Retail investing remains to be driving spot Bitcoin (BTC) exchange-traded funds (ETFs), however extra establishments are sinking capital into the brand new merchandise every quarter, in keeping with a senior analyst with crypto intelligence platform K33 Analysis.

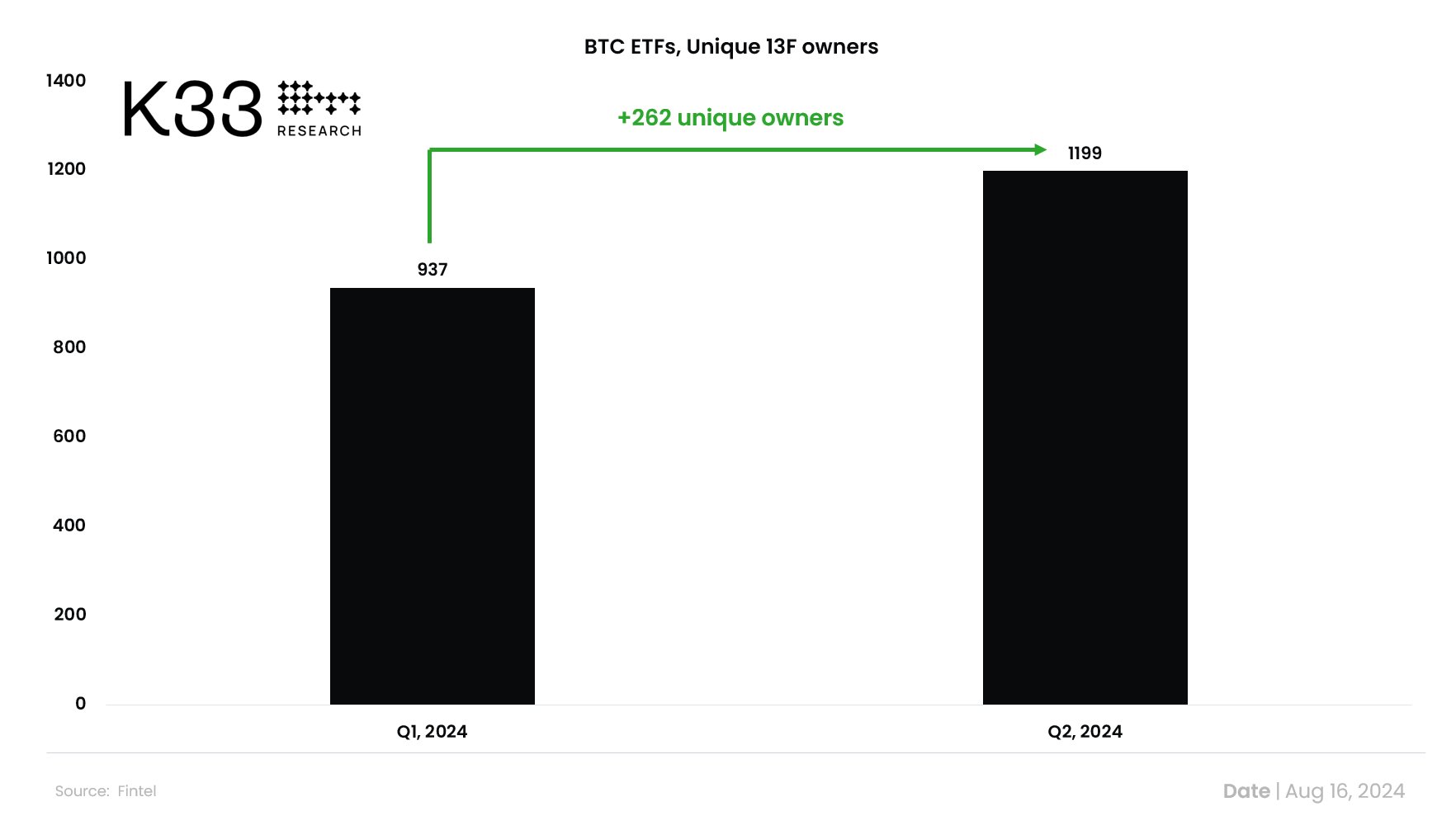

K33’s Vetle Lunde notes on the social media platform X that 262 extra skilled corporations bought investments in spot BTC ETFs, bringing the entire variety of corporations with investments to 1,199.

“Whereas retail traders nonetheless maintain the vast majority of the float, institutional traders elevated their share of complete AUM (asset beneath administration) by 2.41 share factors, now accounting for 21.15% in Q2.

