Bitcoin has skilled a major worth surge since Tuesday, following the Federal Reserve’s announcement of a 50 bps rate of interest reduce. This transfer pushed BTC previous the crucial $62,000 mark, a psychological degree that has grow to be a turning level for investor sentiment. With Bitcoin now testing native provide, market contributors are intently looking ahead to additional upside potential.

Associated Studying

As the worth continues to push larger, analysts are pointing to essential information indicating a possible shift in Bitcoin’s development after months of downtrend worth motion. Glassnode metrics reveal a notable development change, suggesting BTC could also be coming into bullish territory as soon as once more. This resurgence is drawing elevated consideration from each retail and institutional traders as they consider whether or not Bitcoin’s rally has endurance or if the market will face resistance at larger ranges.

With renewed momentum, the approaching days can be crucial in figuring out if Bitcoin can maintain this upward trajectory and totally get away of its earlier bearish part.

Bitcoin Indicators A Bullish Return

Bitcoin traders have seen sentiment shift dramatically from fearful to hopeful in only a few days. Following the Federal Reserve’s price reduce announcement on Wednesday, Bitcoin surged over 8%, breaking crucial ranges and testing native provide. This sudden worth motion has sparked renewed optimism within the broader crypto market, giving traders hope for a recent begin after months of bearish worth motion.

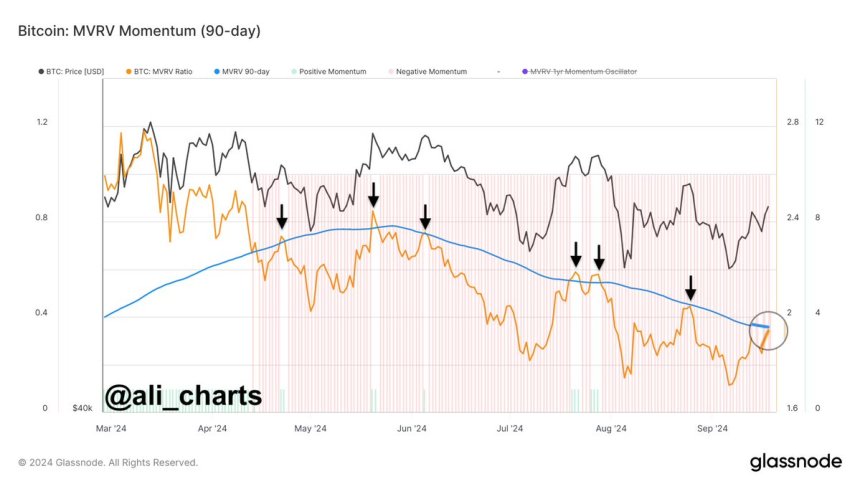

Distinguished crypto analyst Ali Martinez has shared priceless insights on X, drawing consideration to key information from Glassnode that means a major shift in Bitcoin’s worth development. Particularly, Ali highlights the Market Worth to Realized Worth (MVRV) ratio, which tracks the distinction between BTC’s market worth and its precise worth.

The MVRV ratio, which had been in a downtrend since April, is now rising, signaling that Bitcoin could also be regaining power. Ali notes that the MVRV is a crucial indicator for assessing momentum, and the present upward development hints at a possible return to bullish territory.

Associated Studying

The analyst additional explains that if the MVRV can shut above its 90-day transferring common, it could affirm a stronger bullish outlook for Bitcoin. Given the aggressive worth surge and the growing demand mirrored in current worth motion, this state of affairs appears more and more probably. Buyers are actually watching intently, as Bitcoin’s subsequent strikes might mark the start of a brand new bull part.

Technical Ranges To Watch

Bitcoin (BTC) is buying and selling at $63,024 after days of constant “solely up” worth motion since hitting native lows. The value not too long ago broke above the every day 200 exponential transferring common (EMA) at $59,350 and is now testing the crucial every day 200 transferring common (MA) at $63,954.

This every day 200 MA is a key long-term indicator, signaling general market power. If Bitcoin can reclaim this degree as assist, it could probably set off a major worth surge, bolstering the bullish outlook.

Associated Studying

For bulls to keep up momentum, the subsequent goal can be round this crucial degree, with a possible push towards $65,000, a worth final examined in late August. Nonetheless, ought to BTC fail to carry above $60,000 within the coming days, traders may even see a retracement to decrease demand ranges. The flexibility to remain above key assist zones will decide the subsequent part of worth motion.

Featured picture from Dall-E, chart from TradingView