A preferred on-chain analyst says Bitcoin (BTC) is not wanting bearish primarily based on a number of key indicators.

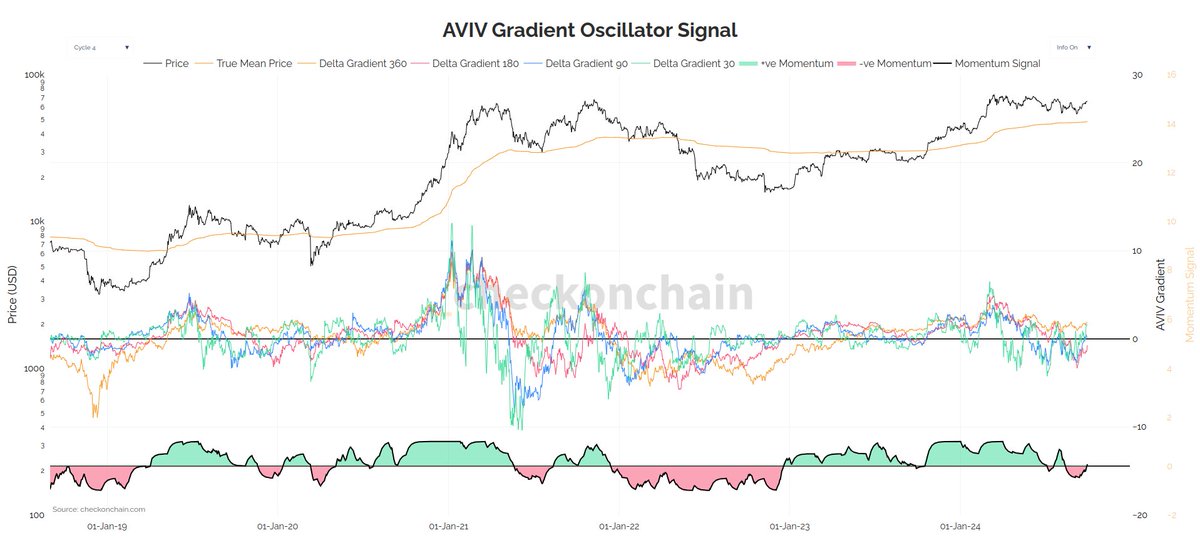

Pseudonymous on-chain sleuth Checkmate tells his 98,300 followers on the social media platform X that Bitcoin’s Lively-Worth-to-Investor-Worth (AVIV) ratio has moved from a downtrend sign to a impartial one.

The AVIV is the ratio between the energetic capitalization, which excludes misplaced or inactive cash, and the realized capitalization of traders, the worth at which the BTC was bought. The indicator helps gauge whether or not Bitcoin is overbought or oversold.

“Bitcoin market momentum is again to impartial throughout a number of timeframes. Not strictly bullish, however not bearish (which is kinda bullish…comparatively talking).”

