Within the conventional finance world, dollar-cost averaging (DCA) is a time-honored funding technique that entails buying set quantities of inventory at common intervals, whether or not the value is excessive or low. This technique means that you can scale back your common buy value on the shares. It’s additionally a great way to take a few of the emotion out of funding selections, and supplies alternatives for larger returns over time. However how does dollar-cost averaging apply to crypto belongings? Let’s have a look.

What’s dollar-cost averaging in crypto?

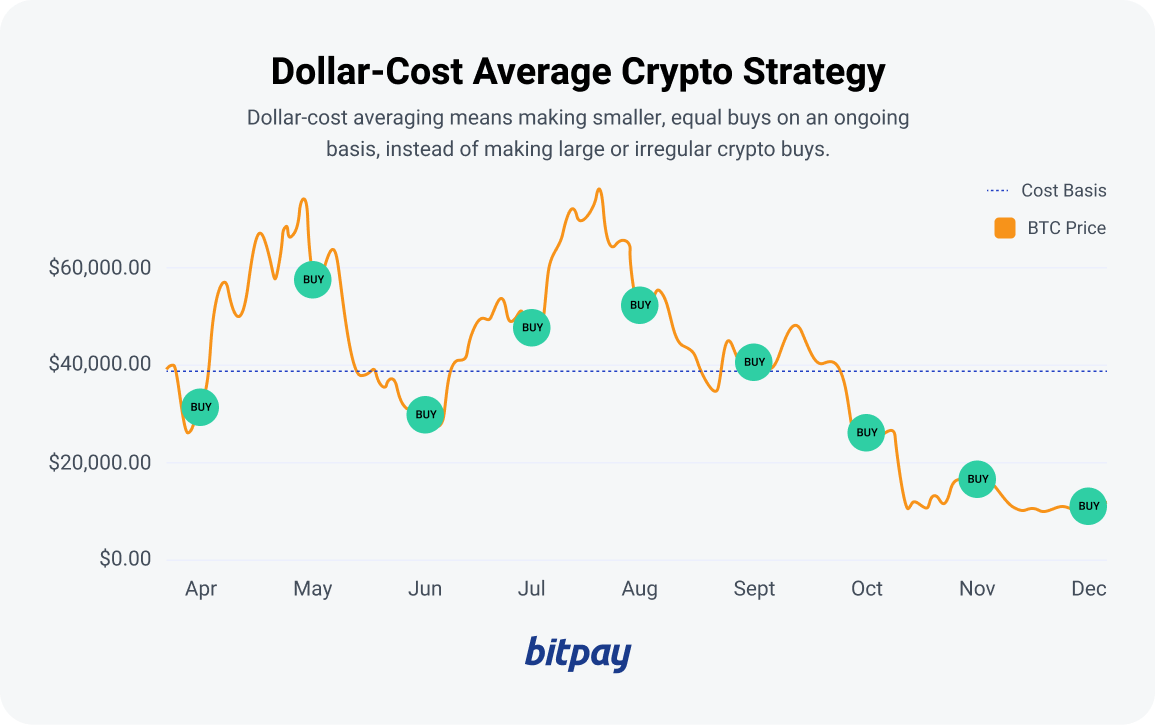

Greenback-cost averaging (DCA) means making smaller, equal investments on an ongoing foundation, as an alternative of constructing massive or irregular crypto buys. Though cryptocurrency may be significantly extra risky than shares, dollar-cost averaging with crypto may help you reap lots of the similar rewards conventional equities merchants get pleasure from via the technique. By usually shopping for your favourite cash, you’ll be robotically investing extra over time it doesn’t matter what’s happening within the crypto market. This lets you develop your holdings, and may decrease your total cost-basis throughout dips.

🧠

Fast reminder: The value foundation is the price of an asset whenever you make your buy. For those who purchase 1 Bitcoin when it equals $50,000, your value foundation is $50,000.

How does dollar-cost averaging with crypto work?

