HodlX Visitor Submit Submit Your Submit

As we strategy the shut of the primary quarter of the twenty first century, the world has witnessed exceptional transformations throughout almost each area.

Amongst these, the emergence of cryptocurrencies led by Bitcoin has been nothing wanting revolutionary. Nevertheless, as we glance ahead, the way forward for Bitcoin stays fiercely contested.

Will it proceed its unprecedented ascent to grow to be a pillar of worldwide finance or may it fade into irrelevance?

On this article, we’ll delve into contrasting projections for Bitcoin’s worth in 2050, starting from a mind-boggling $52 million to a complete collapse to zero, and discover the components that form these divergent forecasts.

Is Bitcoin headed for a $52 million valuation or one thing extra modest

Because the world’s first decentralized cryptocurrency, Bitcoin has shaken up the monetary panorama.

With its present valuation at $55,862 as of August 6, 2024, Bitcoin continues to thrive because the market more and more embraces digital belongings.

This ongoing progress has led many specialists to take a position about its trajectory over the subsequent 25 years.

Whereas some envision Bitcoin reaching extraordinary heights, others foresee a drastic downfall. Let’s first look at the arguments supporting a bullish future for Bitcoin.

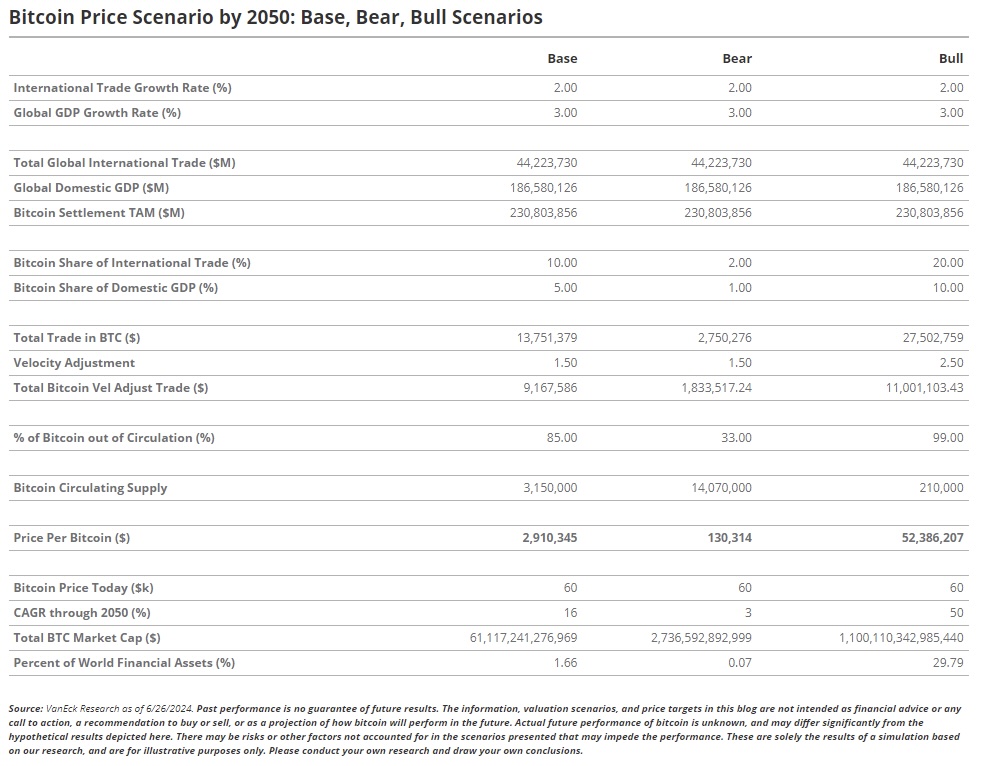

A complete evaluation by VanEck’s Digital Belongings Analysis Staff initiatives that Bitcoin’s worth may surge to $2.9 million in a base situation and even attain an astounding $52 million n a bullish situation by 2050.

