Bitcoin’s spot buying and selling volumes over the previous week present a various degree of market exercise and sentiment. Bitcoin’s worth noticed some volatility over the week, peaking on Might 25 at $69,270, adopted by a slight decline and stabilization across the $68,000 to $69,000 vary.

This peak corresponds to the bottom spot buying and selling quantity prior to now week of $2.121 billion. This reveals that the worth spike could have decreased buying and selling exercise because the market awaited additional worth actions or reached some extent of hesitation.

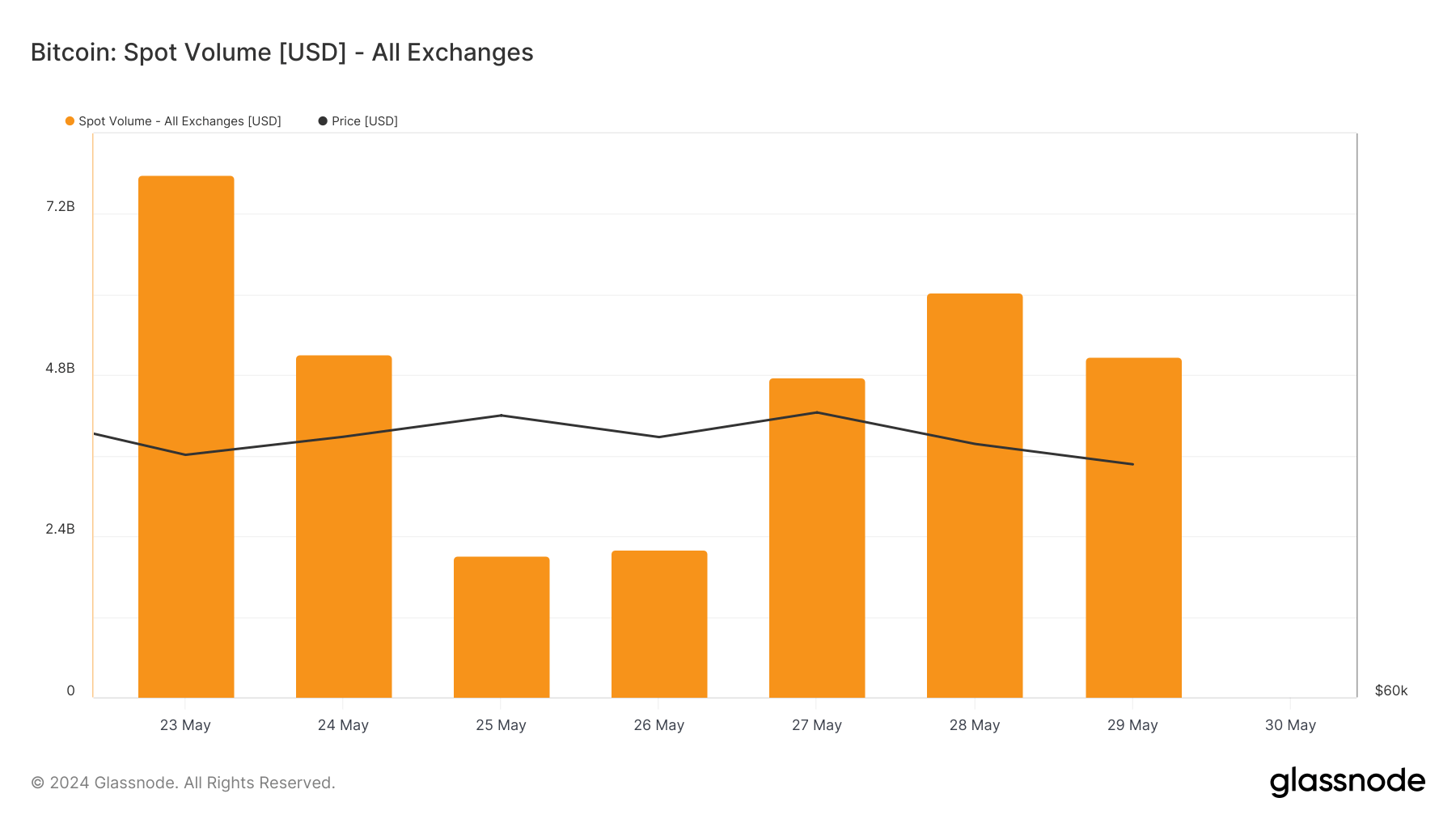

The intraday spot quantity information from Glassnode reveals a pointy decline from Might 23, with $7.780 billion, to Might 25, with $2.121 billion. This important drop in quantity reveals a interval of low volatility and a scarcity of robust market catalysts, resulting in a considerable discount in buying and selling exercise.

The next days present a restoration in buying and selling volumes. On Might 27, the spot buying and selling quantity elevated to $4.761 billion as Bitcoin regained $69,385. On Might 28, the spot buying and selling quantity surpassed $6 billion regardless of a slight worth drop to $68,280.

This sample means that worth peaks will not be at all times adopted by an instantaneous enhance in buying and selling exercise, as merchants have a tendency to attend out the consolidation that inevitably happens after a worth enhance.

