As seen with Maker and the surrounding liquidity crunch, liquidity is all the things. With out it, programs crumble. Because of this, we’ve seen the realized potential for permissionless DEXs like Kyber and Uniswap. The flexibility for anybody to faucet into their respective liquidity swimming pools has allowed for each exchanges to expertise unparalleled development in current months as they each break new report quantity amid the coronavirus outbreak.

Kyber’s success could largely be resulting from its excessive potential for composability and skill for dApps and customers to simply entry liquidity with far decrease slippage than on automated platforms. Regardless, regardless of the huge volatility in crypto markets, Kyber Community was capable of deal with the current liquidity crunch whereas efficiently reaching report highs in day by day quantity.

The expansion in Kyber Community shouldn’t go unnoticed. Volumes in each USD and ETH phrases, distinctive addresses, and different metrics have all reached new all-time highs. As such, we’ve determined to take a while to dive into the current development of one in all DeFi’s main liquidity protocols.

| Stat Field | Since Jan 1. 2019 |

| USD Quantity | 2668.54% |

| ETH Quantity | 1201.97% |

| Trades | 406.59% |

| Distinctive Addresses | 332.95% |

| First Trades | 323.72% |

Basic Development

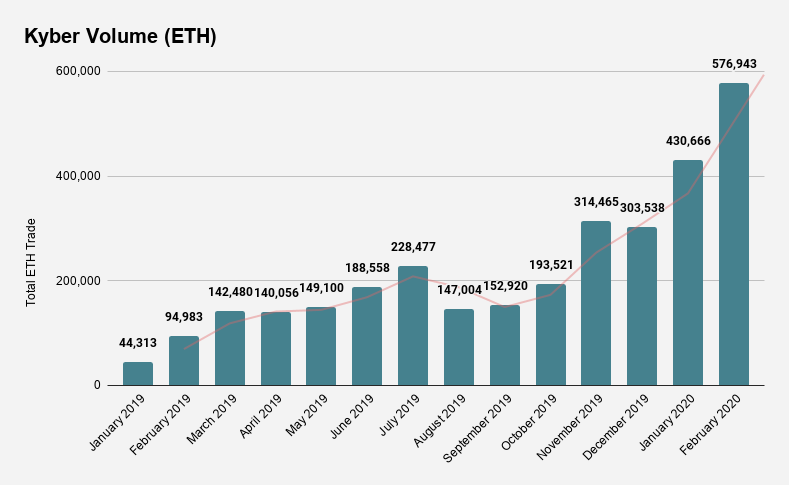

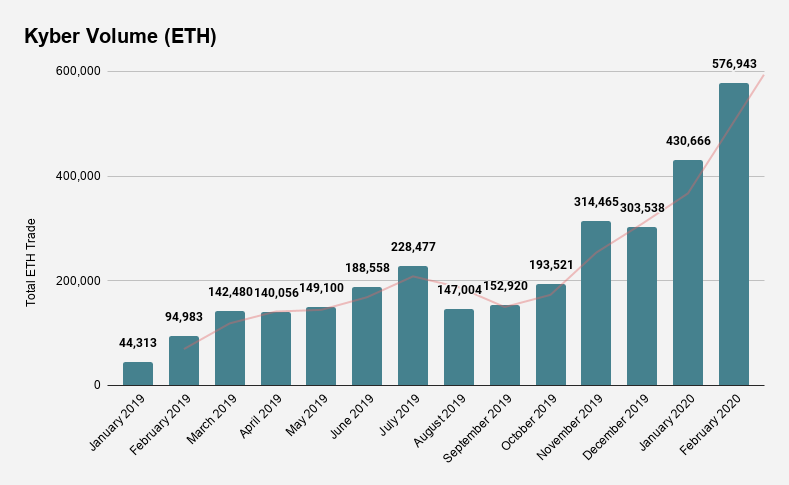

Wanting on the numbers, Kyber has skilled important development throughout the board in virtually each basic metric. In January 2019, month-to-month DEX quantity reached round ~44,000 ETH. By February of 2020, the protocol processed over ~577,000 ETH in month-to-month quantity, leading to a 1,201% enhance over 13 months. Regardless of the comparatively stagnant worth of ETH over the identical time interval, the amount has elevated steadily in ETH phrases.