However what’s driving these optimistic predictions?

VanEck’s analysis is rooted within the perception that Bitcoin will evolve right into a key international reserve foreign money.

The agency anticipates that Bitcoin may quickly play a central position as a global medium of alternate, notably with the implementation of recent Bitcoin layer two options.

In addition they predict that Bitcoin will facilitate 10% of worldwide commerce transactions and 5 p.c of home commerce by 2050.

Moreover, VanEck means that central banks may maintain two-point-five p.c of their belongings in Bitcoin by then.

Listed here are some important components VanEck highlights that might contribute to Bitcoin’s worth surge by 2050.

A remodeling worldwide financial system

A serious driver of Bitcoin’s potential rise is a shift within the IMS (Worldwide Financial System).

In accordance with VanEck’s evaluation, present tendencies point out that economies are step by step distancing themselves from conventional foreign money reserves.

Right this moment, the IMS is basically dominated by the US greenback, together with the British pound, Japanese yen and euro.

A rustic’s foreign money is utilized in international commerce based mostly on its share of the world’s GDP (gross home product), which in flip strengthens the monetary infrastructure constructed round that foreign money.

For many years, this technique has remained steady, however cracks are starting to indicate. VanEck’s analysis notes that the US greenback’s share in cross-border funds has hovered round 61% for the previous 45 years.

Nevertheless, the euro and yen have seen important declines.

The euro’s share of worldwide funds has dropped from 22% within the mid-2000s to 14.5% by the top of 2023. Its presence in central financial institution reserves has additionally decreased from 25.3% within the late 2000s to 19.75% in 2023.

The Japanese yen has fared even worse, with its share of worldwide funds falling from 12% within the mid-Nineties to underneath 5 p.c in 2023, whereas its central financial institution reserves have shrunk from six-point-two p.c to only over 5 p.c in the identical interval.

These shifts counsel that reliance on the ‘precept 4 currencies’ the US greenback, yen, euro and pound is waning globally.

VanEck posits that this diminishing dependence opens the door for Bitcoin to fill the hole within the years forward.

De-dollarization and the emergence of a brand new IMS

VanEck’s evaluation additionally highlights a major shift tied to de-dollarization.

Though the US greenback stays a dominant international reserve foreign money, many countries are step by step shifting away from it a pattern often known as de-dollarization.

A number of components are driving this transition, together with the next.

- The US greenback turning into more and more costly for rising economies

- Modifications in oil demand and commerce relations with the Gulf international locations

- Geopolitical occasions essentially the most essential being the Russia-Ukraine battle

This gradual distancing from the US greenback is paving the best way for a brand new IMS. In accordance with VanEck’s analysis, the Chinese language Yuan Renminbi) has seen its worth double over the previous 12 months.

Nations reminiscent of Saudi Arabia, Brazil and Russia are more and more utilizing RMB for worldwide commerce instead of the US greenback.

Furthermore, rising economies are favoring native currencies over the US greenback. As an example, India is now buying oil utilizing INR (Indian Rupees) and settling commerce with Malaysia in INR.

Disruption in conventional worldwide foreign money reserves

The transition away from the normal IMS has disrupted international foreign money reserves. VanEck initiatives that by 2050, there will probably be an increase in bilateral commerce agreements and a extra important position for the Chinese language RMB.

Moreover, rising market currencies may account for 3 p.c to seven-point-five p.c of central financial institution reserves over the subsequent 25 years.

As reliance on dominant reserve currencies diminishes, VanEck foresees Bitcoin’s share of worldwide reserves climbing to two-point-five p.c.

The agency additionally predicts Bitcoin’s position in worldwide and home commerce will enhance, capturing 10% and 5 p.c of market share, respectively.

Bitcoin rising as a brand new reserve foreign money

On this evolving IMS, Bitcoin is more likely to emerge as a brand new reserve foreign money for international economies.

VanEck asserts that almost all rising markets lack the steadiness or affect to attain reserve foreign money standing.

Whereas some international locations could lean on China and different rising powers, these cautious of suboptimal reserve choices may flip to Bitcoin.

VanEck identifies a number of benefits that Bitcoin gives as a reserve foreign money, together with the next.

- Unchallenged financial coverage

- Neutrality

- Ample property rights

- An absence of presidency bias

Bitcoin’s decentralized, impartial construction permits for clear, software-driven algorithms slightly than politically influenced decision-making, making it a lovely choice for reserve standing.

Valuing Bitcoin in 2050

VanEck’s Bitcoin valuation mannequin for 2050 is predicated on three key components Bitcoin’s velocity, the GDP of commerce (each home and worldwide) settled in BTC and the actively circulating Bitcoin provide.

Their evaluation assumes Bitcoin will grow to be integral to the worldwide monetary system, taking market share from the normal ‘precept 4’ currencies that at the moment dominate international reserves.

The analysis begins with the world’s GDP in 2023 and projected progress charges, factoring in a 20% decline out there share of the prevailing main currencies.

It additionally consists of a rise in Bitcoin’s position in international commerce, as mentioned earlier, which incorporates 5 p.c of home and 10% of worldwide transactions.

The valuation additional incorporates predictions that central banks will maintain two-point-five p.c of their belongings in Bitcoin by 2050, with 85% of Bitcoin faraway from circulation on account of its store-of-value enchantment.

Assuming a Bitcoin velocity much like the US common VanEck’s evaluation concludes that Bitcoin’s base worth may attain $2.9 million by 2050, representing one-point-six p.c of the world’s monetary belongings.

Whereas the bearish situation pegs Bitcoin’s worth at $130,314, the bullish outlook sees it skyrocketing to an eye-watering $52 million per coin.

May the worth of Bitcoin actually go to zero

Whereas forecasts like VanEck’s paint an image of Bitcoin reaching extraordinary heights, there’s a powerful counter-narrative from outstanding voices who predict the precise reverse Bitcoin crashing to zero.

Regardless of the keenness round crypto, influential figures like Jim Rogers and Charlie Munger are brazenly skeptical, dismissing Bitcoin’s long-term viability.

Jim Rogers he skeptical investor

Jim Rogers, a famend investor and international finance authority, is notably pessimistic about the way forward for cryptocurrencies.

On the India Right this moment Conclave, he expressed his doubts, stating that he doesn’t imagine cryptocurrencies, together with Bitcoin, have lasting worth.

He argues that actual, tangible commodities like sugar and rice have extra inherent worth than digital belongings.

Rogers stated,

“I’ve extra confidence in actual issues that folks can use than in Bitcoin.”

He predicted that Bitcoin may ultimately “disappear and go to zero.”

Rogers favors conventional safe-haven belongings like gold and silver, arguing that whereas individuals perceive these bodily shops of worth, they continue to be largely unfamiliar with and distrustful of Bitcoin.

When requested about his personal crypto investments, he bluntly acknowledged that he holds none.

Charlie Munger n outspoken critic

One other staunch critic is Charlie Munger, vice chairman of Berkshire Hathaway.

Recognized for his sharp, no-nonsense views, Munger has repeatedly slammed Bitcoin, labeling it “silly” and “evil” throughout Berkshire Hathaway’s annual assembly.

He, together with CEO Warren Buffet, warned that Bitcoin undermines established monetary techniques just like the Federal Reserve and nationwide currencies.

Munger is unequivocal in his prediction Bitcoin’s worth will possible hit zero.

Munger’s issues are rooted not simply in monetary logic but in addition in broader social impacts. He believes Bitcoin fuels speculative bubbles and promotes a “tribal” mindset amongst traders, resulting in irrational habits.

A extra nuanced critique conomic and regulatory dangers

Past these outstanding voices, there are further the reason why Bitcoin’s worth may doubtlessly collapse. One important concern is regulatory intervention.