Analyzing the intraday spot shopping for and promoting volumes helps us decide the general market sentiment. If a lot of the buying and selling quantity comes from promoting, it reveals a bearish market that’s both dashing to capitalize on sharp worth actions and exit or lower its losses.

Conversely, if a lot of the buying and selling quantity comes from shopping for, the overwhelming sentiment is bullish because the market is racing to enter at present worth factors, anticipating additional will increase.

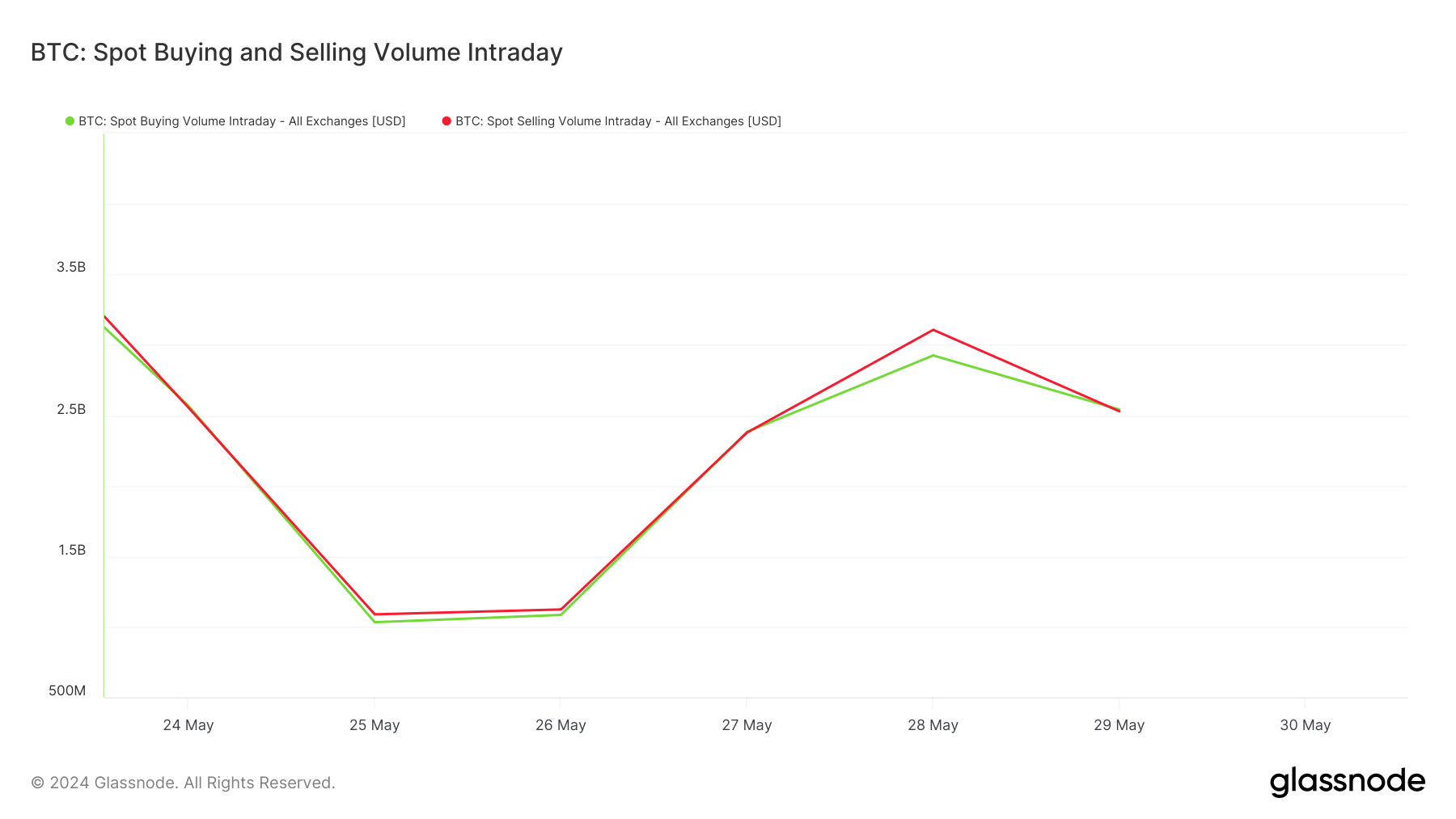

Glassnode’s information from the previous week reveals a market that’s virtually in equilibrium. On Might 23, the shopping for quantity was $3.796 billion in opposition to a promoting quantity of $3.984 billion. Whereas this is able to normally point out a bearish sentiment, having these volumes so shut collectively reveals a break up market with no clear directional bias.

This development continued all through the previous week. Might 24 noticed virtually equal shopping for and promoting volumes of round $2.566 billion and $2.553 billion, respectively, whereas the bottom volumes in Might confirmed shopping for at $1.032 billion and promoting at $1.088 billion.

When buying and selling quantity began to select up on Might 27, shopping for and promoting volumes continued to match at round $2.383 billion and $2.378 billion, displaying a extremely energetic buying and selling surroundings with individuals partaking equally in shopping for and promoting.

The height in spot promoting quantity on Might 28 at $3.106 billion, in comparison with shopping for quantity at $2.924 billion, suggests a slight bearish sentiment, presumably influenced by the worth drop to $68,280, as merchants took benefit of the worth actions to unload holdings.

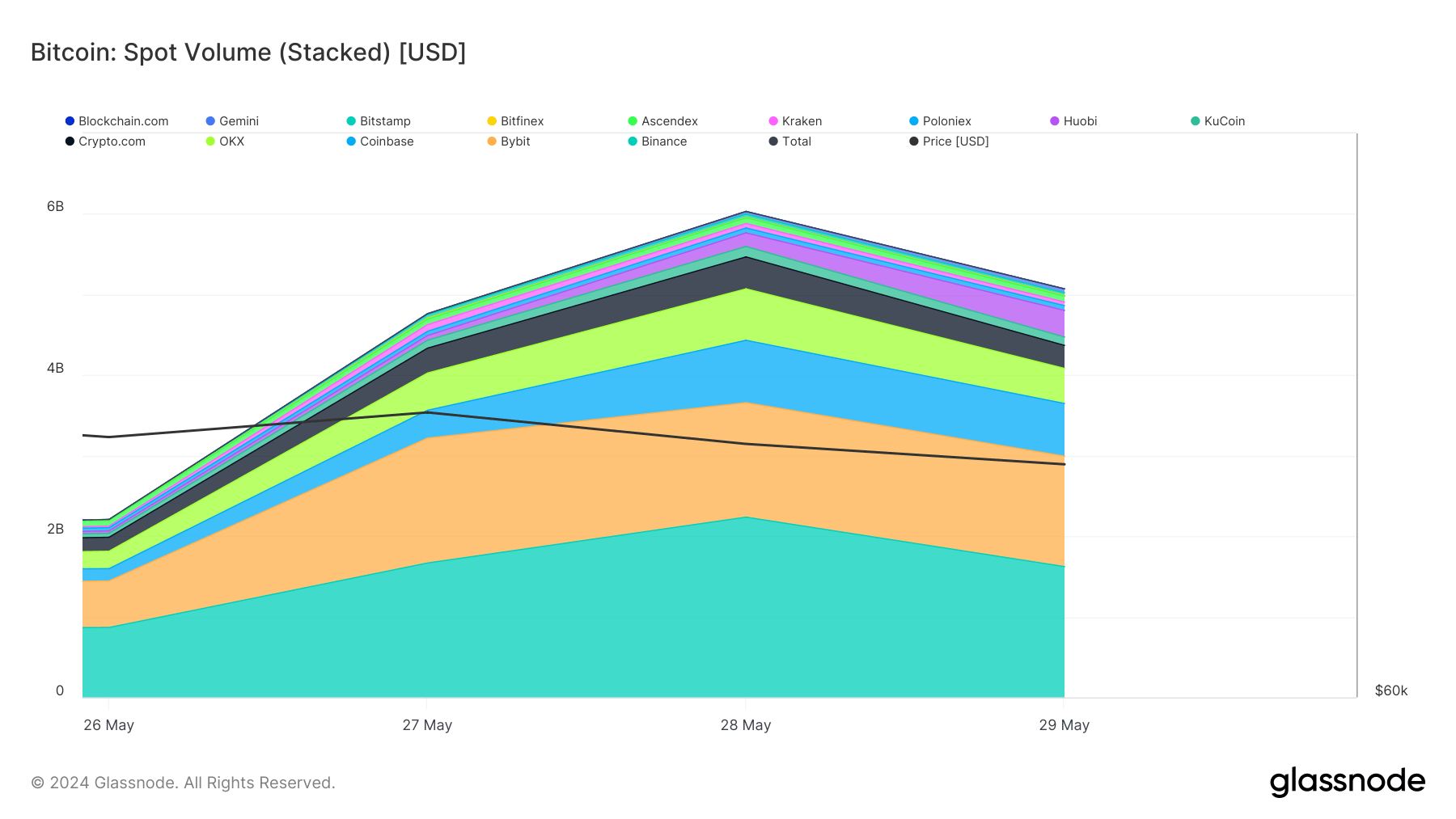

Wanting on the spot volumes throughout exchanges reveals Binance constantly main, adopted by Bybit and Coinbase. On Might 26, Binance had $866.776 million in quantity, which elevated considerably to $2.236 billion by Might 28. Bybit and Coinbase additionally confirmed a rise in volumes, with Bybit peaking at $1.550 billion on Might 27 and Coinbase at $774.203 million on Might 28.

The considerably increased volumes on Binance, which frequently surpassed the mixed quantity of Bybit and Coinbase, may be attributed to its giant person base and low buying and selling charges, making it the popular alternate for high-volume merchants.

The steadiness between shopping for and promoting volumes seen over the previous week signifies that the market is indecisive and risky.

The publish Bitcoin market break up as shopping for and promoting volumes stay the identical appeared first on CryptoSlate.