Big funding supervisor VanEck believes that Ethereum (ETH) may hit a five-figure worth over the approaching years.

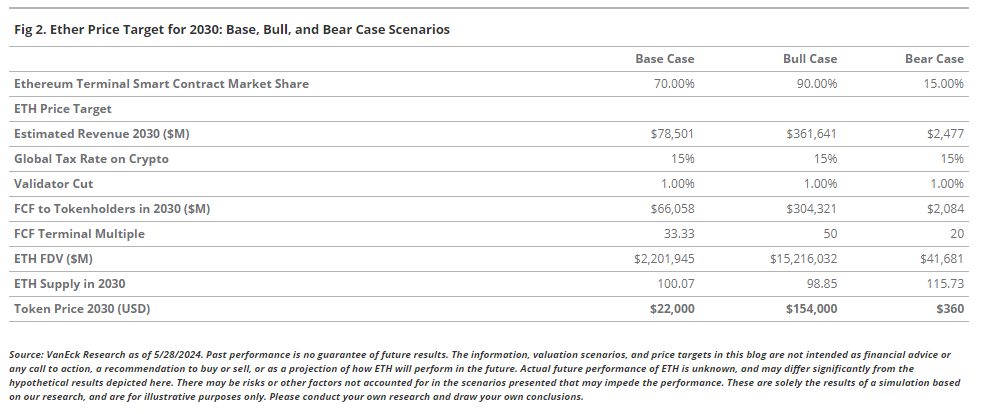

In a brand new analysis report, VanEck says that its 2030 base case goal for Ethereum is $22,000, a achieve of 472% from the present worth, whereas its bull case goal for a similar interval is $154,000, a 3,905% rally from the present degree.

The worldwide funding supervisor says that Ethereum’s potential worth rally will probably be pushed by a rise in its free money flows – the quantity of ETH obtainable from the Ethereum community’s operations after subtracting all community prices akin to gasoline charges used for transactions and good contracts.

“Ethereum is a profitable digital financial system that draws roughly 20 million month-to-month lively customers whereas settling $4 trillion in settlement worth and facilitating $5.5 trillion in stablecoin transfers during the last twelve months. Ethereum secures over $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain belongings, and $308 billion in digital belongings. The centerpiece asset of this monetary system is the ETH token…

…We challenge ETH’s 2030 valuation based mostly upon a forecast of $66 billion in free cashflows generated by Ethereum and accruing to the ETH token.”

Ethereum is buying and selling at $3,845 at time of writing.

VanEck, which at present boasts $101.9 billion in belongings beneath administration, says that Ethereum at present generates extra revenues per consumer than some main family manufacturers.

“Ethereum month-to-month lively consumer generates $172 in annual income, akin to Apple Music, $100; Netflix, $142; and Instagram, $25. We categorize Ethereum as a platform enterprise just like the Apple App Retailer or Google Play.”

Based on the worldwide funding supervisor, a number of the draw back dangers going through Ethereum embrace regulatory ones.

“a. Relying upon regulation. ETH or lots of the belongings inside its ecosystem could also be categorized as securities. This might trigger many Ethereum companies to need to register with the SEC or face critical authorized penalties.

b. The most important monetary corporations have substantial lobbyist presence in addition to former workers appointed to the very best ranges of most governments world wide. These former workers may create regulatory moats that disfavor disrupters like Ethereum.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Cristina Conti/Inky Water