Bitcoin is agency at spot charges, wanting on the improvement within the each day chart. Even so, the downtrend stays, and value motion stays inside a bearish breakout formation. This outlook follows the dump on September 7 that noticed the world’s most beneficial coin plunge, approaching the all-important spherical quantity, $50,000.

Bitcoin Leveraged Positions Constructing Up

Technically, the downtrend stays, particularly if bulls can’t unwind the losses of September 7. From an effort-versus-result perspective, the development set in movement by September 7 will form the short-term, presumably accelerating the autumn under August lows.

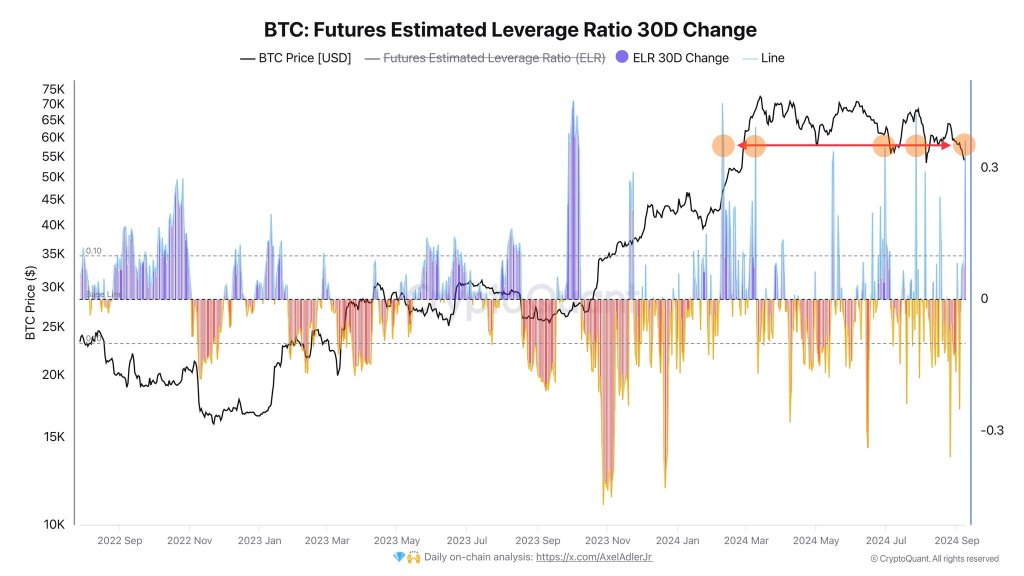

Amid this improvement, one on-chain analyst notes that there was a large accumulation of leveraged positions from March 2024. Although it stays unsure which path costs will transfer, the present state of affairs means sellers have the higher hand.

If bulls take over, this may be a large sentiment increase for BTC bulls, who’ve needed to cope with sharp losses over the previous three months. Whatever the path, this build-up in leverage place precedes a interval of heightened volatility within the coming days.

Whereas Bitcoin developments decrease, sentiment has taken a success, explaining the shrinking buying and selling quantity over the previous two weeks. Since late August, BTC has fallen from round $66,000, dropping almost 20% by final week’s lows.

On the identical time, volatility is relatively low and never not like the state of affairs when BTC turned the nook, sharply increasing from late February earlier than printing contemporary all-time highs in mid-March 2024.

Common Funding Charge Is Bullish, Will This Change?

Curiously, regardless of the decrease lows, buying and selling information exhibits that the typical funding price throughout derivatives exchanges has remained bullish for over a 12 months.

This improvement might be because of the shift in value motion that noticed the world’s most beneficial coin flip the nook, rising from late Q3 2023. The restoration noticed BTC shake off weak point and explode to above $70,000 after losses in 2022 that took the coin to as little as $15,800.

For bulls to dominate within the derivatives market, costs should recuperate steadily. A break above $66,000 and July highs would doubtless spur demand, lifting the coin above the multi-month resistance at $72,000.

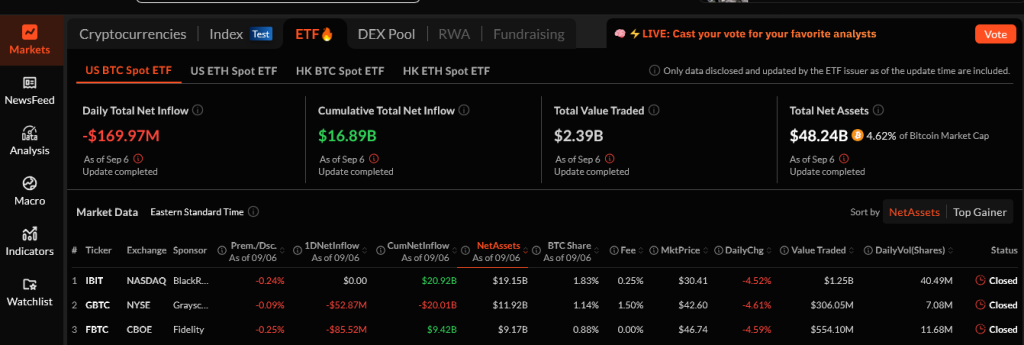

Nonetheless, for this to occur, there have to be inflows to identify Bitcoin ETFs. Falling costs have accelerated outflows from this product, that means establishments are enjoying secure. To date, SosoValue exhibits outflows of over $169 million for spot Bitcoin ETF issuers in the US.