Altcoins are producing important buzz amongst cryptocurrency watchers, as rumors of a possible Bitcoin breakout flow into. After weeks of sluggish buying and selling, a current surge of capital has revitalized the king of cash. This raises a urgent query: will altcoins journey the wave, or are they doomed to be left behind?

Associated Studying

Whispers Of A Bitcoin Bonanza

Knowledge from Farside Buyers reveals a major shift in investor sentiment. Practically $890 million flowed into Bitcoin exchange-traded funds (ETFs) on June 4th, a transparent signal of renewed curiosity. This surge in shopping for might act as a catalyst, sparking a wave of hypothesis and propelling Bitcoin costs upwards.

Nevertheless, the query stays: how will this newfound concentrate on Bitcoin affect the broader cryptocurrency market? Traditionally, sturdy Bitcoin rallies have typically been adopted by altcoin seasons, intervals the place various cryptocurrencies expertise explosive progress. However is that this time totally different?

Altcoin Season: Simply Over The Horizon?

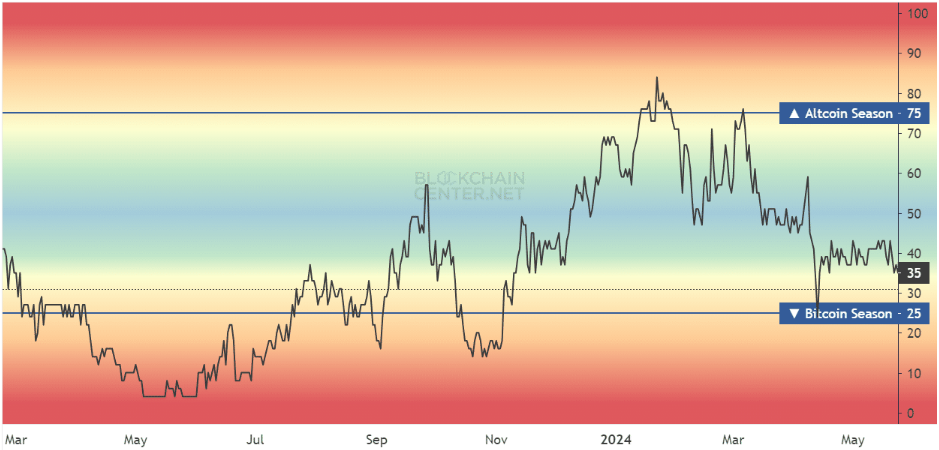

The Altcoin Season Index, a metric that gauges market sentiment in direction of altcoins, at present sits at a lowly 35. This stands in stark distinction to the readings of 80 noticed simply six months in the past. This implies that altcoins are usually not but basking within the mirrored glory of Bitcoin’s potential rise.

Consultants consider that even with a Bitcoin surge, solely a choose few altcoins are prone to outperform the market chief. To actually unleash an altcoin season, the Altcoin Season Index would wish to climb above 75, an indication of widespread bullishness throughout the whole altcoin ecosystem.

Why Altcoins May Battle To Shine

The sheer variety of altcoins in comparison with earlier cycles additionally throws a wrench into the altcoin season equation. In 2017 and 2021, as an illustration, the altcoin market was a a lot smaller pond. When Bitcoin surged, investor cash flowed extra readily right into a smaller pool of altcoins, resulting in important value will increase throughout the board.

At the moment, the panorama is vastly totally different. With 1000’s of altcoins vying for investor consideration, any beneficial properties throughout an altcoin season is likely to be concentrated in only a handful of high-performing initiatives, leaving the overwhelming majority behind.

Bitcoin Dominance: A Key Indicator To Watch

One other essential issue to think about is Bitcoin Dominance (BTC.D). This metric displays Bitcoin’s market capitalization as a share of the whole crypto market cap. Traditionally, a major decline in BTC.D has coincided with altcoin seasons. In early 2021, for instance, the coin’s dominance degree plummeted from 70% to 40%, paving the way in which for a interval of explosive altcoin progress.

Associated Studying

At present, nevertheless, BTC.D is on the rise, suggesting that altcoins are usually not but the focal point. Buyers on the lookout for altcoin alternatives ought to preserve an in depth eye on this metric, as a sustained downtrend within the crypto’s dominance could possibly be a harbinger of an approaching altcoin season.

Featured picture from Indiana Day by day Pupil, chart from TradingView