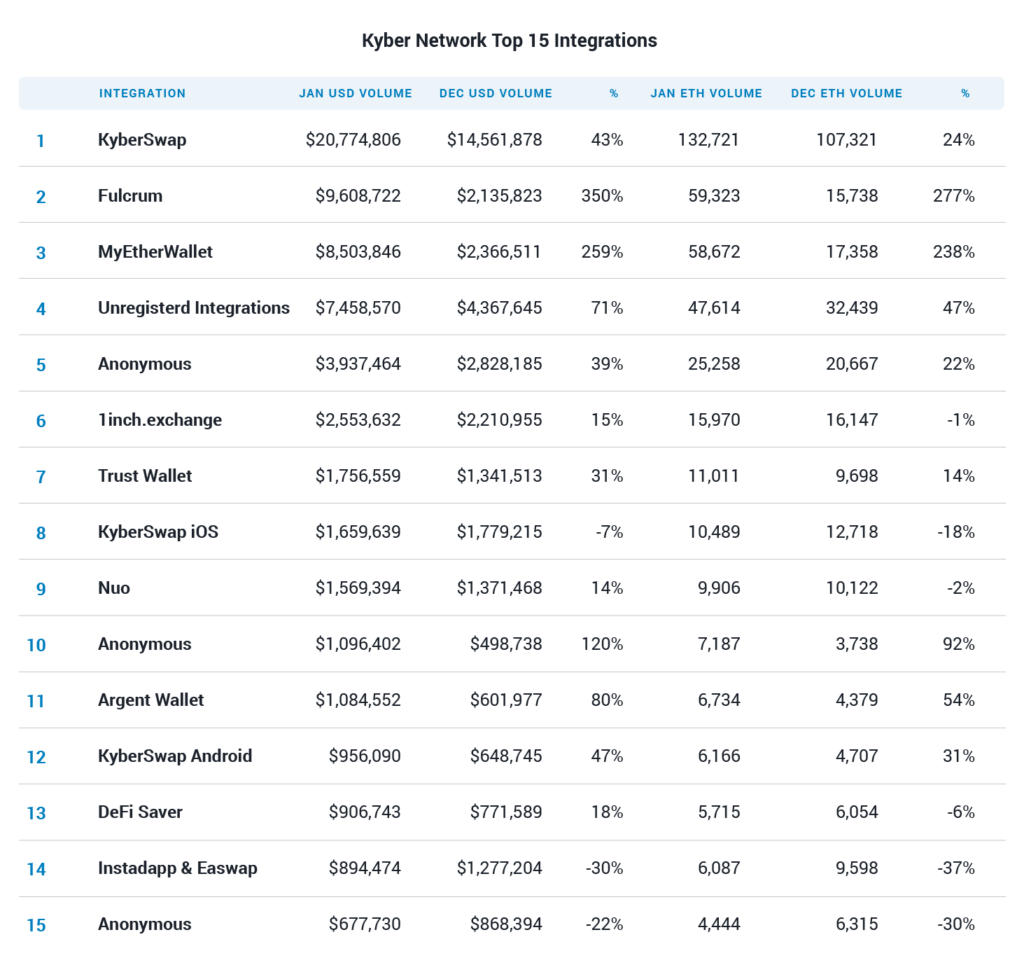

As reported within the final ecosystem report, many Kyber integrations have seen equally sturdy development as Fulcrum and MyEtherWallet (MEW) attain 277% and 238% month-over-month quantity development, respectively. One other notable integration seeing a good quantity of development was Argent.

The DeFi good pockets reached over 54% month-over-month development by its pockets software regardless of having restricted entry. We will count on that as Argent continues to scale its consumer base, we must always see a excessive uptick in total quantity as extra customers on-board the pockets and leverage its capabilities.

Desk through Kyber Ecosystem Report #11

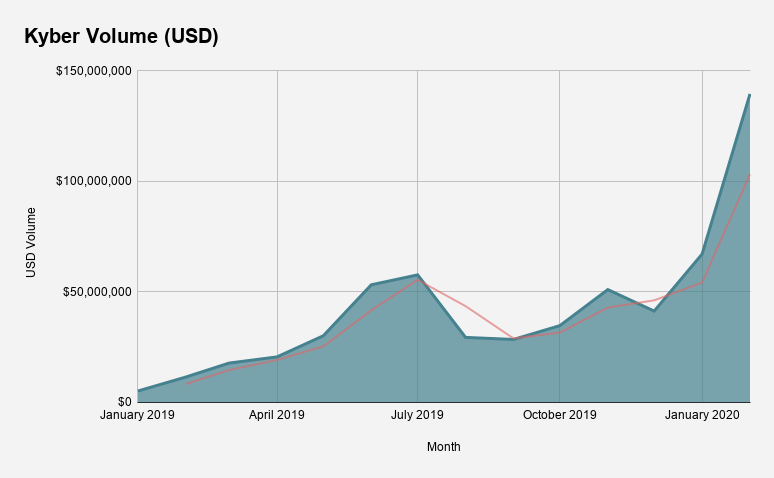

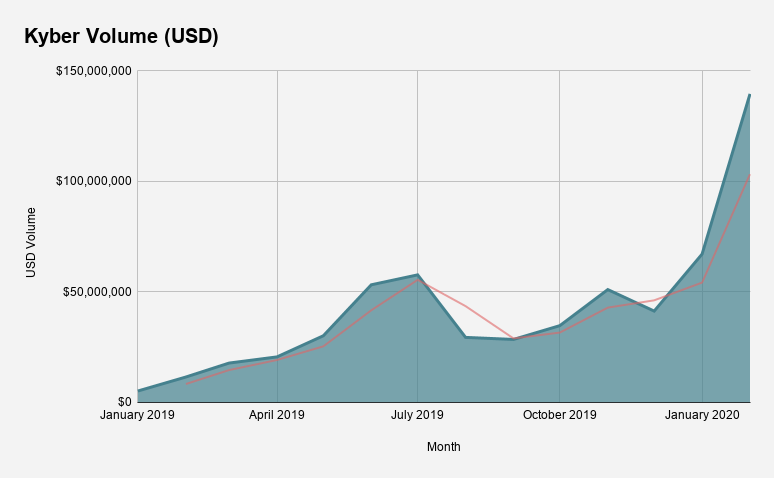

Taking a look at USD volumes, it’s obvious that the liquidity protocol continues to develop exponentially as we progress into the brand new yr. Whereas the protocol reached new ATHs in ETH quantity, the near-parabolic spike in USD quantity should even be attributed to Ether’s sturdy worth efficiency in 2020.

