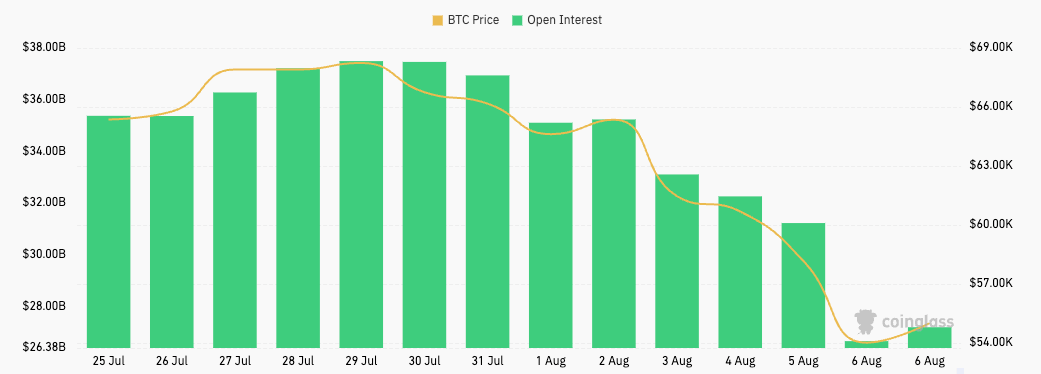

This week’s crash has led to a few of the highest losses we’ve seen for the reason that collapse of FTX, wiping out billions from the crypto market. Bitcoin’s drop to under $50,000 dramatically affected the futures market, with futures open curiosity plunging from $31.22 billion on Aug. 5 to $26.65 billion on Aug. 6.

Such a sharp drop in simply 24 hours was almost certainly brought on by pressured liquidations of futures positions as a consequence of margin calls. When Bitcoin’s worth drops under important ranges wanted to take care of collateral, it normally triggers a cascade of liquidations, and over-leveraged merchants have their positions forcibly closed.

The wipeout in futures open curiosity we’ve seen this week exhibits {that a} important variety of merchants have been betting on Bitcoin’s continued rise and have been caught off guard by the sudden downturn, main to an enormous discount in leveraged positions.

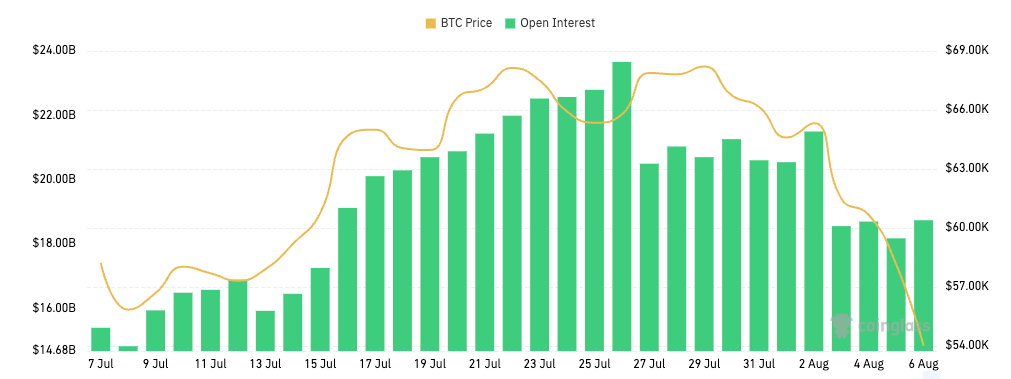

Alternatively, the choices market remained comparatively secure in the course of the worth downturn. Choices open curiosity remained virtually flat, fluctuating barely round $18 billion in the course of the weekend.

In contrast to futures, choices don’t contain margin calls that may pressure positions to shut instantly. As a substitute, they provide merchants the appropriate, however not the duty, to purchase or promote BTC at a predetermined worth. This inherent attribute permits choices merchants to carry onto their positions with out the instant danger of liquidation, even during times of maximum worth volatility.

