New information from the crypto market analytics agency Kaiko Analysis signifies merchants are inserting massive bets that Bitcoin (BTC) may have a robust October.

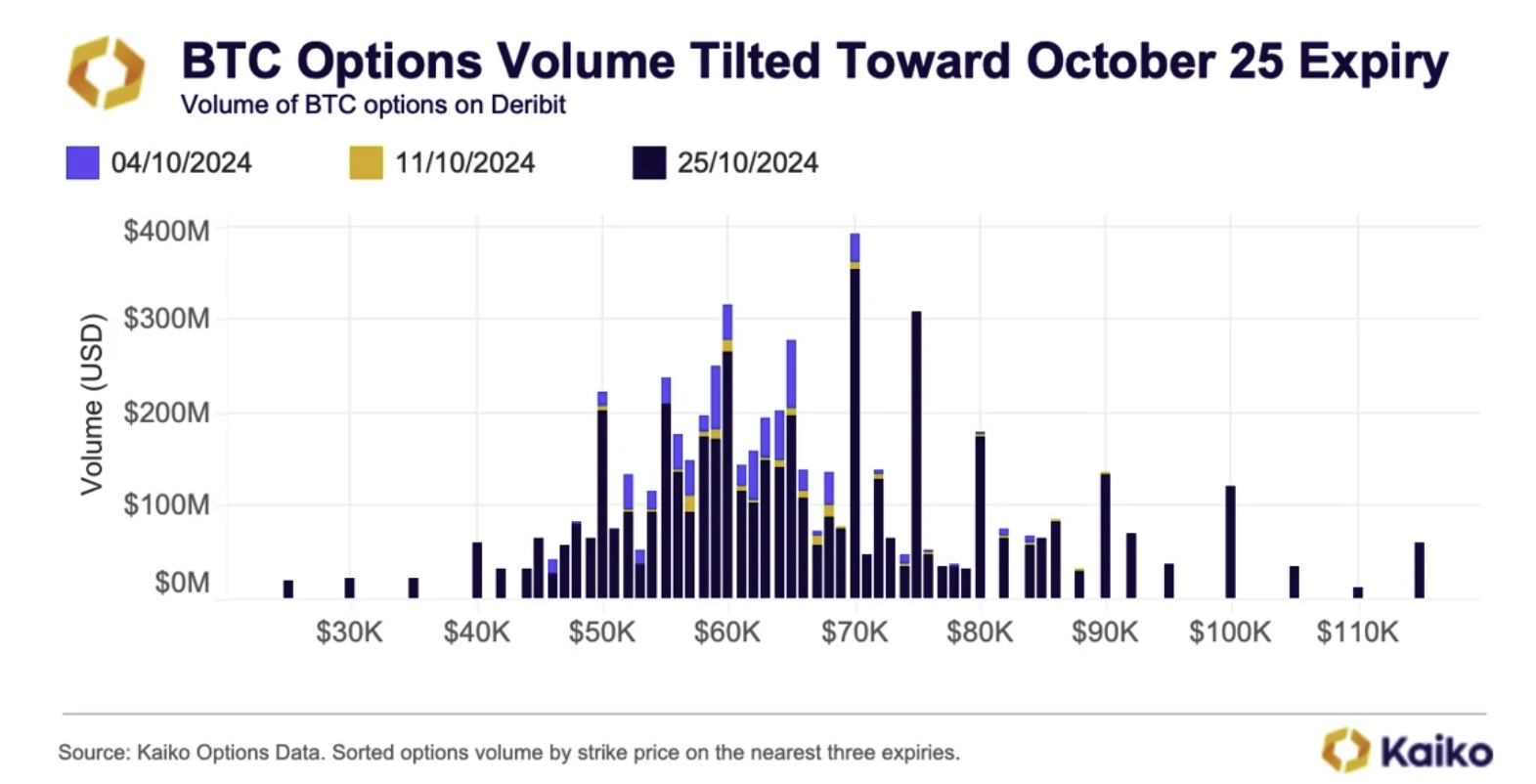

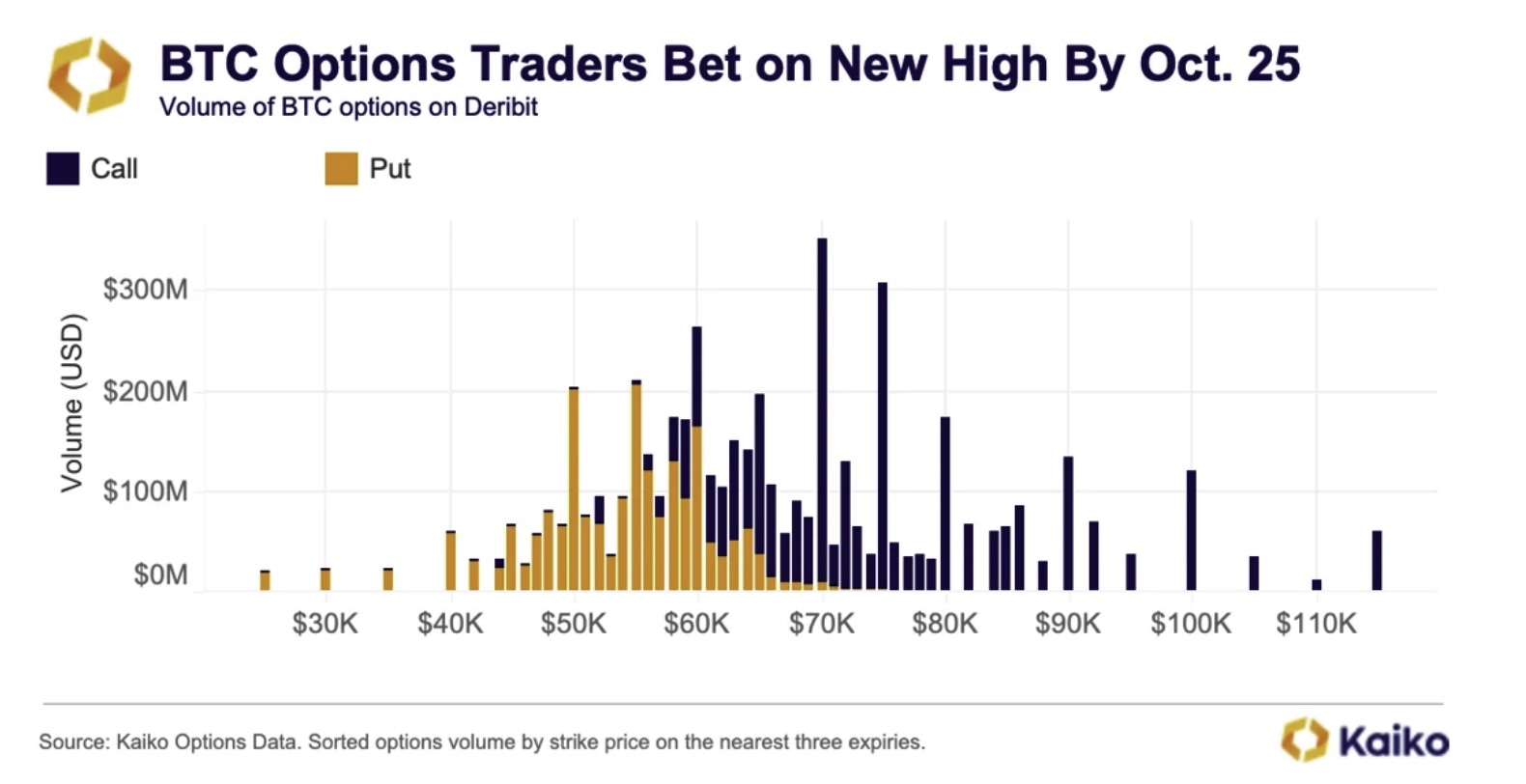

In a brand new report, Kaiko finds that derivatives merchants are betting a whole bunch of hundreds of thousands of {dollars} on the crypto choices trade Deribit that Bitcoin goes to regain the $70,000 vary this month.

“Choices volumes have elevated over the previous few weeks as markets shift to a risk-on mindset. Merchants are positioning themselves to seize upside value actions forward of what’s traditionally BTC’s greatest buying and selling month. BTC’s value has solely ended October down twice since 2013.

Trying on the three expiries in October, we are able to see that many of the quantity is concentrated on the BTC choices expiring on the finish of the month. Sometimes, the front-month contracts would have extra quantity and liquidity.”

Based on Kaiko, new macroeconomic situations are additionally contributing to the merchants’ conduct.

“Nonetheless, a number of elements make this 12 months totally different. First, the US central financial institution started a rate-cutting cycle this month, shifting its financial coverage. The Fed’s jumbo charge minimize has already boosted risk-on sentiment. The central financial institution has signaled two extra cuts earlier than the 12 months’s finish, prompting speculative trades on December 27 contracts with vital quantity on strike costs above $100,000.

What hasn’t proven up within the markets but is the impact of cheaper {dollars} and the eventual easing of the Fed’s quantitative tightening measures, which eliminated liquidity. International liquidity lags the markets, so the consequences of the Fed’s easing cycle will take longer to look.”

Bitcoin is buying and selling for $61,026 at time of writing, down 3.9% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney