Ever since, the connection between Ripple’s XRP buybacks and its affect on value has been a topic of intense dialogue. Crypto Mark, an lively neighborhood member on X, raised a pertinent query relating to Ripple’s technique of buying extra of the cryptocurrency. “Shouldn’t Ripple be attempting to distribute XRP and never shopping for extra although? Want to see them personal much less XRP, no more,” Crypto Mark posted.

The Affect Of XRP Buybacks By Ripple On The Worth

This inquiry was addressed by Mr. Huber, a famend member of the neighborhood, who offered an in depth clarification of the dynamics at play. Huber emphasised the strategic rationale behind Ripple’s buybacks.

“That’s only a query of your information. Ripple makes it clear. That’s why we all know. And also you need Ripple to purchase again XRP. You don’t need them to only promote it. Imagine me. If XRP really has a use for Ripple you then need them to purchase on open markets for liquidity causes,” he defined. This assertion highlights the need and advantages of Ripple’s buyback technique, suggesting that it’s useful for sustaining market liquidity.

In his evaluation of the market, Mr. Huber identified key patterns: “Information; 1. XRP has sudden inexplicable very quick value spikes between 30 and 100% that are then misplaced over a number of months. 2. These value spikes virtually invariably coincide with buybacks of Ripple on open markets. They happen roughly as soon as 1 / 4. 80% reliability. 3. In case you take a look at these buybacks, you understand that when Ripple buys 100 million {dollars} of internet purchases inside 1-2 days, they set off a value spike of round 50%.”

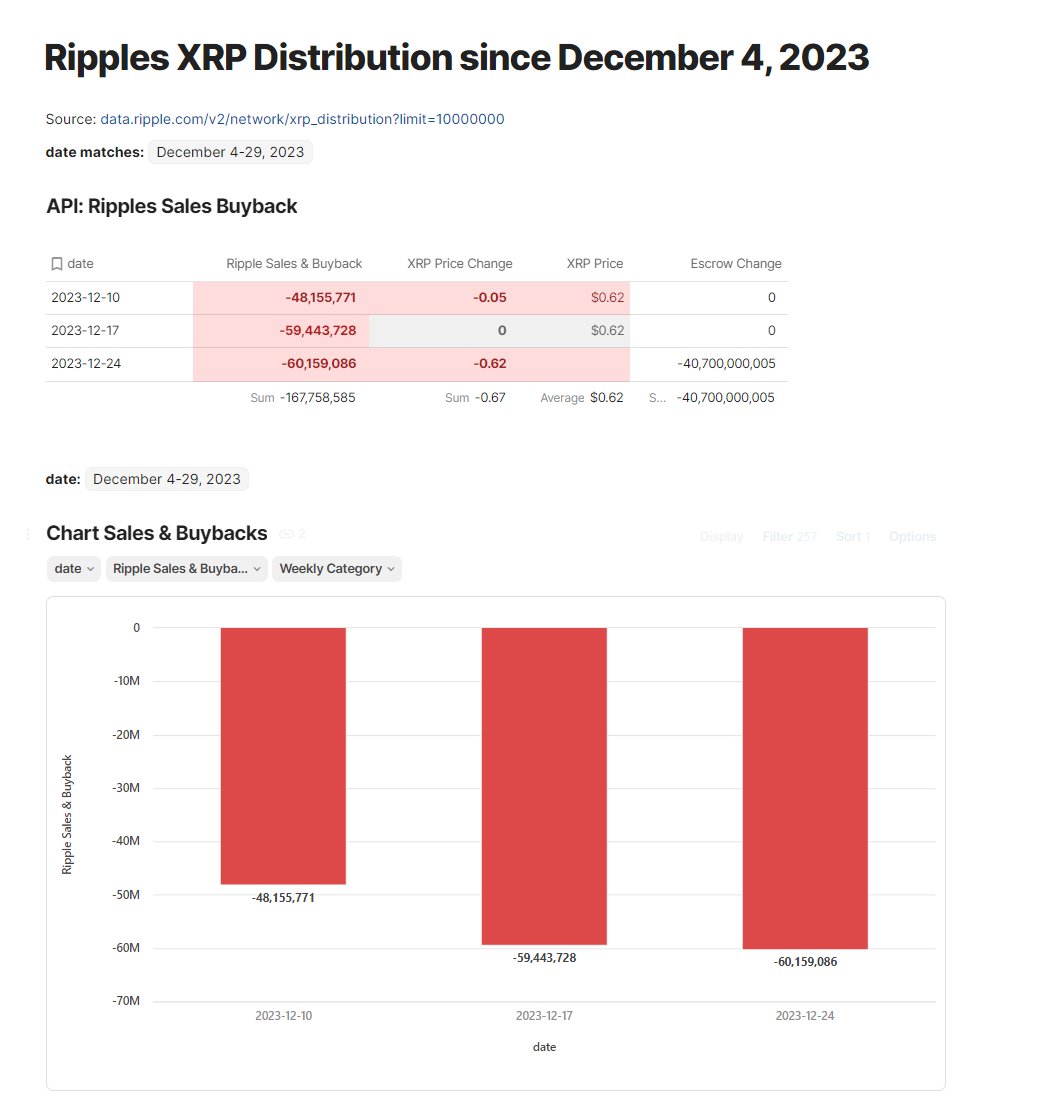

Latest information from Ripple’s API revealed a notable lower within the firm’s buyback exercise. The researcher famous that the API was up to date simply days in the past with the most recent information. Ripple’s gross sales now account for 167,758,585 XRP, for a median of $0.62, which ends up in a complete of $104,010,323 from December 4 to 29.

“That is twice the standard gross sales quantity of the final 6 months. I believe that Ripple needs to push this lower down once more with the subsequent buyback,” reported Mr. Huber.

Addressing a consumer’s query in regards to the scale of funding wanted for a considerable improve within the cryptocurrency’s value, Mr. Huber acknowledged, “$100 million {dollars} set off a value swing of round 30-50%. So for two,000% you would need to anticipate no less than 4-6 billion {dollars} in internet purchases.” This response gives a transparent indication of the monetary magnitude required for substantial market actions.

Affect Of Ripple’s Sale And Distributions

Moreover, Mr. Huber in contrast Ripple’s gross sales and distribution technique with different cryptocurrencies. He wrote, “Ripples Gross sales and Distribution of XRP of the previous 10 years. 6.48% Inflation for 2023. Compared with SOL and ETH, it turns into clear that the worth motion is due rather more to a scarcity of demand than to Ripple gross sales.”

He added, “ETH – Decreasing provide and proof of stake, however hardly any value motion because the Merge. […] The (XRP/XRPUSD)/(BTC/BTCUSD) chart exhibits that during the last 9 years, the availability of XRP has solely elevated by 22.73% greater than the availability of Bitcoin.”

At press time, XRP traded at $0.63135.

Featured picture from Kraken Weblog, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual danger.