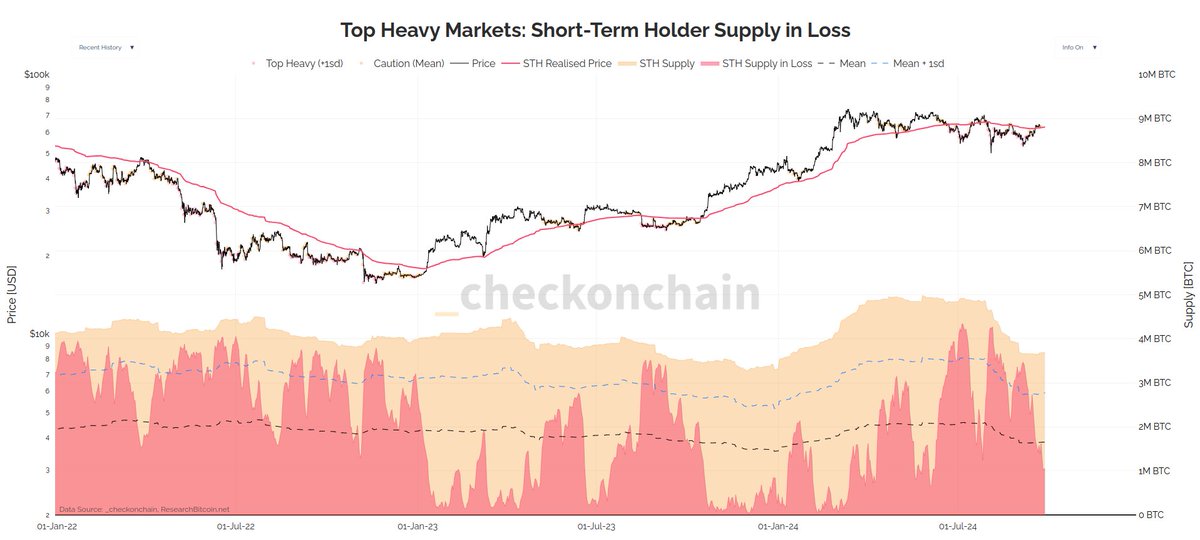

Subsequent, the analyst says the Bitcoin short-term holder (STH) provide metric, which tracks the quantity of cash held for lower than 155 days, is beginning to flash bullish.

“Primarily based on short-term holder provide, the Bitcoin market is not ‘prime heavy.’ This implies the vast majority of current patrons are again in revenue, and all issues being equal, is extra probably to enhance sentiment.”

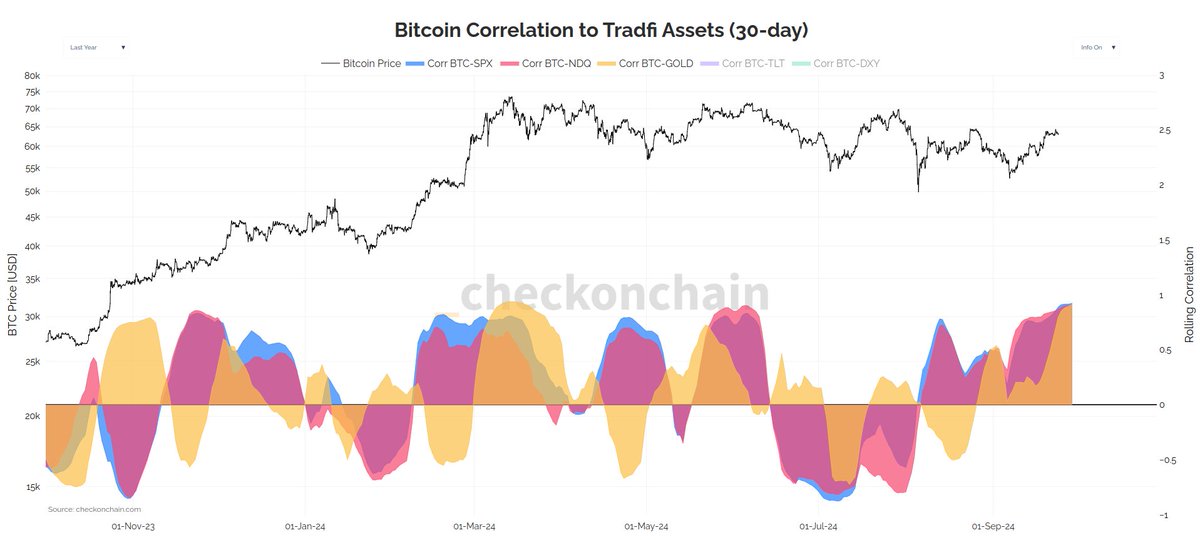

Lastly, the analyst says that Bitcoin appears to be transferring in tandem with gold and shares, that are in an uptrend.

“Bitcoin is at the moment very correlated with Gold, and equities during the last 30-days. Which I suppose is kinda good, contemplating these property are all hitting new ATHs (all-time highs).”

Bitcoin is buying and selling for $60,994 at time of writing, down 4% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/3000ad