Bitcoin is in an uptrend, however occasions within the day by day chart present pockets of weak spot. Although BTC is stagnant, analysts are upbeat, anticipating costs to rise within the days to come back.

Is Bitcoin Prepared To Rip Increased: Analyst Says Bulls Are Eyeing $140,000

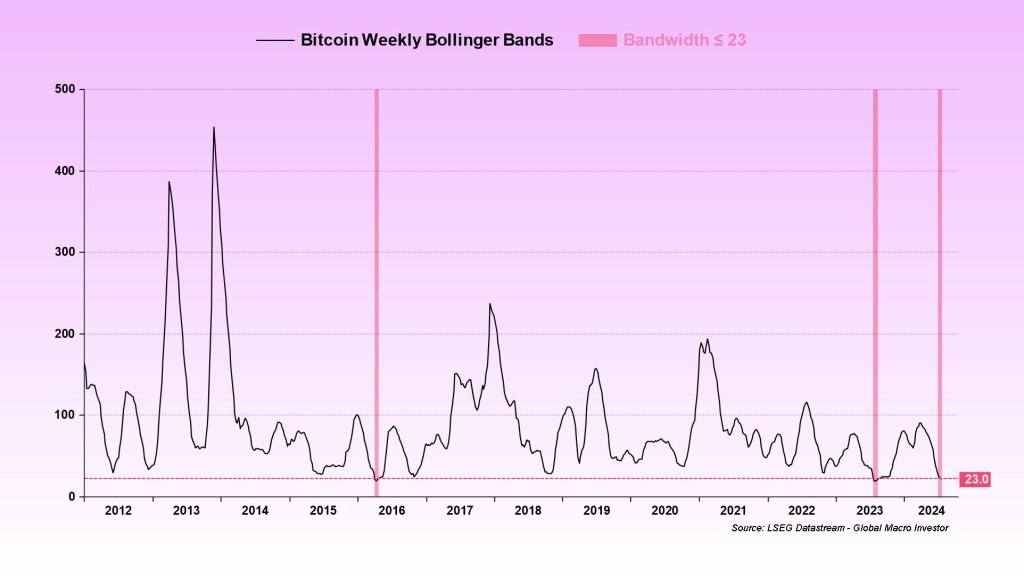

Taking to X, one analyst has picked out an uncommon improvement: Within the weekly chart, the Bitcoin Bollinger Bands (BB) is at the moment at their tightest degree in historical past. In addition to April 2016 and July 2023 occasions, the Bitcoin BB is tightening, forming a squeeze.

Associated Studying

Since BB is a technical indicator used to gauge underlying volatility, what’s taking place now ought to draw merchants’ consideration. Particularly, costs are inclined to explode throughout the subsequent few classes at any time when BB kinds a squeeze, compressing to what’s now.

Nonetheless, merchants must also know that the path of breakout could be in both path. Up to now, Bitcoin costs rose increased. For example, after the BB squeeze in July, the coin went on to fly within the coming months, breaking $70,000 by March earlier than the coin rose to $73,800.

If the previous guides, and certainly, costs explode on the finish of this squeeze, the analyst predicts Bitcoin flying to $140,000 and even $190,000 within the subsequent few months.

The growth can be a welcomed increase for bulls, contemplating that costs are actually in what the analyst described as a “boring zone.”

Any uptick above $73,800 and all-time highs, pushing BTC to six-digit ranges, would robotically be within the “banana zone.”

Spot BTC ETF Issuers On A Shopping for Spree, Donald Trump’s Endorsement

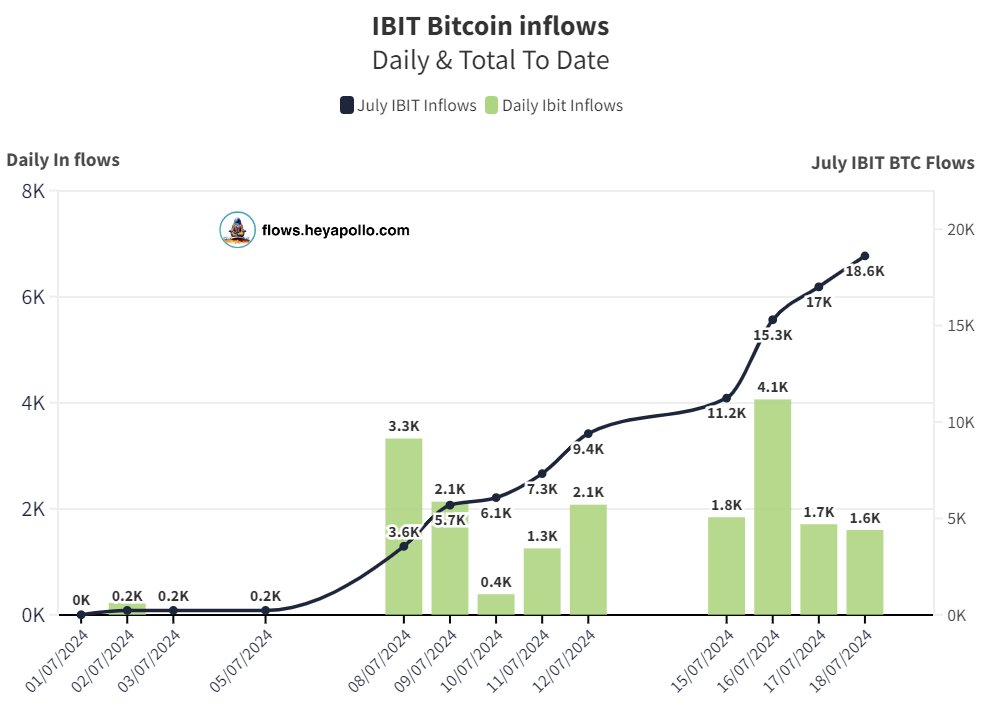

The boldness that Bitcoin will rip increased can also be on account of basic components. Regardless of the present value lull after the refreshing surge earlier this week, spot Bitcoin ETF issuers are shopping for.

BlackRock is spearheading this shopping for spree. Information present that the asset supervisor purchased over $1 billion of BTC in July.

On July 18, one observer famous that they purchased 18,600 BTC, or $107 million price of the coin, on behalf of their shoppers. In response to SosoValue, as of July 19, BlackRock’s IBIT manages over $20 billion price of BTC.

Associated Studying

Furthermore, including gasoline to the fireplace, it’s speculated that if Donald Trump wins the US presidency, his administration would possibly think about BTC a strategic reserve. Whereas this risk is debatable for now, it highlights the rising curiosity from policymakers, which is an enormous increase for crypto.

Function picture from DALLE, chart from TradingView