GBTC (Grayscale Bitcoin Belief) noticed a considerable discount of their institutional capital, whereas IBIT and FBTC noticed a pronounced development in skilled investor dominance.”

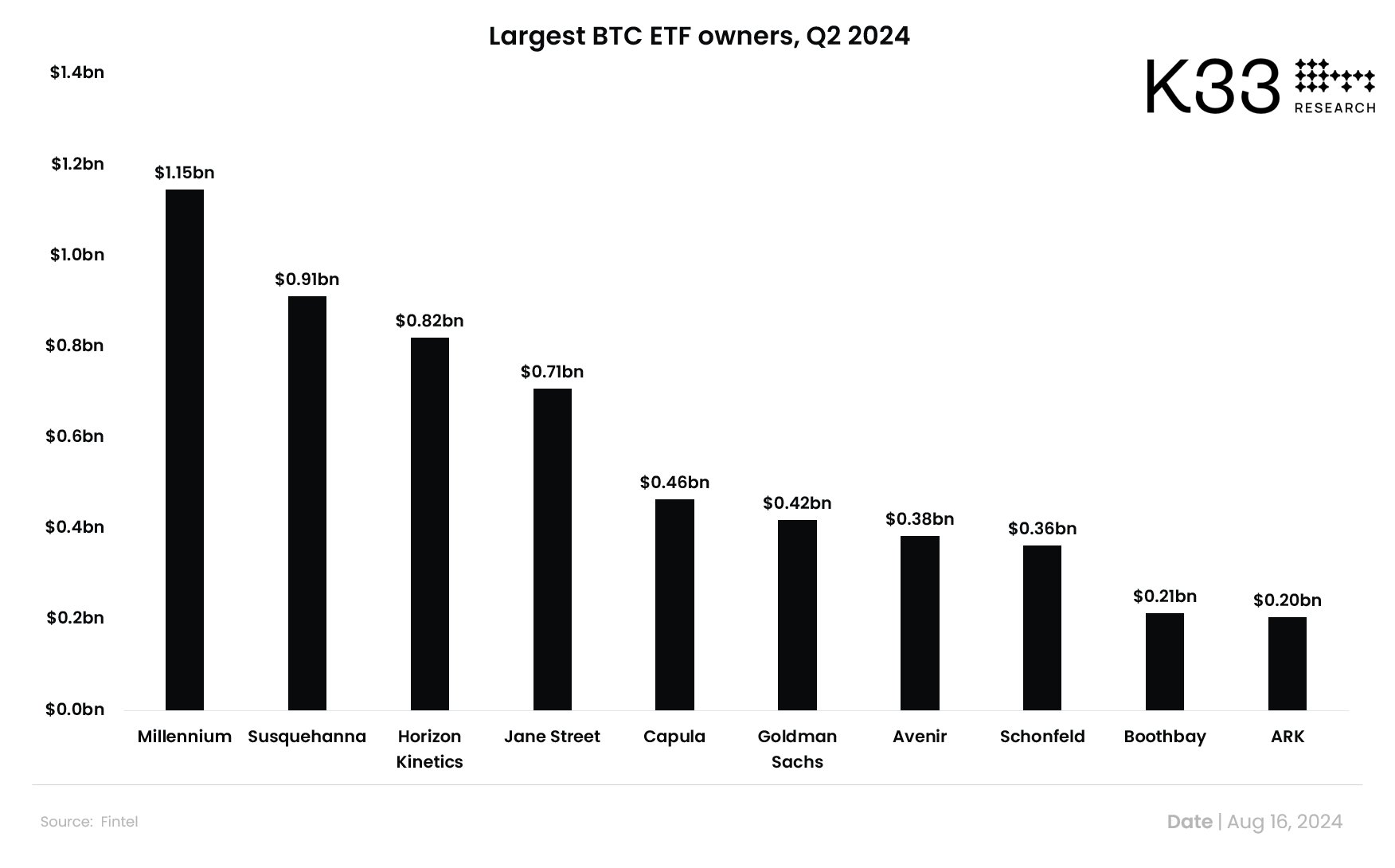

The analyst additionally notes that the largest institutional spot BTC ETF house owners are market makers.

“Millennium and Susquehanna stay the biggest holders however have diminished their publicity in comparison with Q1. Two elements seemingly led to this discount:

1) stiffening competitors as Jane Avenue entered the market in Q2

2) calming market circumstances, resulting in much less juicy yields – annualized CME premiums closed June thirtieth at 8.6%, in comparison with March thirty first’s 14%.”

Bitcoin is buying and selling at $59,141 at time of writing. The highest-ranked crypto asset by market cap is up greater than 2.6% previously 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney