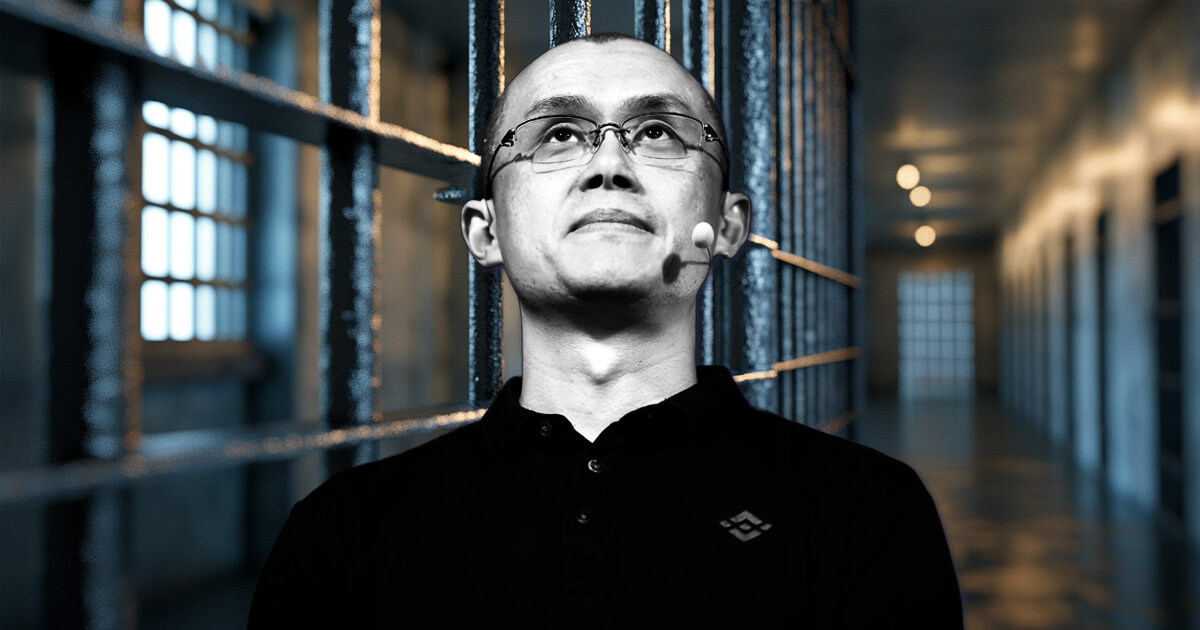

Changpeng Zhao, co-founder of Binance, is about to be launched from US custody on Sept. 29, in line with the US Federal Bureau of Prisons web site.

Zhao is presently serving a four-month sentence and was just lately transferred to the Lengthy Seaside Residential Reentry Administration (RRM) facility in central California.

RRMs function native federal jail liaisons, aiding inmates nearing launch by working with federal courts, the US Marshals Service, and native corrections.

Zhao’s authorized points

Zhao’s authorized points started in November when he and Binance pleaded responsible to breaking US federal legal guidelines.

The allegations included Zhao’s failure to implement an efficient anti-money laundering program, as required by the Financial institution Secrecy Act. It was additionally alleged that Binance had processed transactions linked to illegal actions, together with these between US residents and people in sanctioned areas like Iran.

As a part of the settlement, Binance was ordered to pay $4.3 billion in fines, whereas Zhao personally agreed to pay $50 million. Zhao additionally stepped down as Binance’s CEO however retains an estimated 90% possession within the firm

Binance authorized struggles

Whereas Zhao’s authorized troubles are nearing an finish, Binance’s authorized points proceed. The US Securities and Alternate Fee (SEC) filed an amended grievance in opposition to the change in July, reiterating its accusation that the change violated federal securities regulation.

The SEC claimed that Binance performs a key position within the crypto market by republishing and amplifying info from issuers and promoters. The submitting additionally alleged that Binance promotes digital belongings it lists and trades by sharing particulars on asset growth, buying and selling volumes, and value info.

Moreover, the monetary regulator reaffirmed its stance that Binance’s token, BNB, was provided and offered as a safety. It additionally highlighted the expectation amongst prospects, staff, and buyers that BNB would improve in worth because of efforts by issuers and promoters.

This comes regardless of a earlier court docket choice dismissing expenses associated to the secondary sale of BNB by third events.