Bitcoin (BTC) and U.S. shares have proven a unfavourable correlation recently, with Bitcoin usually shifting in the other way of conventional markets. This divergence has caught the eye of analysts and traders, particularly because the cryptocurrency enters a interval of consolidation together with the broader crypto market. Historically, shifts on this correlation—from unfavourable to constructive—have usually signaled a bullish development for Bitcoin.

Associated Studying

As each markets face challenges, the altering dynamics between BTC and U.S. shares might present essential insights into the place the market is headed. Buyers are carefully watching this relationship, anticipating {that a} shift might point out a possible breakout for Bitcoin.

Bitcoin Information Suggests Potential Uptrend

The unfavourable correlation between Bitcoin (BTC) and the U.S. inventory market, notably the S&P 500 (SPX), has develop into more and more evident. Distinguished analyst and dealer Daan on X lately highlighted this phenomenon by overlaying the BTC/USDT futures chart with SPX costs.

His evaluation reveals that whereas conventional markets just like the SPX have skilled a swift restoration, Bitcoin has not adopted swimsuit. This divergence underscores the decoupling between these two markets, with Bitcoin lagging behind the broader inventory restoration.

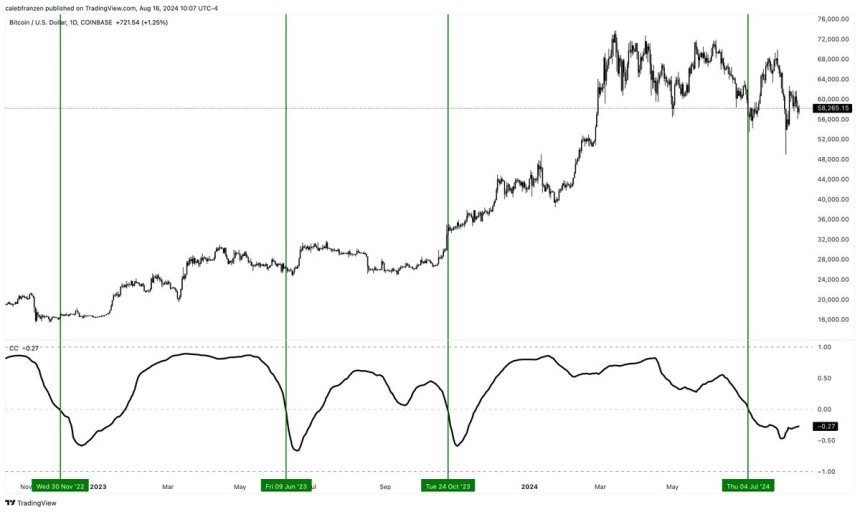

One other key analyst, Caleb Franzen, introduced consideration to this development, sharing knowledge revealing Bitcoin’s unfavourable correlation with main inventory indices. Particularly, Franzen factors out that the 90-day correlation between Bitcoin and the Nasdaq-100 ($QQQ) presently stands at -27%. This unfavourable correlation means that as tech shares recuperate, Bitcoin has been shifting in the other way, which may signify distinctive market dynamics.

Whereas intervals of unfavourable correlation between Bitcoin and shares aren’t inherently bullish, historic proof means that constructive market shifts usually comply with such phases. The crucial level for traders is to observe a possible reversal of this correlation—when Bitcoin begins to maneuver in tandem with the Nasdaq-100 ($QQQ) as soon as once more.

If Bitcoin’s correlation with tech shares turns constructive, it might sign a strengthening market and a doable uptrend for BTC. This shift might present a key indicator for timing potential entry factors out there.

BTC Worth Buying and selling Beneath A Key Indicator

Bitcoin trades at $59,350, under the crucial each day 200-day shifting common (MA) at $62,915. This shifting common is a key indicator many analysts use to gauge market developments. When BTC’s worth is under the each day 200 MA, it usually suggests a downtrend or a big correction. Conversely, buying and selling above this stage signifies market power and bullish momentum.

For Bitcoin to substantiate the continuation of its bull market, it must reclaim the each day 200 MA and persistently shut above it. This might sign a possible shift in development, offering confidence to merchants and traders that the bullish section continues to be intact.

Presently, BTC is hovering round the important thing psychological stage of $60,000, and the market stays in a consolidation section after enduring months of uncertainty and volatility.

For the bullish state of affairs to unfold, Bitcoin should break above $63,000, retaking the each day 200 MA and surpassing the August eighth native excessive of $62,729. This might mark a big restoration and point out that the market is regaining its power.

Associated Studying

However, if BTC fails to shut above $57,500 within the coming days, it might sign additional draw back strain, probably resulting in a pullback to sub-$50,000 ranges. The approaching days shall be essential in figuring out whether or not Bitcoin can regain its upward momentum or if extra bearish strain lies forward.

Cowl picture from Dall-E, charts from TradingView.