On-chain knowledge exhibits that the Bitcoin value reiterates the final price foundation degree related to the short-term holder group.

Bitcoin Worth Has Surged Previous Remaining Quick-Time period Holder Value Foundation

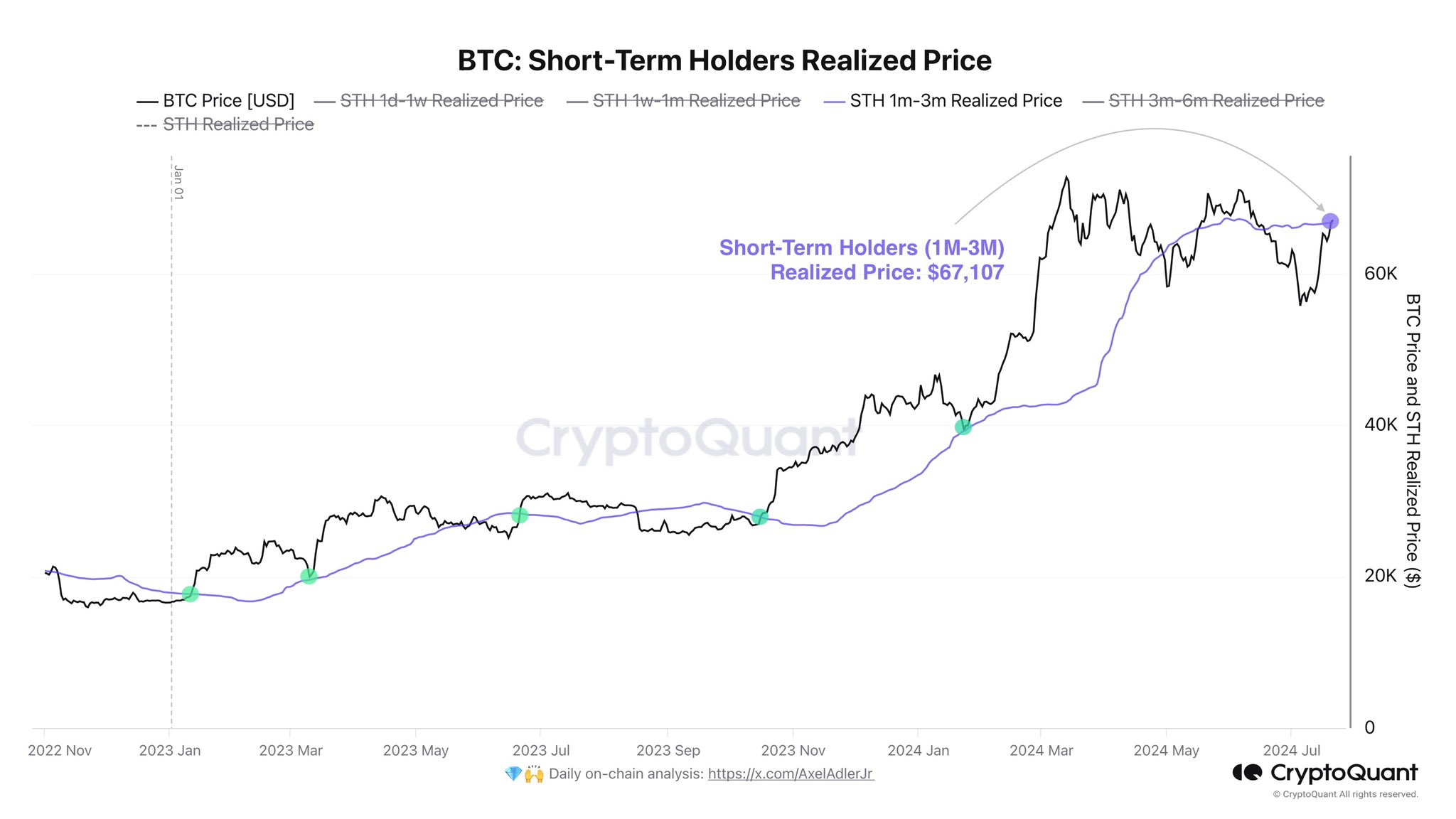

As defined by CryptoQuant writer Axel Adler Jr in a brand new put up on X, Bitcoin has just one Realized Worth of the short-term holders left to interrupt. The “Realized Worth” right here refers to an on-chain indicator that retains monitor of the typical price foundation of the buyers within the BTC market.

Traders carry web earnings when the cryptocurrency’s spot value is above this degree. Then again, it being below the metric suggests the dominance of losses available in the market.

Within the context of the present dialogue, the Realized Worth of all the market isn’t of curiosity however quite that of a small phase of it. The group in query is a bit of the “short-term holders” (STHs), broadly together with the buyers who purchased their cash inside the previous six months.

Under is the chart that exhibits the pattern within the Realized Worth particularly for the STHs who’ve been holding since between one and three months in the past:

This phase of the STHs sits proper in the course of the group, between the newcomers who’ve simply purchased into the asset and those that have began to achieve some resilience, with a promotion into the long-term holder (LTH) group probably arising for them.

In line with the analyst, Bitcoin has already surged previous the Realized value of the opposite two components of the STH group, which means that the buyers falling in them can be in earnings now.

The chart exhibits that the Realized Worth of the 1 month to three months outdated buyers, the one degree BTC is but to interrupt, is valued at $67,100. This cryptocurrency value is presently floating round, suggesting that this cohort’s earnings are canceling their losses.

The STH price foundation ranges have traditionally been related for the cryptocurrency, as these buyers, who’re typically fickle-minded, are prone to present some response when the worth retests their price foundation.

In bullish intervals, these buyers have a tendency to purchase at their very own price, whereas if the environment is bearish, they might promote as a substitute. As such, a profitable break above this potential resistance boundary that Bitcoin is retesting proper now might point out the presence of bullish sentiment among the many STHs.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $67,200, up nearly 6% over the previous week.