Defunct Bitcoin alternate Mt. Gox has lastly introduced the ultimate date to start refunding Bitcoin and Bitcoin Money (BCH) to affected prospects, beginning as early as this week.

This eagerly awaited announcement has raised issues inside the cryptocurrency neighborhood relating to the potential contribution of those prospects to ongoing promoting stress within the Bitcoin market.

Specialists Assured In Absorbing Potential Mt. Gox Promote-Off

Whereas some analysts categorical apprehensions about potential losses in Bitcoin, they typically agree that any sell-off issues associated to Mt. Gox will seemingly be contained and short-lived.

Lennix Lai, chief industrial officer (CCO) of crypto alternate OKX, believes that a lot of Mt. Gox’s early customers and collectors are long-term Bitcoin fanatics who’re much less more likely to promote their whole Bitcoin holdings instantly.

Drawing comparisons to earlier sell-offs associated to regulation enforcement actions, such because the Silk Highway case, Lai highlights that they didn’t end in sustained catastrophic worth drops.

Associated Studying

Specialists, together with Jacob Joseph, a analysis analyst at CCData, counsel that the markets have adequate liquidity to soak up any attainable mass-market sell-off.

Joseph explains that a lot of Mt. Gox’s collectors could choose to obtain early compensation by accepting a ten% discount on their holdings, which would scale back the general promoting stress.

Current worth actions point out that the momentary influence of Mt. Gox repayments could already be factored into the market, additional supporting the view that the potential promoting stress may very well be mitigated.

Various Recipients And Time Ingredient

Alex Thorn, head of analysis at Galaxy Digital, believes that fewer cash will likely be distributed than anticipated, leading to much less promote stress than anticipated.

Nevertheless, Thorn acknowledges that even when solely 10% of the distributed Bitcoin is offered, it might nonetheless have a market influence. Thorn factors out that the majority particular person collectors deposit their cash straight into buying and selling accounts, making them simply sellable.

Vijay Ayyar, head of client development for Asia-Pacific at crypto alternate Gemini, means that the general influence of the Mt. Gox disbursement is more likely to be dissipated because of the various recipients of the funds.

Particular person holders will obtain their Bitcoin instantly, whereas a big quantity will likely be disbursed to claims funds, which is able to then be distributed to their restricted companions. Ayyar mentions that this course of might take time, including a time component to the influence on worth.

Bitcoin Value Predictions For July

Because the cryptocurrency market enters the month of July, analysts are providing insights into Bitcoin’s worth prospects based mostly on historic tendencies and technical evaluation.

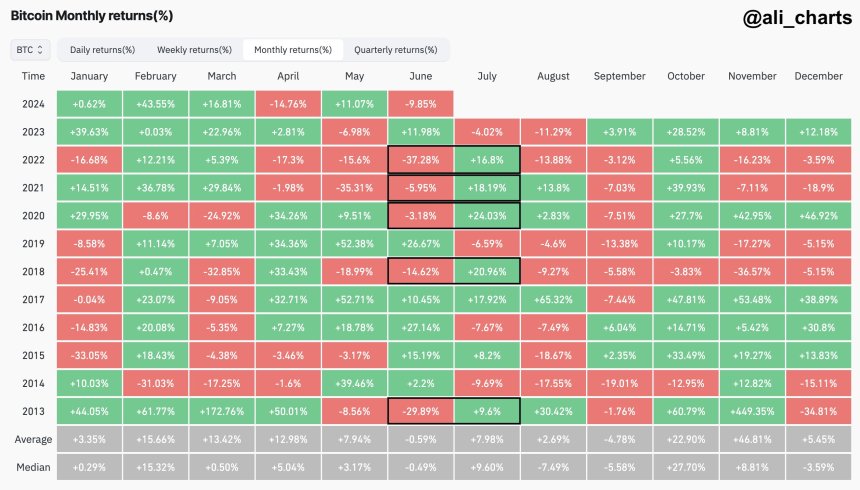

Notably, Ali Martinez suggests that Bitcoin has traditionally exhibited a powerful rebound in July following a destructive efficiency in June. Martinez highlights that in this month, Bitcoin has proven a mean return of seven.98% and a median return of 9.60%.

Martinez additionally emphasizes that Bitcoin at the moment demonstrates strong assist at $61,100, which might function an important stage for worth stability. Alternatively, the analyst identifies $64,050 and $66,250 as a very powerful resistance areas.

Breaking via these resistance ranges is pivotal for Bitcoin’s potential to retest its all-time excessive of $73,700 in March of this yr.

Associated Studying

Supporting this view, one other technical analyst, Rekt Capital, suggests that Bitcoin reveals favorable worth motion to type a cluster on the Vary Low of $60,600. This clustering impact, in accordance with the analyst, might develop all through July.

This cluster formation goals to organize for a possible rally again to the Vary Excessive at $71,500.

When writing, the biggest cryptocurrency in the marketplace trades at $62,630, up 2% within the 24-hour timeframe.

Featured picture from DALL-E, chart from TradingView.com