Macro investor Luke Gromen says that within the coming years, Bitcoin (BTC) and danger belongings will profit from a souring sentiment in US long-term bonds.

In a brand new video replace, Gromen says that because of inflationary pressures, capital will probably rotate from the bond market into shares, gold and Bitcoin.

The investor says that due to these pressures, the iShares 20+ Yr Treasury Bond exchange-traded fund (TLT) is signaling weak spot in opposition to danger belongings and inflation hedges.

“There’s a $130 trillion world bond market that might want to run right into a $65 trillion inventory market which I believe is going on. [There’s a] $14 trillion gold market and a $1.3 trillion Bitcoin marketplace for security from that inflation. And also you’re seeing that within the charts.

In case you have a look at the S&P 500 over the TLT – the lengthy bond ETF – it appears like a hockey stick. Nasdaq over TLT: hockey stick. Industrials over TLT: hockey stick. Gold over TLT, all collectively now: hockey stick. Bitcoin over TLT: hockey stick however very risky hockey stick.

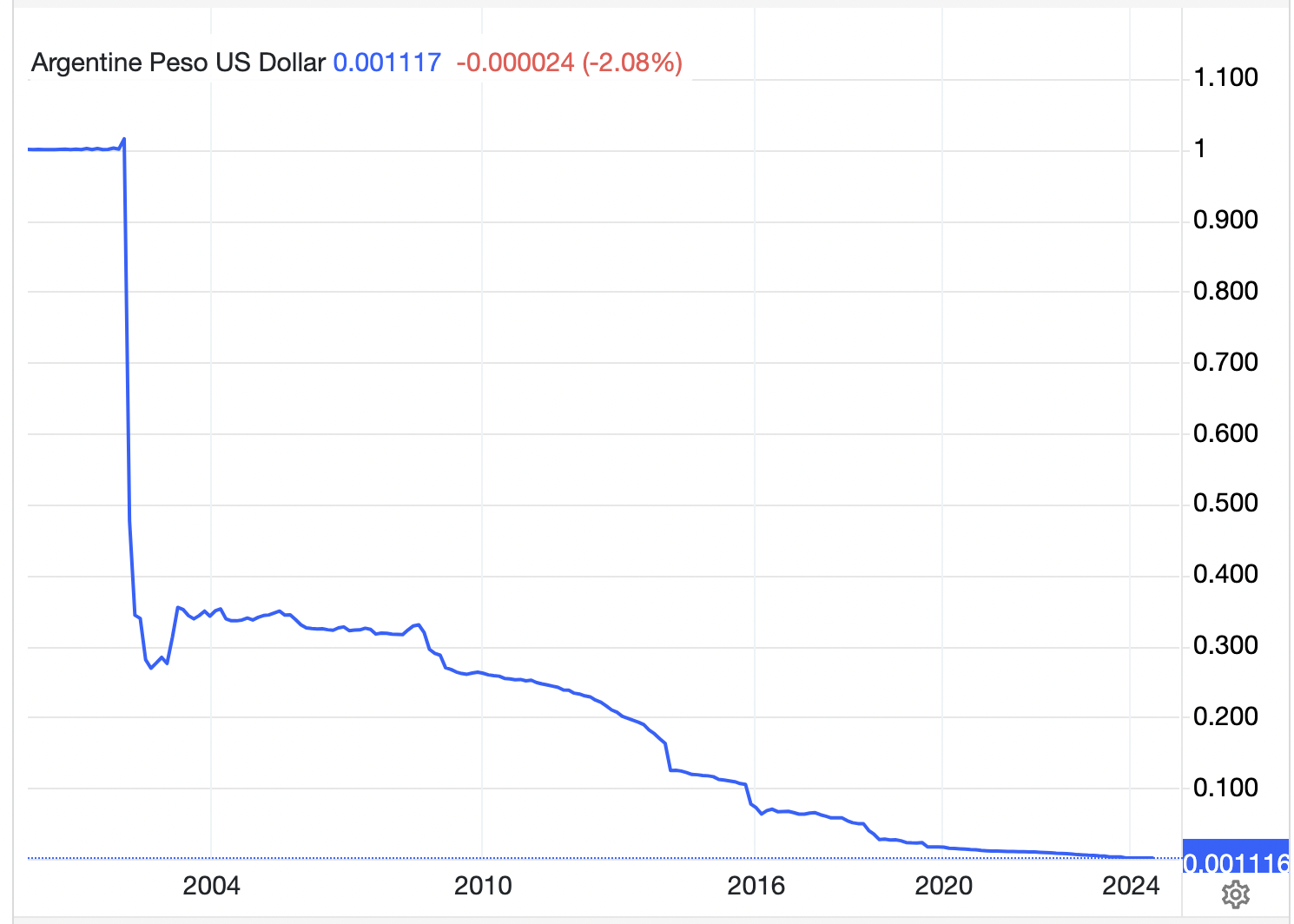

So my view is within the secular inflation that we’re within the early days of, you’ll see shares up in greenback phrases [but] down in gold and Bitcoin phrases. Mainly Argentina with US traits.”

Because of heavy inflation, the Argentinian inventory market index (MERVAL) has skyrocketed over 3,779% within the final twenty years, averaging greater than 188% returns every year.

Nonetheless, in greenback phrases, the Argentinian peso has basically gone to zero in the identical timeframe.

At time of writing, Bitcoin is buying and selling at $64,689.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE3