LUNC, the resilient token rising from the tumultuous aftermath of Terra’s downfall, witnessed a notable 14% downturn, mirroring a considerable authorized setback delivered by a U.S. District Court docket.

This judicial determination favored the Securities and Trade Fee (SEC) of their authorized pursuit in opposition to Terraform Labs, the entity steering the Terra blockchain, injecting uncertainty into the destiny of the beleaguered cryptocurrency.

Paying homage to the SEC’s assertions in February, the once-mighty stablecoin, LUNA, now lies on the coronary heart of the controversy that unfolded in Might 2022. The SEC contends that LUNA transcended the classification of a digital greenback, deeming it a safety.

Extra Ache For LUNC

Crucially, Terraform Labs allegedly uncared for to register it as such. The gravity of the scenario intensifies as Do Kwon, co-founder of Terraform Labs, faces accusations of orchestrating the sale of those unregistered securities, putting extra pressure on the longer term trajectory of LUNC.

Decide Jed Rakoff’s definitive ruling echoes a harsh actuality – each LUNA and MIR, one other token throughout the Terra ecosystem, are acknowledged as securities. This authorized stance paves the way in which for potential additional motion by the SEC in opposition to Terraform Labs, casting a shadow over LUNC’s future.

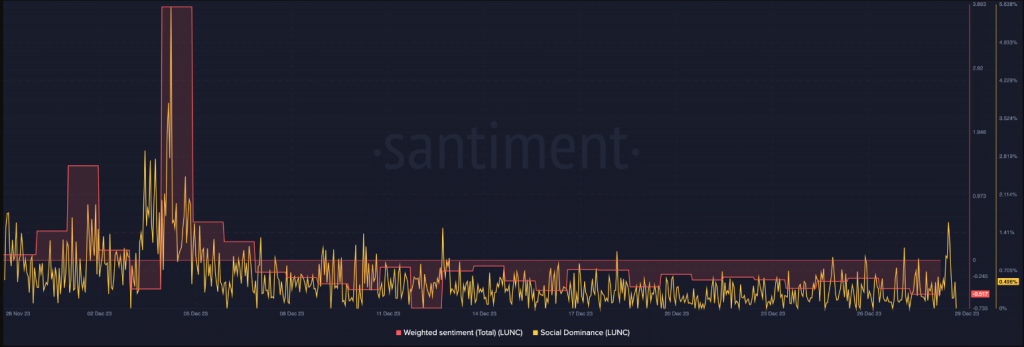

Supply: Santiment

The abrupt shift in market sentiment is clear as LUNC’s Weighted Sentiment, a metric gauging market optimism, plummeted to -0.510 post-ruling. This stark transformation from bullish to bearish suggests a lack of investor confidence within the short-term prospects of the token.

Social Dominance, reflecting the eye given to LUNC, skilled a surge on December twenty ninth, correlating with the court docket ruling. Nonetheless, this heightened curiosity shortly dissipated, indicating that the preliminary affect was ephemeral, and merchants could have swiftly integrated the adverse developments into their decision-making.

LUNCUSD at the moment buying and selling at $0.000142 territory. Chart: TradingView.com

LUNC Worth Evaluation: General Downtrend With Potential For Reversal

- The chart (under) confirms a downward pattern over the previous seven days, mirroring the bearish sentiment post-court ruling.

- Nonetheless, technical indicators counsel a potential for reversal:

- RSI: Dipping in direction of the oversold zone, implying a potential value rebound.

- Damaging Divergence: Hints at an upcoming uptrend, although the authorized uncertainty provides complexity.

- EMAs: The latest 20 EMA crossover above the 50 EMA affords a bullish sign, albeit weak.

LUNC seven-day value chart. Supply: Coingecko

Affect Of Court docket Ruling:

- The sharp drop on December twenty ninth coincides with the ruling, highlighting its important affect.

- Continued bearish momentum suggests ongoing issues concerning the authorized and regulatory panorama.

Assist And Resistance Ranges:

- Assist: The $0.00013 space has acted as a barrier, holding value from additional decline. Sustaining this stage is essential for bullish momentum.

- Resistance: Breaking above the $0.00015 stage may sign a stronger uptrend, however overcoming psychological resistance could also be difficult.

Quantity And Historic Tendencies:

- Low quantity signifies investor indecision, probably because of the authorized uncertainty.

- Evaluating to historic traits:

- Earlier assist and resistance ranges provide restricted steerage because of the latest crash.

- Previous volatility patterns may not be dependable given the distinctive authorized context.

General:

The technical indicators current a possible for LUNC reversal, however the court docket ruling casts a shadow of uncertainty. Carefully monitor key assist and resistance ranges, look ahead to adjustments in quantity, and stay cautious because of the risky market circumstances.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual threat.