Onchain Highlights

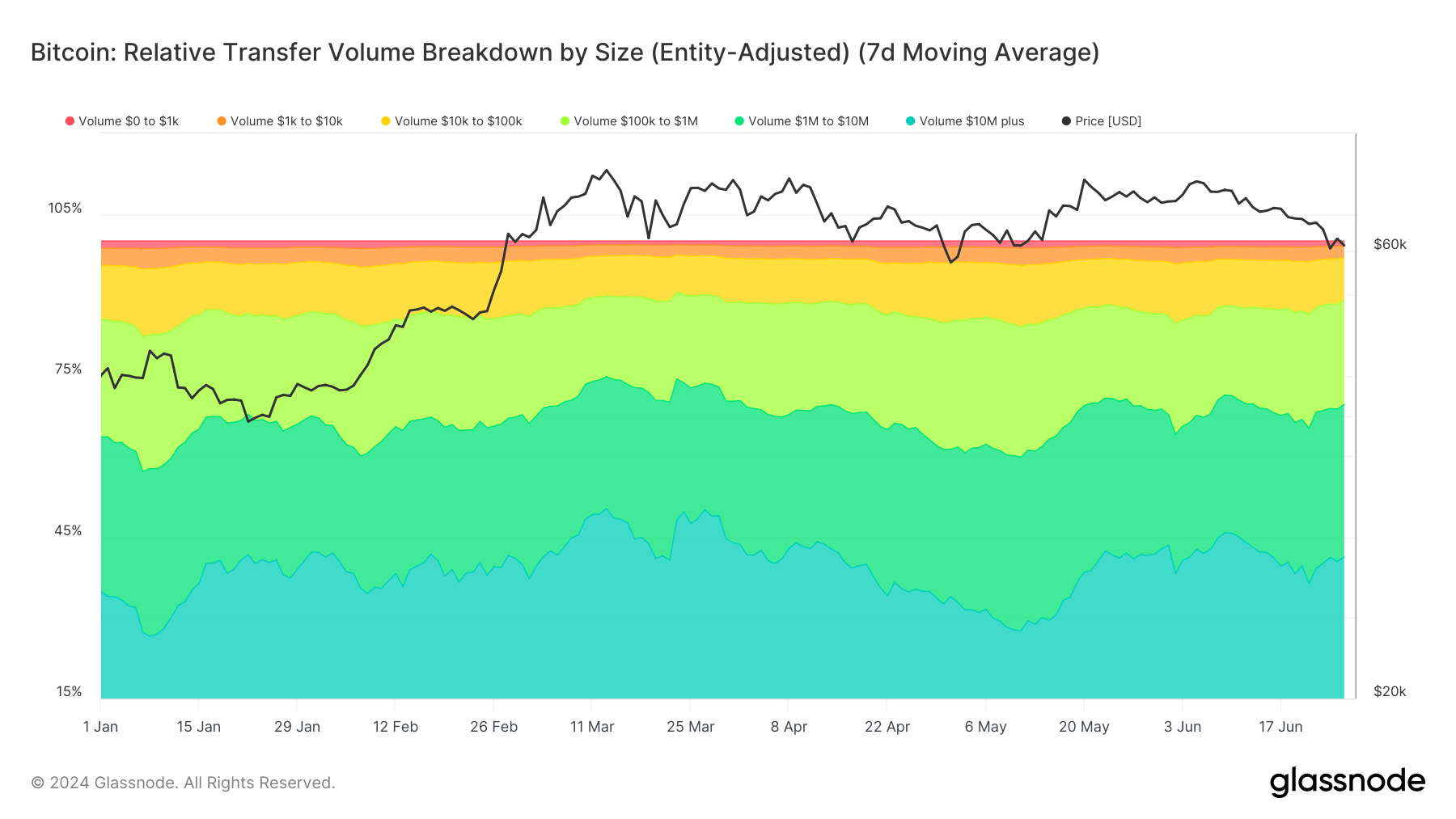

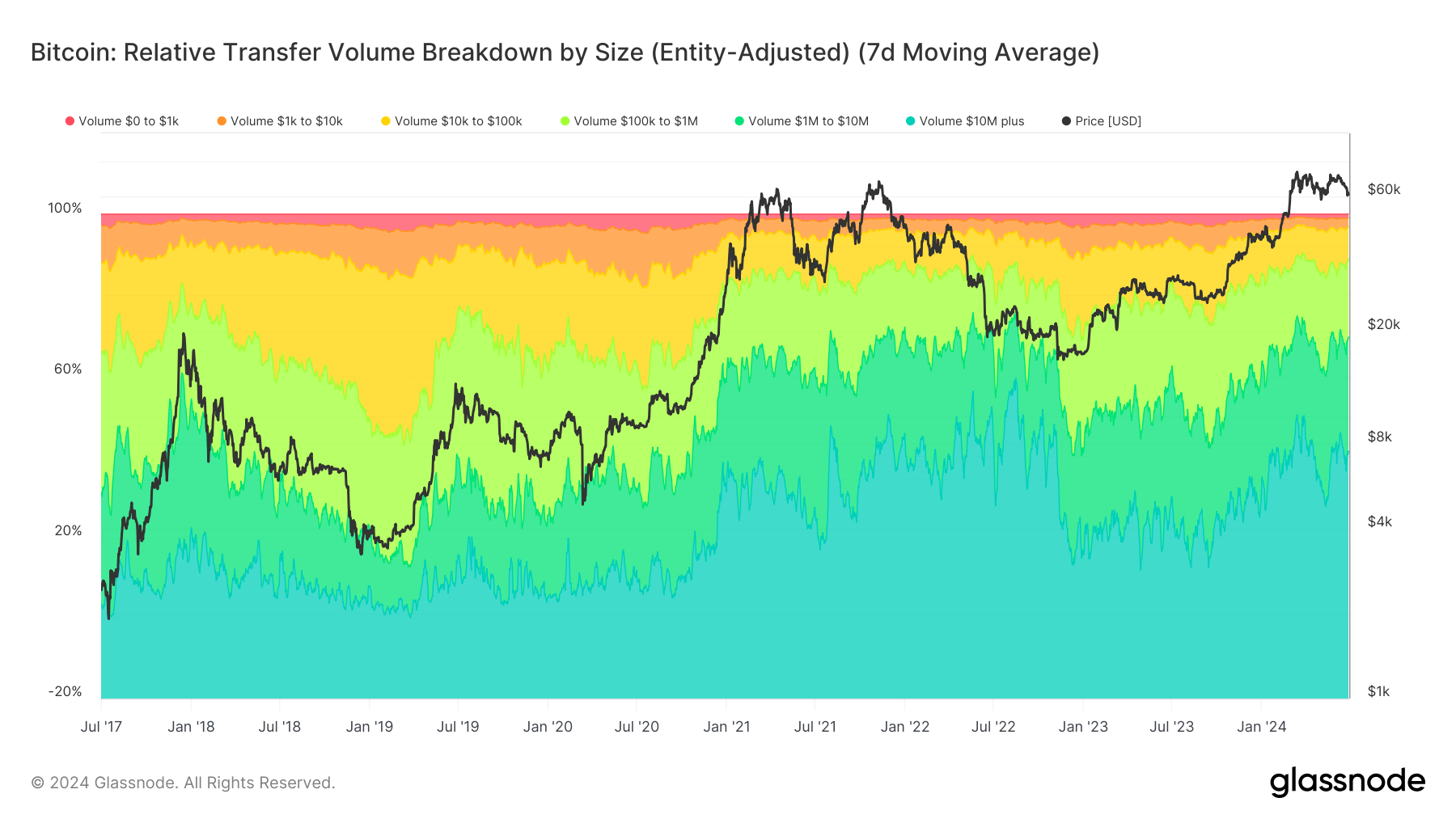

DEFINITION: Entity-adjusted relative on-chain quantity breakdown by the USD worth of the transfers.

Bitcoin’s relative switch quantity, when adjusted by entity and categorized by switch measurement, reveals nuanced traits throughout various transaction bands. In January 2024, transfers beneath $1,000 constituted a minor portion of general exercise. Notably, transactions between $1,000 and $10,000 skilled a slight improve, reflecting incremental retail participation.

Bigger transfers, starting from $10,000 to $100,000 and $100,000 to $1 million, demonstrated a rise, sustaining round 20-30 % of the overall quantity. This implies a rise in institutional exercise. In the meantime, the $1 million to $10 million bracket additionally confirmed progress, whereas transfers over $10 million declined.

Between mid-January and April, quantity over $10 million noticed a resurgence earlier than a decline, bottoming in Could.

Ranges for the biggest transfers grew once more in late Could and have stabilized since. Different brackets moved comparatively, apart from transfers beneath $100,000, which retained stability.

In contrast with historic information since 2017, the previous 12 months has seen a discount within the dominance of the smallest transactions, changed by mid-sized volumes, particularly these over $100,000. This shift highlights a maturation in Bitcoin’s consumer base, with a rising reliance on important transactions, probably aligning with the post-halving market circumstances and a matured institutional footprint.