Nonetheless, it’s extremely unlikely that the steadiness in choices OI we’ve seen over the previous few days was as a consequence of merchants holding onto their positions.

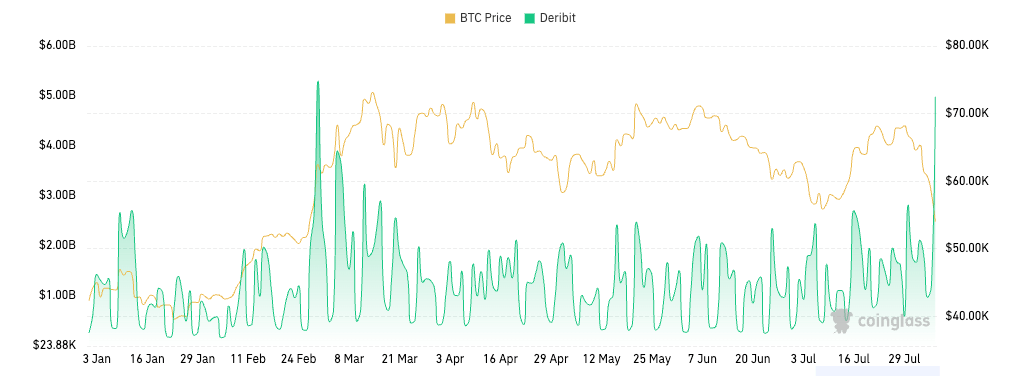

Choices buying and selling quantity on Deribit surged from $1.22 billion on Aug. 5 to $4.98 billion on Aug. 6. That is the second-highest choices quantity ever recorded, topped solely by the $5.30 billion in quantity the market noticed on Feb. 29 this 12 months.

Such a excessive spike in quantity signifies heightened buying and selling exercise, the place merchants are actively participating out there. A number of components might have contributed to this phenomenon the place open curiosity stays secure whereas buying and selling quantity will increase.

Firstly, during times of excessive volatility, merchants enter and exit positions extra regularly, which suggests opening new contracts and shutting current ones at a speedy tempo. If the variety of new contracts opened roughly equals the variety of contracts closed, the OI will stay comparatively unchanged whereas the quantity spikes. A excessive turnover of contracts might end result from short-term hypothesis, hedging, or rolling over positions.

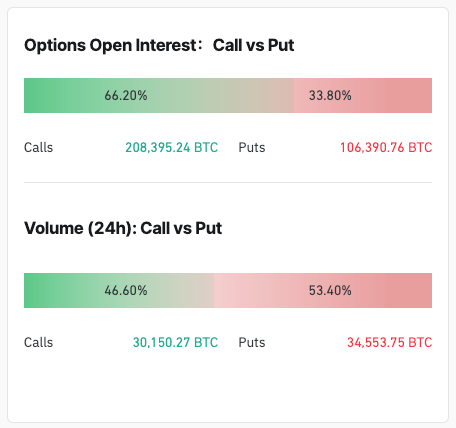

An attention-grabbing facet of the choices market throughout this era is the skew in direction of calls over places. With over 66% of the choices open curiosity being calls, it exhibits a bullish sentiment nonetheless prevails amongst merchants.

Nonetheless, whereas open curiosity exhibits a powerful bias towards calls, buying and selling quantity is skewed towards places. The 24-hour choices buying and selling quantity between Aug. 5 and Aug. 6 got here from places. This may be defined by the instant reactions merchants needed to the value drop. When Bitcoin skilled a pointy decline, merchants seemingly rushed to purchase places to hedge their current positions or to invest on additional worth declines within the quick time period.

In distinction, open curiosity displays extra of merchants’ longer-term positioning. Most open curiosity being calls signifies that merchants have constructed up these positions over time, sustaining a bullish outlook on Bitcoin’s longer-term prospects. These positions usually are not as rapidly adjusted or closed as short-term trades, which is why the open curiosity stays closely skewed towards calls.

The put up Bitcoin’s crash wipes out $5 billion in futures OI however choices stay secure appeared first on CryptoSlate.