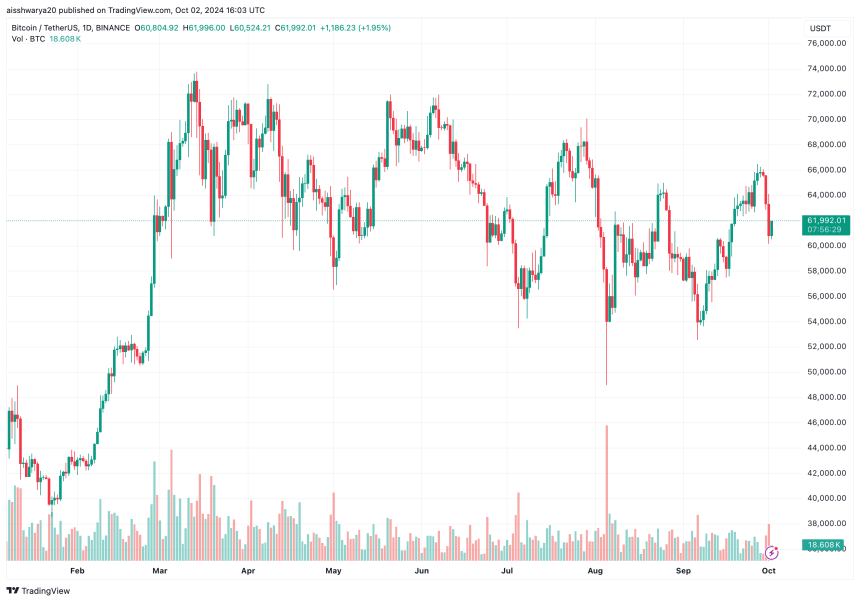

In distinction, the digital belongings market was hit comparatively tougher, with Bitcoin (BTC) sliding greater than 5% following Iran’s assault. The whole crypto market cap eroded over 6% in worth whereas liquidations surpassed $550 million prior to now 24 hours, knowledge from CoinGlass signifies.

Associated Studying

Within the report, QCP Capital says that the premier cryptocurrency appears to have discovered robust help on the $60k degree. Nevertheless, the agency cautions that additional escalation within the Center East would possibly power BTC to drop to $55k.

Concerning the market sell-off witnessed yesterday, the buying and selling agency said:

Center East geopolitics will steal the limelight for now, however the shallow sell-off means that the market stays nicely bid for threat belongings. This minor setback shouldn’t distract from the larger image.

The report additionally remarked that China’s latest financial coverage actions are much like these of Japan within the Nineteen Nineties. Notably, the Financial institution of Japan (BoJ) tackled deflation by lowering rates of interest, introducing detrimental rates of interest, and beginning the quantitative easing program. The report added:

The flush of liquidity from the PBoC and potential fiscal help will seemingly help asset costs in China, with bullish sentiment doubtlessly spilling over globally to help threat belongings, together with crypto.

Moreover, the report pointed to the US Federal Reserve (Fed) Chair Jerome Powell’s latest dovish remarks on the Nationwide Affiliation for Enterprise Economics, signaling additional rate of interest cuts in 2024.

For context, the Fed lower charges for the primary time in 4 years on September 18. Subsequently, monetary markets worldwide skilled a surge within the value of risk-on belongings, akin to shares and cryptocurrencies.

The report concluded that “asset costs are anticipated to stay supported heading into 2025”, buoyed by aggressive rate of interest cuts by each the most important (Fed) and third largest (Individuals’s Financial institution of China) central banks on the planet.

What To Anticipate From Bitcoin In This fall 2024?

Though the Iran-Israel battle straight impacted BTC’s value, crypto analysts stay optimistic a couple of doubtlessly robust This fall 2024. One analyst recommended that the latest dip may signify BTC’s “quarterly low.”

Associated Studying

One other crypto analyst Eric Crown opined that BTC may attain new all-time-high (ATH) worth in This fall 2024, basing his evaluation on the cryptocurrency’s historic efficiency within the months following September. Bitcoin trades at $61,992 at press time, down 1.2% during the last 24 hours.

Featured picture from Unsplash, chart from Tradingview.com