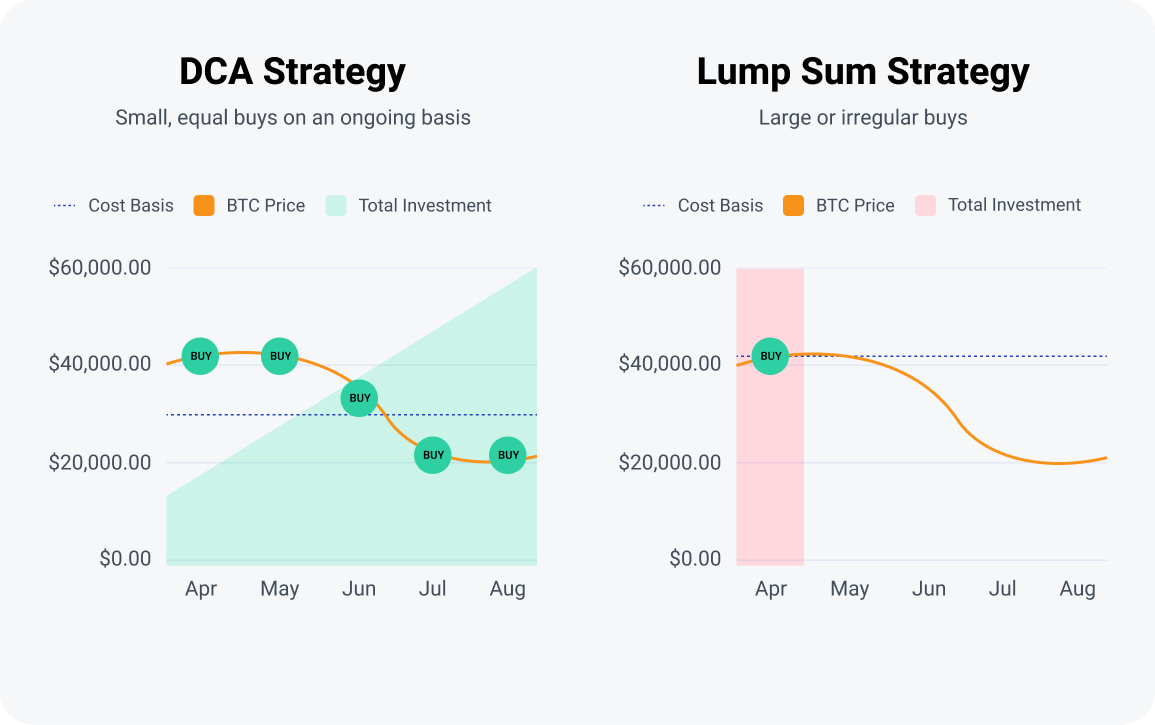

Let’s say you’ve gotten $50,000 you’d prefer to spend money on cryptocurrency. If the value of Bitcoin was at present $50,000 and also you made a lump sump funding proper now, you’d have one Bitcoin at a value foundation of $50,000. Nevertheless, for those who unfold that $50,000 throughout 5 equal $10,000 buys at a value of $50,000/BTC, $45,000/BTC, $25,000/BTC, $25,000/BTC and $55,000/BTC then your common value foundation could be $40,000, and also you’d have 1.4 Bitcoin. When Bitcoin’s value goes again up, your positive factors might be magnified since you lowered the typical value to amass your holdings. With dollar-cost averaging crypto you’ll be buying extra Bitcoin even throughout ups and downs.

How one can DCA crypto

Are you able to attempt dollar-cost averaging with crypto? Whereas the general thought of standard buys stays true, there are a couple of different issues to think about earlier than leaping in. Here is learn how to DCA crypto like a professional:

- Select the belongings you may be shopping for

- Determine how usually you may make your buys

- Set a tough sum of money you may be investing

- Select a reliable supplier/trade you may use to make investments

- Choose a safe, handy place the place you may retailer and handle your funding

Determine on the token/cryptocurrency you’ll be shopping for

For those who’re trying to begin dollar-cost averaging on future purchases of cryptocurrencies you already personal, you seemingly already know what cash you’ll be focusing on. For those who’re new to crypto, it’s sensible to conduct thorough due diligence on any token you’re fascinated by buying, particularly earlier than attempting your hand at dollar-cost averaging.

How usually will you make investments?

Many exchanges supply the choice to make computerized purchases month-to-month, weekly and even day by day in some instances. Day by day or weekly recurring purchases don’t make as a lot sense for slower-moving belongings like conventional securities, however crypto’s volatility means you may feasibly make the most of a DCA technique with larger frequency than you’d when shopping for inventory. As all the time, make sure the cash you earmark for investing is just not wanted to maintain a roof over your head or pay your payments (until you’re paying payments with crypto).

How a lot will you make investments?

All investing entails threat, however given the crypto market’s potential for excessive volatility, it is best to solely make investments cash you may afford to lose. Dig into your month-to-month finances to find out how a lot in discretionary earnings it’s important to decide to investing and keep away from exceeding that determine.

The place will you make your buys?

A number of buying and selling exchanges supply recurring buys which may be handy. Nevertheless, comfort comes at a value. Exchanges received’t all the time have the most effective charges and may add pricey charges on high of every purchase. Recurrently examine charges to see the place you’ll be able to get the most effective value. BitPay gives crypto buys with no hidden charges and reveals a number of gives to be sure to get the most effective price.