With that in thoughts, Kyber’s month-to-month USD quantity has seen the very best development out of each different metric on the board – hitting 2,668% quantity development since January 2019. Previously three months, Kyber on common skilled over $82M in month-to-month quantity in comparison with $11.3M within the first three months of 2019. Because of this, the liquidity protocol has seen a 626% enhance in common month-to-month quantity between January – March 2019 and January – March 2020.

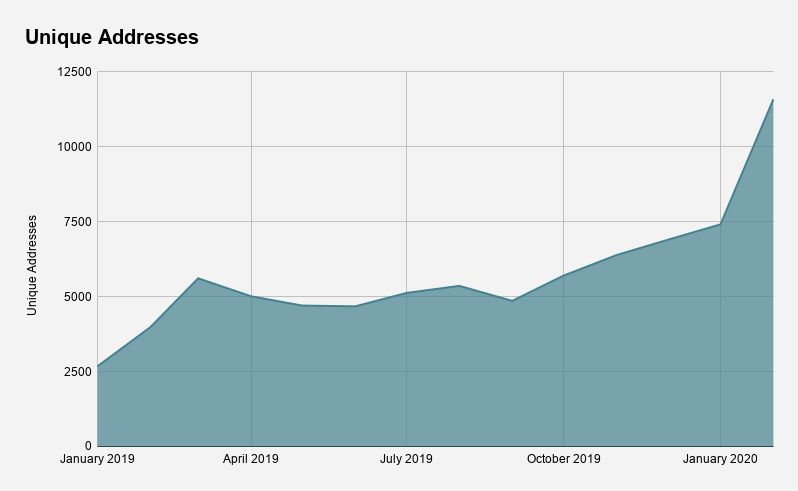

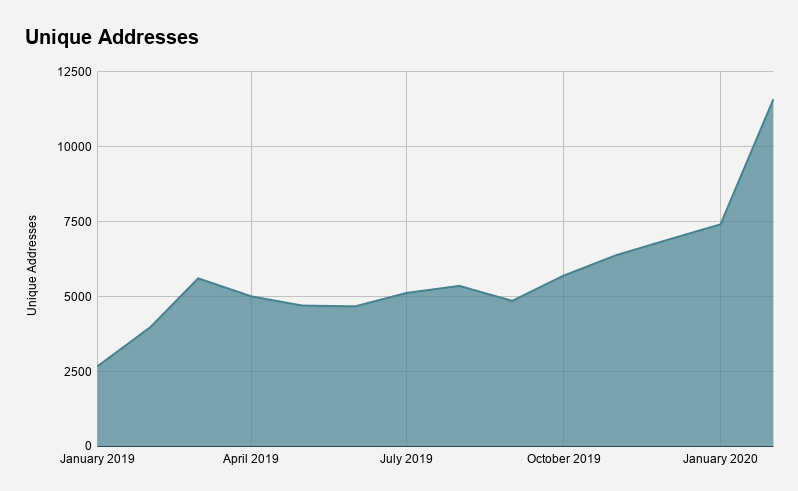

As volumes proceed to pattern upwards, it’s additionally vital to have a look at what number of distinctive addresses are interacting with the liquidity protocol. Whereas this isn’t an ideal measure for energetic customers (as the identical consumer can have a number of addresses), it does give us a primary framework for a way the protocol’s consumer base is rising over time.

Within the month of January 2019, Kyber Community noticed round 2,600 distinctive addresses work together with the protocol. Quick ahead a yr later and the liquidity protocol noticed practically 7,500 distinctive addresses leverage the liquidity protocol. Most just lately within the month of February, Kyber Community’s consumer base reached new all-time-highs with over 11,500 distinctive addresses within the month alone.

Extra broadly talking, between the time of January 2019 and February 2020, Kyber noticed a 322.95% enhance in distinctive addresses.

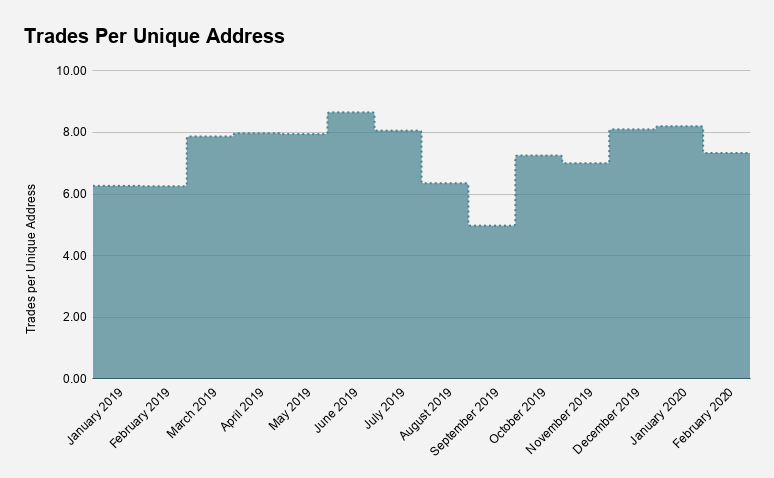

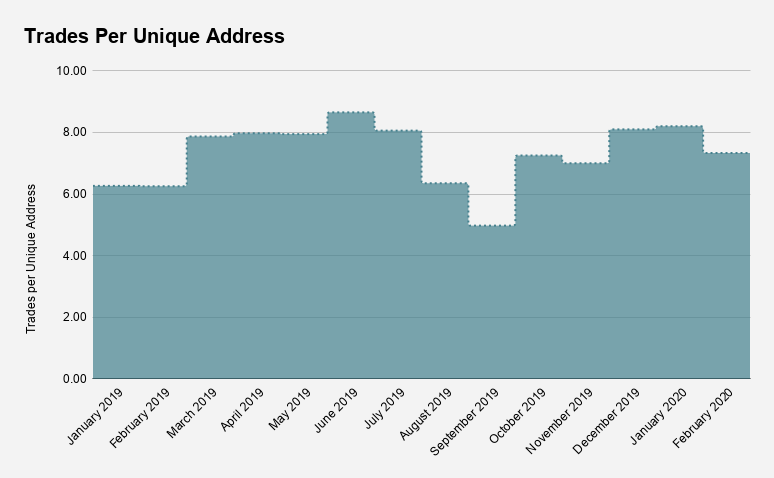

The query now turns into – what number of occasions is every tackle utilizing Kyber on a month-to-month foundation?

Usually talking, this statistic has stayed comparatively regular over the previous yr as customers proceed to make use of the liquidity protocol. In January 2019, the typical tackle interacted with Kyber 6.27 occasions per thirty days. Merchants per distinctive tackle noticed a slight uptick to 7.33 over a yr later – displaying sturdy consumer retention for one in all DeFi’s main liquidity protocols.

