After a colorless week characterised by Bitcoin, Ethereum, and Solana costs both dumping or shifting sideways, costs bounced off strongly by the top of final week.

Of notice, losses in Ethereum have been arrested as costs recovered, rising from round $3,000. On the identical time, Bitcoin and Solana pushed greater, closing in on $70,000 and $200, respectively.

Curiosity In Bitcoin, Ethereum, And Solana Spikes

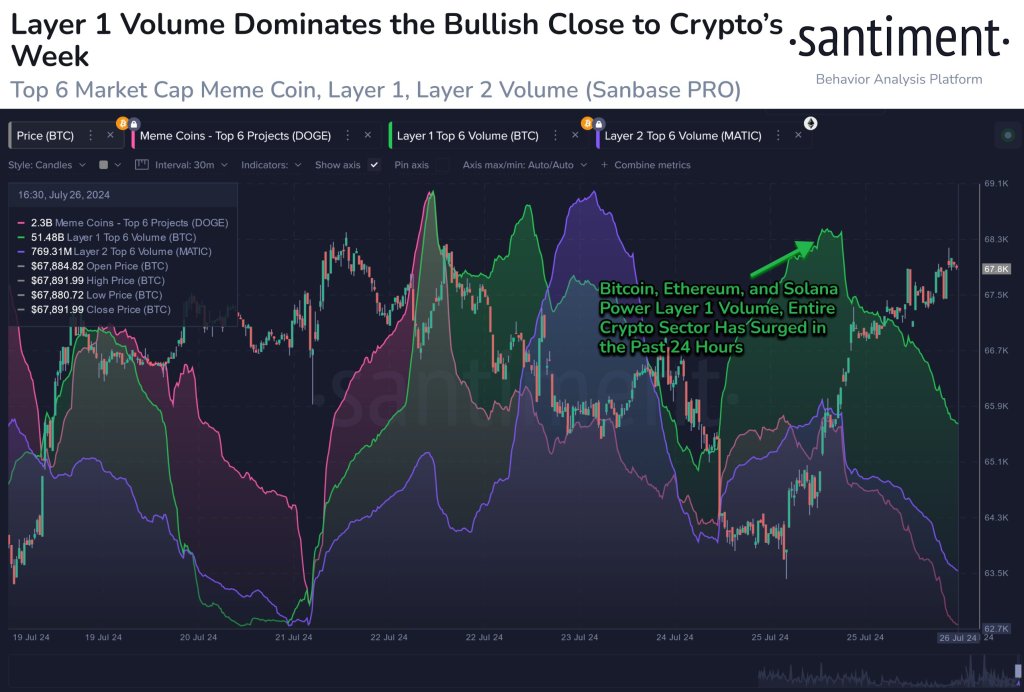

Based on Santiment knowledge, regardless of weak spot throughout the scene, there have been hints of power on the tail finish of final week. Of notice was renewed curiosity, the place Solana, Bitcoin, and Ethereum noticed a marked spike in buying and selling quantity.

Associated Studying

When buying and selling quantity surges, it typically means that market contributors are curious and prepared to interact, particularly if costs are rising. Since these high cash have been agency, rejecting losses, particularly from Friday, July 26, consumers have been within the equation, trying to capitalize.

As Santiment analysts famous, how Bitcoin, Ethereum, and Solana carry out tends to influence the overall market. If Ethereum rallies, for instance, it might profit the broader layer-2 and three ecosystems. It will push meme cash and even decentralized finance (DeFi) exercise even greater.

There have been a number of elements behind this curiosity. In Bitcoin’s case, shifting regulatory perspective on the world’s most respected coin and rising endorsement from politicians, particularly in the USA, might clarify why extra are prepared to study in regards to the coin.

The Affect Of Trump, Spot Ethereum ETFs, And SOL Flipping BNB

Over the weekend, Donald Trump, the previous president and the presidential candidate within the upcoming November election, delivered a keynote tackle on the just lately concluded Bitcoin convention in Nashville. Trump expressed his help for Bitcoin, saying he would make America the house of crypto.

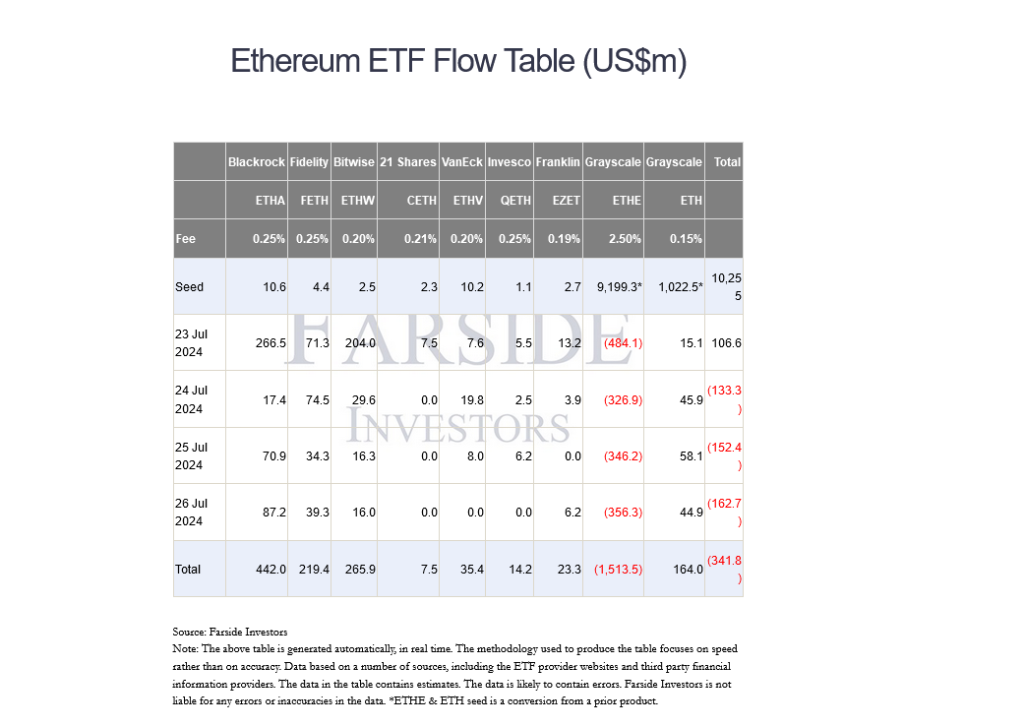

In the meantime, eyes have been on Ethereum following the approval of spot ETFs by the USA Securities and Trade Fee (SEC). Although the by-product product started buying and selling at main bourses, together with the NYSE and Cboe, inflows stay low.

If something, Farside knowledge confirmed that by Friday, spot Ethereum ETFs had posted outflows for 3 consecutive days. Outflows from Grayscale’s ETHE mainly drove this. Even amid this sudden improvement, BlackRock’s spot Ethereum ETF product noticed over $87 million inflows on July 26.

Associated Studying

Merchants additionally tracked Solana after the coin flipped BNB because the third most respected cryptocurrency, excluding stablecoins. Based on July 29, SOL commanded a market cap of $88.5 billion, whereas BNB stood at $86.5 billion, in response to CoinMarketCap knowledge.

Over the previous few weeks, SOL has been edging greater. To place within the numbers, SOL is up 56% from July lows. It would possible register contemporary Q3 2024 highs if consumers breach $200.

Characteristic picture from DALLE, chart from TradingView