The place will you retailer your funding?

Deciding the place you’ll maintain your crypto holdings protected and sound is a private resolution. There are many various kinds of crypto wallets. For those who’re utilizing a custodial crypto pockets, make sure it’s received a stable popularity and a longtime safety observe file. For extra superior customers who’re selecting to self-custody, there are various crypto wallets to select from, together with the BitPay Pockets. Not solely does the BitPay Pockets supply market-leading safety features like self-custody, biometric safety, multisig and key encryption to maintain your funds protected, it additionally opens the door to a various ecosystem of BitPay services and products that will help you get extra utility out of your holdings. Purchase and swap the most well-liked cash with BitPay to help in your DCA crypto technique.

Kick off your DCA technique with BitPay

Purchase Crypto with No Hidden Charges

DCA vs. lump-sum investing

Everytime you put a single lump-sum of cash into an funding, the worth of your holdings is pegged solely to the ups and downs of its share value (or coin value, within the case of cryptocurrency).. By using a dollar-cost averaging technique, nonetheless, you may flatten out a few of the value volatility over time by making extra purchases throughout market downturns. As of 2022, we’re within the midst of one other crypto winter which implies asset costs are depressed. Greenback-cost averaging technique may be particularly profitable throughout these market situations.

Potential drawbacks of DCA crypto investing

After all, there are not any fully foolproof funding methods, and dollar-cost averaging crypto can carry some disadvantages and dangers. Routinely buying crypto at set intervals means you might spend extra money for smaller quantities of crypto if the market goes up sharply. This has the alternative meant impact of DCA, and may really elevate your cost-basis if quite a few recurring purchases happen after a significant upswing. Some merchants favor lump-sum investing throughout market downturns hoping for larger positive factors, however really reaching these positive factors requires efficiently timing the market, which could be very arduous to do whenever you’re competing in opposition to automated and/or institutional merchants.

Is a DCA crypto technique proper for me?

Utilizing a dollar-cost common in crypto is a constant, easy method to construct your portfolio, notably for learners or those that don’t wish to consistently be in entrance of a display. For those who’d like to speculate extra in crypto, however end up in “evaluation paralysis”, leveraging DCA ways may help instantly relieve your anxiousness and construct a secure portfolio time beyond regulation.

FAQs about DCA methods in crypto

How can greenback value averaging defend your investments?

By making recurring purchases over time in a set quantity, you’re successfully eradicating all emotion from the investing equation. It may be tempting to yank a lump-sum funding out of the market throughout a downturn, even for those who e book a loss consequently. However this might value you huge time positive factors if the crypto you bought comes unexpectedly roaring again to life after you’ve offered all of your holdings.

How do you calculate the dollar-cost common?

For those who’re not a math whiz, don’t fret. There are numerous helpful DCA calculators on the market that allow you to merely plug in some numbers to determine how varied purchases will have an effect on your cost-basis, together with this one from Omni. Technically it’s designed for calculating DCA on inventory purchases, however it might probably simply as simply be used for crypto dollar-cost averaging as properly.

How lengthy do you have to use a greenback value common technique?

This depends upon elements like your investing horizon and monetary targets. Ideally a dollar-cost averaging technique is one thing you may set and neglect, with out having to consistently monitor your portfolio. However true dollar-cost averaging sometimes occurs over a prolonged time period, sometimes not less than 6-12 months. In any case, you may’t actually common one thing out with just a few knowledge factors.

How usually do you have to use a dollar-cost common crypto technique?

Greenback-cost averaging doesn’t should be the whole lot of your crypto investing technique. Some traders could use DCA for a portion of their holdings even when the majority of their purchases are made in lump sums.

Is lump-sum investing higher than greenback value averaging for crypto?

There are advantages and downsides to each methods. Lump-sum investing provides you an opportunity to earn outsize income when an organization’s share value rebounds sharply after a dip, however figuring out the market’s backside or predicting the place a inventory might be in a couple of months or years is nearly not possible to find out. That goes double for crypto investing, the place costs should not solely extra risky than shares, however may be impacted by a variety of exterior, unpredictable elements. Your threat tolerance in addition to your dedication to your long-term funding plan will decide which technique is best for you.

Be aware: All data on this article is for instructional functions solely, and should not be interpreted as funding recommendation. BitPay is just not chargeable for any errors, omissions or inaccuracies. The opinions expressed are solely these of the creator, and don’t mirror views of BitPay or its administration. For funding or monetary steering, knowledgeable needs to be consulted.