Tokens & Charges with PE Ratios

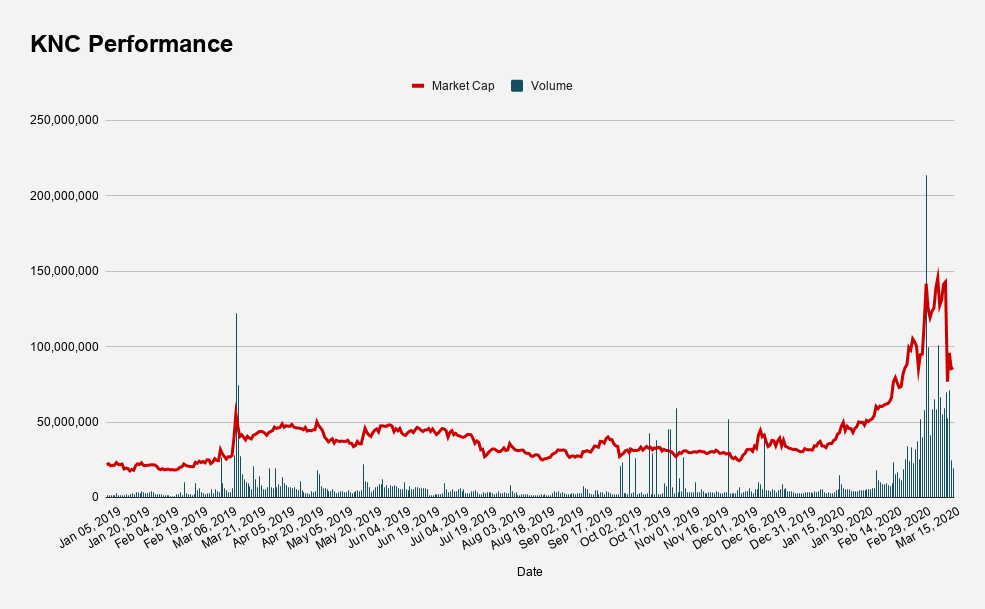

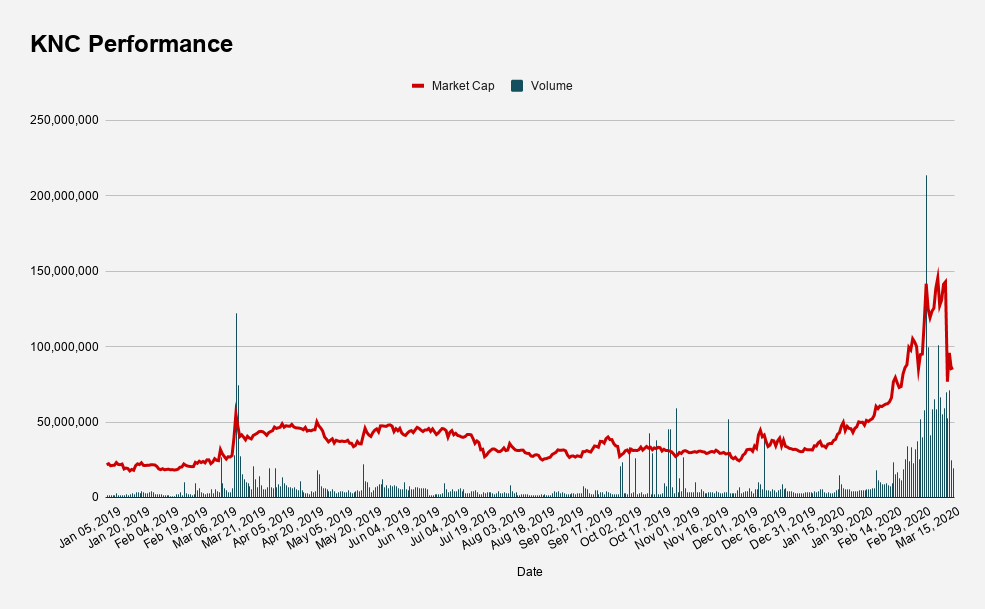

Whereas all of this basic development is thrilling, it’s equally vital to see if the basics translate to worth accrual for the protocol’s native token, KNC.

In 2020, KNC has been among the finest performing tokens in the marketplace, growing by 171% as of writing whereas reaching 358% enhance YTD from its peak in early March. As well as, KNC’s buying and selling quantity has additionally surged prior to now yr. The typical quantity for KNC within the month of March reached ~$70M in comparison with ~$2M again in January 2019, leading to a 3,518% enhance in common day by day buying and selling quantity.

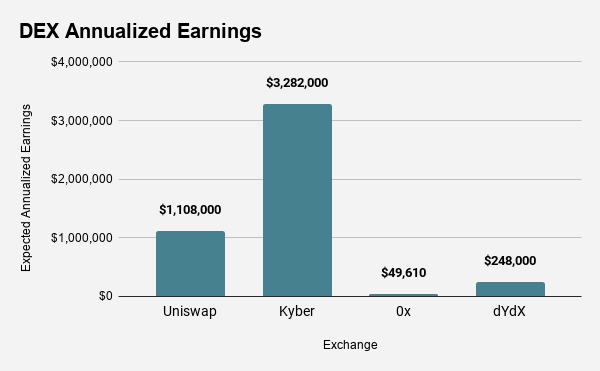

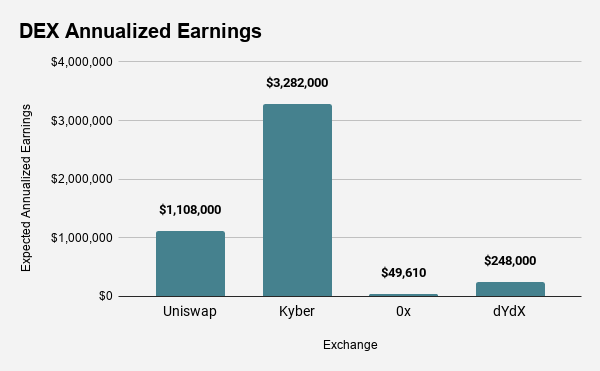

In response to Token Terminal, Kyber Community is predicted to generate round $3.2M in annualized revenues for its tokenholders. With that, the KNC token at present boasts a average PE ratio of 26.98 (Liquid Market Cap / Annualized Earnings). That is line with honest worth for many conventional equities, a notable feat for Ethereum’s nascent cash protocols. In comparison with the remainder of the DEX discipline, Kyber is predicted to generate probably the most in annualized revenues. Naturally, the second-highest in forecasted annualized revenues is Uniswap.

Nevertheless, not like Kyber, Uniswap is untokenized and due to this fact doesn’t have a mechanism in place to distribute the worth throughout all ecosystem individuals. This is without doubt one of the advantages to Kyber – anybody can capitalize on the potential worth accrual for the liquidity protocol at giant.

Different notable gamers within the DEX area embrace 0x and dYdX. The margin buying and selling platform – dYdX – is starting to see notable development in volumes as is proven within the protocol’s earnings. Lastly, regardless of 0x being a somewhat distinguished liquidity protocol (and the one different tokenized protocol), it’s struggling to garner any important earnings for tokenholders.

Wanting Ahead – Katalyst

The current development in Kyber shouldn’t go unnoticed. The liquidity protocol is continuous to realize increasingly traction inside the quickly rising DeFi area as all basic metrics present huge will increase throughout the board.

One of many extra notable issues within the pipeline for Kyber is the brand new token financial rework, Katalyst. Kyber is implementing a brand new, dynamic token mannequin the place protocol earnings might be distributed by three predominant mechanisms:

- Burns

- Distribute to energetic token holders

- Accumulate revenue in Liquidity Supplier pool

Following the improve, KNC holders will be capable to vote on how income might be allotted throughout the ecosystem individuals. Finally, this can be a well-designed token mannequin as tokens give the holders each financial and governance rights – an vital dynamic present in conventional equities.

Given Kyber Community is without doubt one of the few tokenized DeFi protocols producing substantial earnings for its token holders, the Katalyst improve ought to present the ecosystem with a clear-cut design for worth seize in an effort to correctly capitalize on the basic development inside the protocol at giant.

Finally, the approaching yr is extraordinarily thrilling for one in all DeFi’s main DEXs. It is going to be fascinating to see how Katalyst adjustments the dynamic for tokenholders and whether or not or not the protocol will proceed on its path to “hockey stick development” as seen with most profitable, conventional begin ups.

The place is Kyber Community Now?

Kyber Community has gone on to turn out to be a multi-chain crypto liquidity aggregator, combining liquidity from varied DeFi exchanges and aggregators to offer the very best commerce charges.

Kyber Community homepage | Supply: Kyber.community

The community continues to assist 17+ chains and integrations with over 200 DeFi protocols, and has facilitated over $20 billion in buying and selling quantity up to now.

Safety Incidents and Monetary Impression

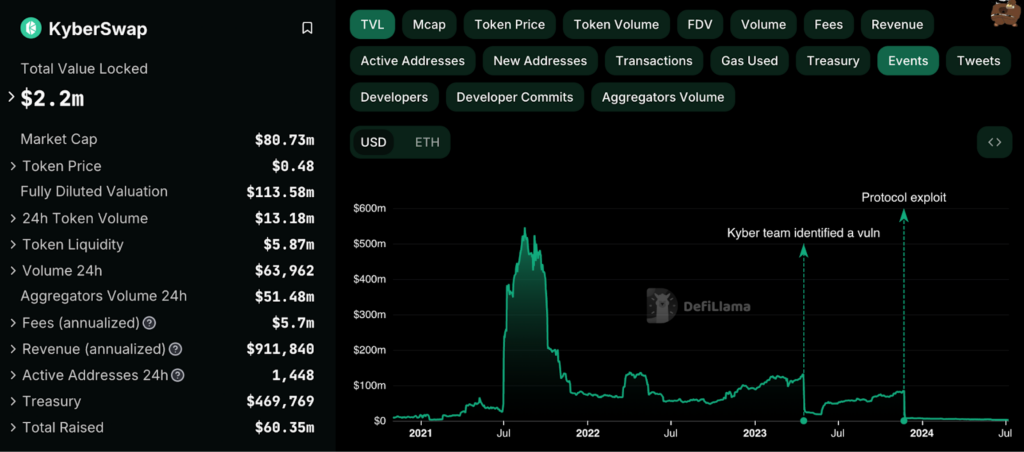

Sadly, following a pair of unlucky occasions in 2023, the protocol’s complete worth locked (TVL) has dwindled to simply $2.2 million on the time of writing.

It had peaked at a big $530 million in August 2021, as proven under:

KyberSwap Whole Worth Locked (TVL) | Supply: Defillama.com

April 2023 Vulnerability

Bear markets apart, the primary synthetic impression got here in April 2023 when a vulnerability was discovered in KyberSwap Elastic’s contracts.

The undertaking suggested liquidity suppliers to withdraw their funds instantly as a precaution. No funds had been misplaced, however farming rewards had been briefly suspended till a brand new good contract was deployed.

November 2023 Exploit ($48M)

The drama didn’t cease there, nonetheless, because the protocol suffered a significant hack on November 23, 2023.

An attacker used an “infinite cash glitch” to empty practically $49 million in digital property. The hacker initially demanded negotiations, which included a $4.6 million bounty provide for returning 90% of the stolen funds.

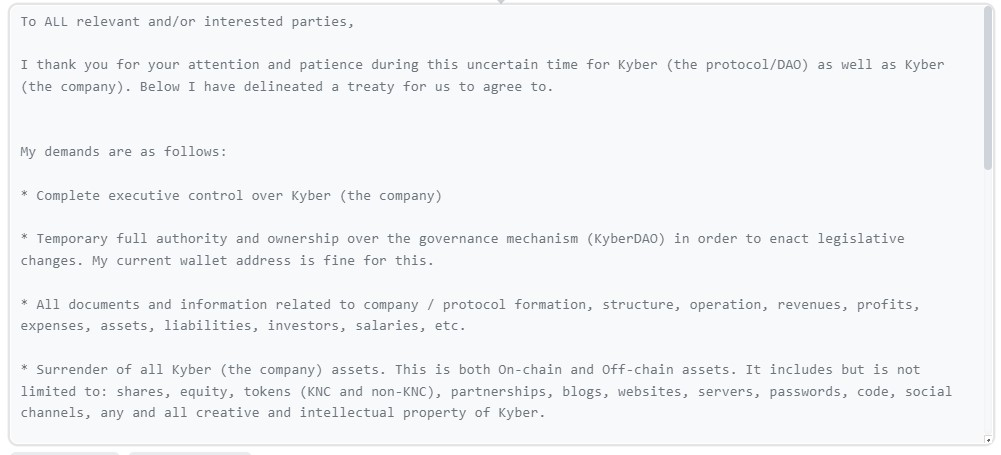

Nevertheless, negotiations went bitter, and the hacker escalated calls for to complete management over KyberSwap and KyberDAO.

A part of the attacker’s message to KyberSwap. | Supply: Etherscan

Following these calls for, KyberSwap determined to launch treasury grants for victims of the hack and was pressured to chop half of its workforce in response to the incident.

