Bitcoin is trending increased at spot charges, breaching $63,000 on June 30 earlier than recoiling. Although momentum is constructing, the motion of the coin’s value is a supply of debate. Nonetheless, some are uncertain, considering there’s motive for a potential overvaluation.

Analyst: Bitcoin Is Overvalued, Right here’s Why

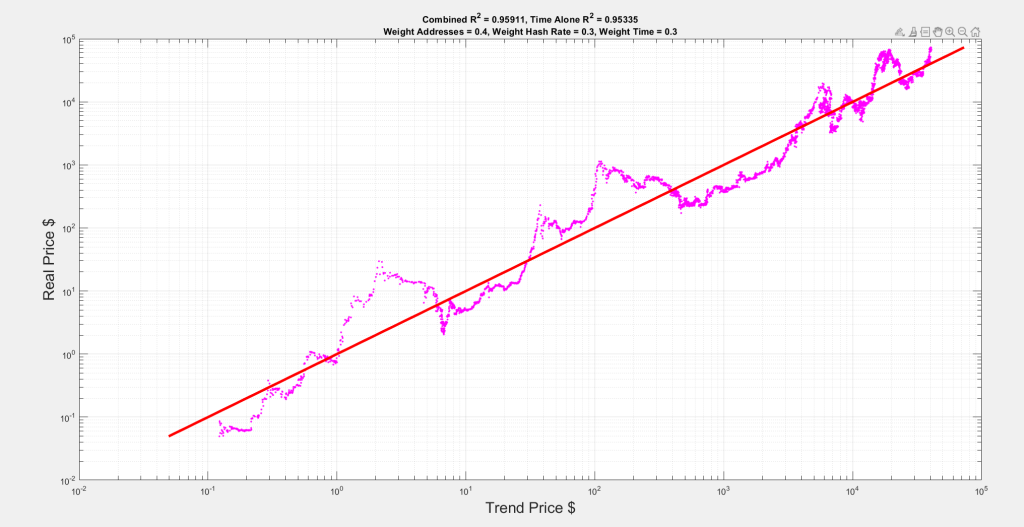

In a publish on X, one analyst argues that the coin might seemingly cool off, extending the 18% drop registered in June. To conclude this, the analyst mentioned the preview factored in a number of parameters, together with time, the variety of lively Bitcoin addresses, and hash price.

By way of this mannequin, the analyst mentioned there was motive to doubt the uptrend, dampening the spirits of optimistic holders anticipating bulls to push on. As of writing, Bitcoin is again within the multi-week vary with caps at all-time highs and assist at $56,800 registered in Could.

Associated Studying

From value motion, it’s clear that patrons are in cost, a minimum of from a top-down preview. Regardless of the decrease lows, particularly in Could when costs breached $60,000, bulls have an opportunity from a top-down preview.

Notably, costs are inside a bull flag after positive aspects in Q1 2024. Nonetheless, patrons’ failure to substantiate positive aspects in mid-March is slowing down the uptrend.

Patrons have did not breach $74,000 from the day by day chart, and $72,000 is a powerful liquidation line. Within the quick time period, the pattern may shift if costs get away decisively above $66,000, ideally in the back of rising buying and selling quantity.

Germany Promoting As BTC Positive aspects Versus M1 Cash Provide In America

Additional fueling considerations is the current dump by the German authorities. On July 1, they transferred 1,500 BTC, price over $94 million. Lookonchain information exhibits 400 BTC have been despatched to 3 exchanges, together with Bitstamp.

Although it’s not instantly clear in the event that they offered, sending them to trade means they’re eager on offloading them–a web bearish. The tackle related to the German authorities at present holds over 44,000 BTC price greater than $2.5 billion at spot charges.

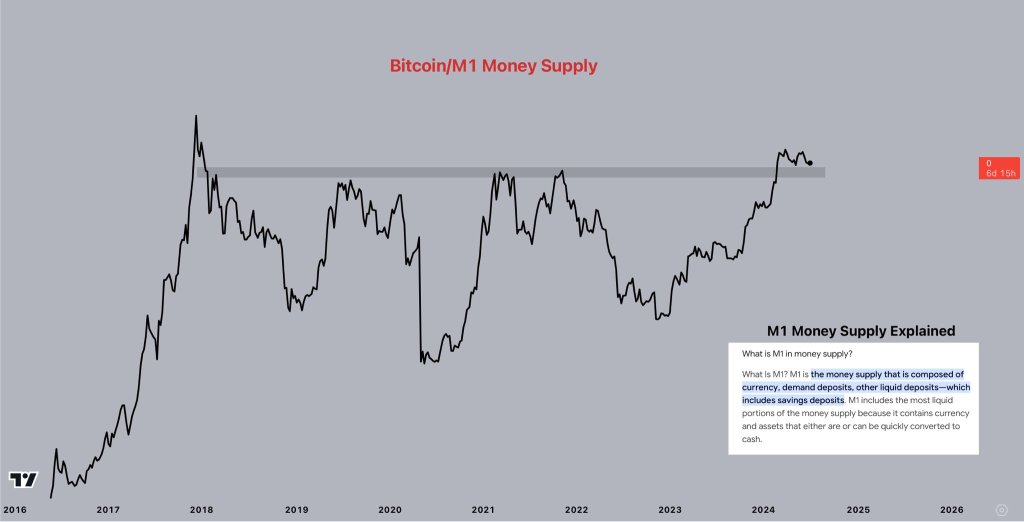

Even amid these considerations, others are bullish on BTC. Citing the connection between the US M1 cash provide and BTC costs, one analyst mentioned the coin is priming for main positive aspects.

Trying on the chart, the analyst argues that Bitcoin has not reached a brand new all-time excessive relative to the US M1 cash provide in over six years.

Associated Studying

Nonetheless, contemplating the regular surge in BTC costs since mid-2023, it’s extremely seemingly that bulls will take over, pushing the coin to recent all-time highs.

Characteristic picture from DALLE, chart from TradingView