In a turbulent 24-hour buying and selling session, the cryptocurrency market noticed almost $200 million worn out in liquidations as Bitcoin worth dropped under $61,000. This sharp decline triggered a wave of liquidations, affecting many buyers and merchants.

Market Meltdown And Crypto Liquidation

The full market valuation has plunged by roughly 2.7% to round $2.34 trillion, underscoring heightened volatility and market stress.

Associated Studying

Bitcoin, main the downturn, shed 1.3% over the week, with a steep 2.8% drop recorded within the final day. This downturn has not solely decreased the worth of many buyers’ portfolios however has additionally led to substantial losses for merchants through liquidations.

Knowledge from Coinglass highlights the extent of the carnage, with 59,816 merchants liquidated and whole liquidations amounting to $170.72 million.

The liquidations have been predominantly from lengthy positions, suggesting that many merchants anticipated the market to rally. Bitcoin merchants confronted roughly $45.76 million liquidations, with Ethereum and Solana merchants experiencing $44.55 million and $11.09 million, respectively.

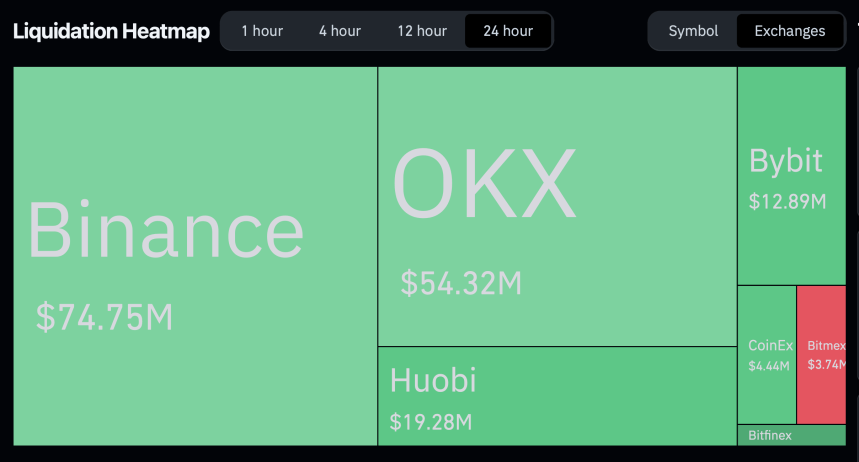

The sector for these liquidations was on main exchanges like Binance, OKX, Huobi, and Bybit, with Binance merchants bearing the brunt at $74.77 million.

Whereas different exchanges similar to OKX, Huobi, and Bybit additionally skilled important liquidations, amounting to $54.29 million, $19.28 million, and $12.93 million, respectively. Regardless of additionally going through liquidations, the smaller exchanges had a relatively minor impression.

Analysts’ Viewpoint On Bitcoin Present Efficiency

Regardless of the present downturn, some market analysts stay optimistic about Bitcoin’s prospects. PlanB, a revered determine within the crypto neighborhood, reaffirmed that the bull market remains to be ongoing, suggesting that underlying on-chain metrics don’t present any abnormalities that may point out a chronic bear market.

Associated Studying

Moreover, crypto analyst Ali just lately advised on Elon Musk’s social media, X, that now could be an opportune time to purchase Bitcoin, anticipating a market rebound.

The TD Sequential, which informed us to purchase #Bitcoin at $60,000 on June 28 and promote at $63,200 on July 1, is telling us to purchase $BTC once more! pic.twitter.com/JJzQtVJcBh

— Ali (@ali_charts) July 3, 2024

Moreover, vocal Bitcoin advocate Samson Mow has emphasised the significance of Bitcoin in addressing basic financial points, suggesting that fixing financial methods may very well be the important thing to broader financial restoration.

Governments, you possibly can’t repair the financial system as a result of the cash is damaged. You should repair the cash first. #Bitcoin

— Samson Mow (@Excellion) July 3, 2024

His views spotlight the potential of Bitcoin not solely to get well but additionally to attain new heights within the monetary panorama.

Featured picture created with DALL-E, Chart from TradingView