Does Kyber Community Have a Future?

Regardless of the implosion, Kyber Community has outlined an formidable product roadmap for 2024-2025.

The undertaking is specializing in enhancing consumer expertise, increasing the ecosystem, and growing utility for KNC holders, with key developments together with:

- Enhancements to KyberSwap API, KyberSwap.com, and KyberDAO: Refining consumer expertise, performance, and governance.

- Good Liquidity Pool Governance: Utilizing statistical fashions to handle liquidity swimming pools effectively and save operational prices.

- Zap Expertise: Introducing APIs and widgets to simplify including liquidity and incomes yield with a single transaction.

- Off-chain liquidity protocols: Growing programs to offer liquidity on an off-chain layer, decreasing good contract dangers whereas sustaining consumer expertise.

The roadmap highlights Kyber’s intention to match the consumer expertise of centralized exchanges whereas sustaining decentralized safety.

The workforce encourages group participation and suggestions to refine and obtain these objectives.

Kyber’s success could largely be resulting from its excessive potential for composability and skill for dApps and customers to simply entry liquidity with far decrease slippage than on automated platforms. Regardless, regardless of the huge volatility in crypto markets, Kyber Community was capable of deal with the current liquidity crunch whereas efficiently reaching report highs in day by day quantity.

The expansion in Kyber Community shouldn’t go unnoticed. Volumes in each USD and ETH phrases, distinctive addresses, and different metrics have all reached new all-time highs. As such, we’ve determined to take a while to dive into the current development of one in all DeFi’s main liquidity protocols.

| Stat Field | Since Jan 1. 2019 |

| USD Quantity | 2668.54% |

| ETH Quantity | 1201.97% |

| Trades | 406.59% |

| Distinctive Addresses | 332.95% |

| First Trades | 323.72% |

Basic Development

Wanting on the numbers, Kyber has skilled important development throughout the board in virtually each basic metric. In January 2019, month-to-month DEX quantity reached round ~44,000 ETH. By February of 2020, the protocol processed over ~577,000 ETH in month-to-month quantity, leading to a 1,201% enhance over 13 months. Regardless of the comparatively stagnant worth of ETH over the identical time interval, the amount has elevated steadily in ETH phrases.

As reported within the final ecosystem report, many Kyber integrations have seen equally sturdy development as Fulcrum and MyEtherWallet (MEW) attain 277% and 238% month-over-month quantity development, respectively. One other notable integration seeing a good quantity of development was Argent.

The DeFi good pockets reached over 54% month-over-month development by its pockets software regardless of having restricted entry. We will count on that as Argent continues to scale its consumer base, we must always see a excessive uptick in total quantity as extra customers on-board the pockets and leverage its capabilities.

Desk through Kyber Ecosystem Report #11

Taking a look at USD volumes, it’s obvious that the liquidity protocol continues to develop exponentially as we progress into the brand new yr. Whereas the protocol reached new ATHs in ETH quantity, the near-parabolic spike in USD quantity should even be attributed to Ether’s sturdy worth efficiency in 2020.

With that in thoughts, Kyber’s month-to-month USD quantity has seen the very best development out of each different metric on the board – hitting 2,668% quantity development since January 2019. Previously three months, Kyber on common skilled over $82M in month-to-month quantity in comparison with $11.3M within the first three months of 2019. Because of this, the liquidity protocol has seen a 626% enhance in common month-to-month quantity between January – March 2019 and January – March 2020.

As volumes proceed to pattern upwards, it’s additionally vital to have a look at what number of distinctive addresses are interacting with the liquidity protocol. Whereas this isn’t an ideal measure for energetic customers (as the identical consumer can have a number of addresses), it does give us a primary framework for a way the protocol’s consumer base is rising over time.

Within the month of January 2019, Kyber Community noticed round 2,600 distinctive addresses work together with the protocol. Quick ahead a yr later and the liquidity protocol noticed practically 7,500 distinctive addresses leverage the liquidity protocol. Most just lately within the month of February, Kyber Community’s consumer base reached new all-time-highs with over 11,500 distinctive addresses within the month alone.

Extra broadly talking, between the time of January 2019 and February 2020, Kyber noticed a 322.95% enhance in distinctive addresses.

The query now turns into – what number of occasions is every tackle utilizing Kyber on a month-to-month foundation?

Usually talking, this statistic has stayed comparatively regular over the previous yr as customers proceed to make use of the liquidity protocol. In January 2019, the typical tackle interacted with Kyber 6.27 occasions per thirty days. Merchants per distinctive tackle noticed a slight uptick to 7.33 over a yr later – displaying sturdy consumer retention for one in all DeFi’s main liquidity protocols.

Tokens & Charges with PE Ratios

Whereas all of this basic development is thrilling, it’s equally vital to see if the basics translate to worth accrual for the protocol’s native token, KNC.

In 2020, KNC has been among the finest performing tokens in the marketplace, growing by 171% as of writing whereas reaching 358% enhance YTD from its peak in early March. As well as, KNC’s buying and selling quantity has additionally surged prior to now yr. The typical quantity for KNC within the month of March reached ~$70M in comparison with ~$2M again in January 2019, leading to a 3,518% enhance in common day by day buying and selling quantity.