As governments around the globe grapple with find out how to management or combine cryptocurrencies into their monetary techniques, stringent rules may severely affect Bitcoin’s adoption and market worth.

As an example, if main economies impose strict restrictions on cryptocurrency buying and selling or mining, demand may plummet.

CBDCs (central financial institution digital currencies)

As extra international locations experiment with their very own digital currencies, Bitcoin may face obsolescence in sure markets the place government-backed options are most popular.

Moreover, Bitcoin’s excessive value volatility and scalability points proceed to be boundaries to mainstream adoption.

If these challenges aren’t resolved, it’s attainable that belief in Bitcoin may erode over time.

$52 million versus zero {dollars} right here does the reality lie

The controversy between Bitcoin reaching astronomical values like $52 million or plummeting to zero highlights the deep uncertainty surrounding the way forward for this digital asset.

The reality possible lies someplace in between these excessive situations. Bitcoin has confirmed resilient over the previous decade, surviving a number of crashes and regulatory crackdowns.

Nevertheless, it’s essential to keep in mind that Bitcoin’s value is closely pushed by hypothesis and investor sentiment, making it inherently unstable and unpredictable.

VanEck’s bullish projection assumes a near-perfect situation the place Bitcoin captures a major share of worldwide monetary belongings however that is removed from assured.

To place this into perspective, if Bitcoin have been to achieve $52 million per coin, its market cap would balloon to a staggering $1.1 quadrillion far surpassing the overall worth of the world’s main corporations and monetary techniques.

Such progress would require unprecedented ranges of worldwide adoption and belief in Bitcoin, a feat that appears inconceivable given the present market dynamics.

On the flip facet, whereas Bitcoin’s critics foresee a collapse, it’s value noting that related doomsday predictions have been made since its inception but Bitcoin stays a significant participant within the monetary panorama.

The chance of Bitcoin going to zero, whereas not unattainable, is mitigated by its rising institutional adoption, technological improvements and the institution of its position as ‘digital gold’ amongst sure investor teams.

To be lifelike, allow us to evaluate this declare with the worth of Nvidia, Microsoft and Apple the three most respected corporations at the moment within the international market.

In 2024, the overall market capitalization of those three corporations is a bit of over $3 trillion.

Allow us to deal with Apple. The corporate goes sturdy and is certain to develop within the years to return. In accordance with a forecast by CoinCodex, the Apple inventory could attain $2,383 by 2050, gaining 1,211%.

This inventory value will push Apple’s worth to $61 trillion in 2050 roughly 20 occasions what it’s at the moment.

Now, if we evaluate this with the prediction of BTC reaching $1,100 trillion by 2050, one thing doesn’t really feel proper.

It doesn’t appear possible for Bitcoin to surpass one of many highest-valued corporations on this planet by such an enormous margin.

Having stated that, whereas such predictions are unlikely, they aren’t unattainable. As an investor, it is best to at all times hold your self knowledgeable and ready for the sudden.

The world has seen a plethora of miracles no stats predicted.

The underside line tay rational and knowledgeable

The world of cryptocurrencies is fraught with hype, worry and uncertainty. Slightly than getting swept up in sensational predictions, traders ought to strategy Bitcoin with a balanced perspective.

Each the ultra-bullish and ultra-bearish situations are speculative and must be taken with warning.

Making knowledgeable, rational selections based mostly on thorough analysis {and professional} recommendation is essential particularly when coping with an asset as unpredictable as Bitcoin.

As at all times, one of the best technique is to diversify your investments, assess your danger tolerance and keep away from making selections based mostly solely on excessive market narratives.

Cryptocurrencies can provide important returns, however they will additionally result in important losses. Be conscious of the dangers and train warning when navigating this unstable market.

Rahul Ka is a enterprise advisor and a tech aficionado decoding the digital frontier one innovation at a time, from blockchain breakthroughs to tech startups.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in online marketing.