The worth of Bitcoin seems to have returned to a uneven market situation, quashing any hopes of a breakout to new highs quickly. Nonetheless, the excellent news is that the present bull cycle should still not be over, despite the fact that it’s taking some time for the premier cryptocurrency to renew its upward momentum.

Particularly, the most recent on-chain remark reveals that Bitcoin has been going via a “euphoria wave” over the previous few months. Right here’s the implication of this section on the present bull run.

How Previous Is The Present Bitcoin ‘Euphoria Wave’?

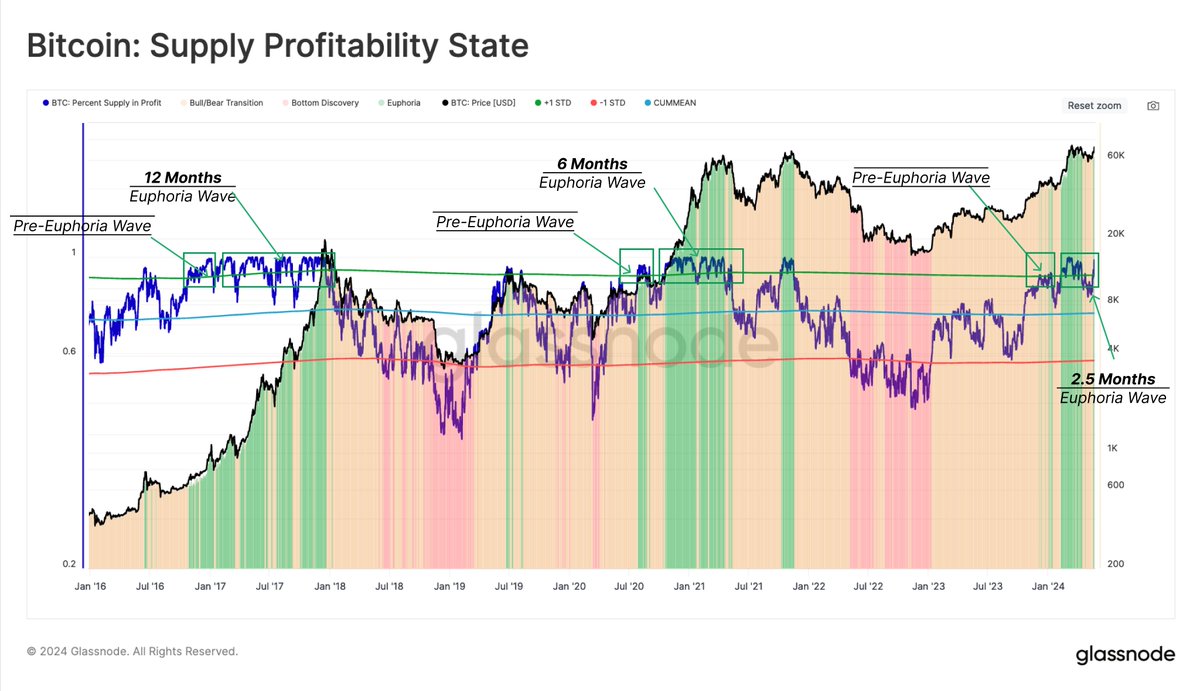

Blockchain intelligence agency Glassnode revealed through a publish on the X platform that Bitcoin has entered the euphoria section of the market cycle. This on-chain remark is predicated on the “P.c Provide in Revenue” metric, which measures the share of the entire circulating Bitcoin provide that’s presently in revenue.

Associated Studying

Based on Glassnode, the “Euphoria Wave” is recognized as a interval throughout which the availability in revenue normally fluctuates across the 90% degree. This section sometimes lasts between 6 to 12 months and is characterised by elevated investor sentiment and heightened market hypothesis.

Glassnode’s knowledge reveals that 93.4% of the circulating Bitcoin provide is presently within the inexperienced and that the Euphoria Wave is “comparatively younger”. The on-chain analytics platform famous that the euphoria section has solely been lively for about two and a half months.

As with each section out there cycle, the Euphoria Wave will ultimately come to an finish in some unspecified time in the future. Traditionally, the euphoria section can sign tops and is normally adopted by a cooling-off interval, which is marked by a downturn within the worth of Bitcoin.

If the final cycle – with a 6-month Euphoria Wave – is something to go by, then there would possibly nonetheless be about three to 4 months within the present bull run. In the end, the present profitability of the premier cryptocurrency might show pivotal within the period of its bull cycle and general future trajectory.

Rise Of BTC Accumulation Addresses Continued In Might: Analyst

One of many tell-tale indicators of the bullish sentiment round Bitcoin is the continual rise in accumulation addresses. Based on an on-chain analyst on CryptoQuant’s platform, there was a notable improve within the variety of new BTC accumulation addresses.

The analyst identified the continuity of this constructive development regardless of BTC’s comparatively gradual worth motion in Might. In the meantime, the massive Bitcoin holders have additionally continued to load their luggage, with vital purchases recorded over the previous month.

Associated Studying

As of this writing, Bitcoin is valued at $67,744, reflecting a mere 0.4% improve within the final 24 hours. Based on knowledge from CoinGecko, the pioneer cryptocurrency is up by about 15% up to now month.

Featured picture from iStock, chart from TradingView