In response to Token Terminal, Kyber Community is predicted to generate round $3.2M in annualized revenues for its tokenholders. With that, the KNC token at present boasts a average PE ratio of 26.98 (Liquid Market Cap / Annualized Earnings). That is line with honest worth for many conventional equities, a notable feat for Ethereum’s nascent cash protocols. In comparison with the remainder of the DEX discipline, Kyber is predicted to generate probably the most in annualized revenues. Naturally, the second-highest in forecasted annualized revenues is Uniswap.

Nevertheless, not like Kyber, Uniswap is untokenized and due to this fact doesn’t have a mechanism in place to distribute the worth throughout all ecosystem individuals. This is without doubt one of the advantages to Kyber – anybody can capitalize on the potential worth accrual for the liquidity protocol at giant.

Different notable gamers within the DEX area embrace 0x and dYdX. The margin buying and selling platform – dYdX – is starting to see notable development in volumes as is proven within the protocol’s earnings. Lastly, regardless of 0x being a somewhat distinguished liquidity protocol (and the one different tokenized protocol), it’s struggling to garner any important earnings for tokenholders.

Wanting Ahead – Katalyst

The current development in Kyber shouldn’t go unnoticed. The liquidity protocol is continuous to realize increasingly traction inside the quickly rising DeFi area as all basic metrics present huge will increase throughout the board.

One of many extra notable issues within the pipeline for Kyber is the brand new token financial rework, Katalyst. Kyber is implementing a brand new, dynamic token mannequin the place protocol earnings might be distributed by three predominant mechanisms:

- Burns

- Distribute to energetic token holders

- Accumulate revenue in Liquidity Supplier pool

Following the improve, KNC holders will be capable to vote on how income might be allotted throughout the ecosystem individuals. Finally, this can be a well-designed token mannequin as tokens give the holders each financial and governance rights – an vital dynamic present in conventional equities.

Given Kyber Community is without doubt one of the few tokenized DeFi protocols producing substantial earnings for its token holders, the Katalyst improve ought to present the ecosystem with a clear-cut design for worth seize in an effort to correctly capitalize on the basic development inside the protocol at giant.

Finally, the approaching yr is extraordinarily thrilling for one in all DeFi’s main DEXs. It is going to be fascinating to see how Katalyst adjustments the dynamic for tokenholders and whether or not or not the protocol will proceed on its path to “hockey stick development” as seen with most profitable, conventional begin ups.

The place is Kyber Community Now?

Kyber Community has gone on to turn out to be a multi-chain crypto liquidity aggregator, combining liquidity from varied DeFi exchanges and aggregators to offer the very best commerce charges.

Kyber Community homepage | Supply: Kyber.community

The community continues to assist 17+ chains and integrations with over 200 DeFi protocols, and has facilitated over $20 billion in buying and selling quantity up to now.

Safety Incidents and Monetary Impression

Sadly, following a pair of unlucky occasions in 2023, the protocol’s complete worth locked (TVL) has dwindled to simply $2.2 million on the time of writing.

It had peaked at a big $530 million in August 2021, as proven under:

KyberSwap Whole Worth Locked (TVL) | Supply: Defillama.com

April 2023 Vulnerability

Bear markets apart, the primary synthetic impression got here in April 2023 when a vulnerability was discovered in KyberSwap Elastic’s contracts.

The undertaking suggested liquidity suppliers to withdraw their funds instantly as a precaution. No funds had been misplaced, however farming rewards had been briefly suspended till a brand new good contract was deployed.

November 2023 Exploit ($48M)

The drama didn’t cease there, nonetheless, because the protocol suffered a significant hack on November 23, 2023.

An attacker used an “infinite cash glitch” to empty practically $49 million in digital property. The hacker initially demanded negotiations, which included a $4.6 million bounty provide for returning 90% of the stolen funds.

Nevertheless, negotiations went bitter, and the hacker escalated calls for to complete management over KyberSwap and KyberDAO.

A part of the attacker’s message to KyberSwap. | Supply: Etherscan

Following these calls for, KyberSwap determined to launch treasury grants for victims of the hack and was pressured to chop half of its workforce in response to the incident.

Does Kyber Community Have a Future?

Regardless of the implosion, Kyber Community has outlined an formidable product roadmap for 2024-2025.

The undertaking is specializing in enhancing consumer expertise, increasing the ecosystem, and growing utility for KNC holders, with key developments together with:

- Enhancements to KyberSwap API, KyberSwap.com, and KyberDAO: Refining consumer expertise, performance, and governance.

- Good Liquidity Pool Governance: Utilizing statistical fashions to handle liquidity swimming pools effectively and save operational prices.

- Zap Expertise: Introducing APIs and widgets to simplify including liquidity and incomes yield with a single transaction.

- Off-chain liquidity protocols: Growing programs to offer liquidity on an off-chain layer, decreasing good contract dangers whereas sustaining consumer expertise.

The roadmap highlights Kyber’s intention to match the consumer expertise of centralized exchanges whereas sustaining decentralized safety.

The workforce encourages group participation and suggestions to refine and obtain these objectives.