Solana (SOL), the self-proclaimed “world’s quickest blockchain,” has been grabbing headlines for its blazing transaction speeds and surging token worth. However is all of it sunshine and rainbows in Solana land, or are there cracks within the seemingly clean highway?

Associated Studying

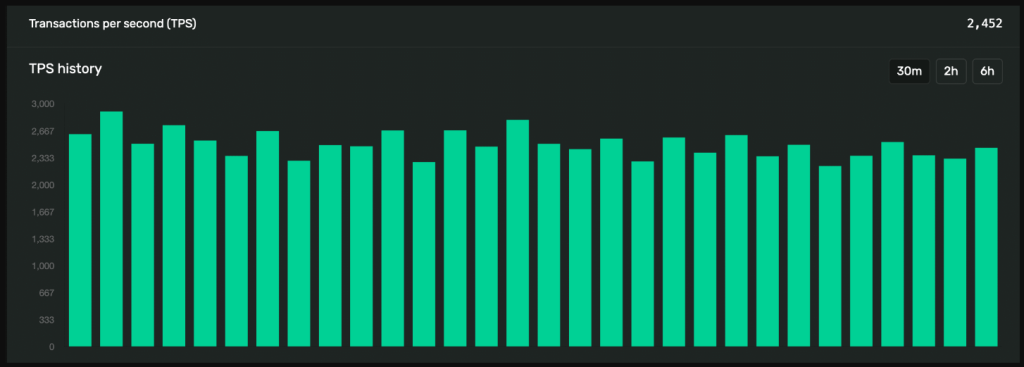

Solana Takes The TPS Crown

In line with CoinGecko knowledge, Solana blew previous opponents like Polygon and Ethereum in transactions per second (TPS). This interprets to quicker transaction processing occasions, a key issue for scalability and mass adoption within the blockchain world.

Nevertheless, a better look reveals a extra nuanced image. Whereas each day energetic addresses, which characterize distinctive customers interacting with the community, have certainly elevated, the each day transaction rely hasn’t saved tempo.

This means a state of affairs the place extra customers are coming into the Solana ecosystem, however they aren’t essentially conducting a excessive quantity of transactions. Is that this a case of informal crypto vacationers dipping their toes in, or is there one thing else at play?

Charges Take A Tumble, However Is It A Sustainable Slide?

One other fascinating wrinkle is the decline in transaction charges on Solana. This may look like excellent news for customers, but it surely might be a double-edged sword. Decrease charges may point out that the transactions being processed are much less complicated and require decrease fees.

This might doubtlessly restrict Solana’s income era in the long term. Moreover, a drop in charges may sign a lower in community congestion, which could clarify the stagnant each day transaction rely.

DeFi Retains The Occasion Going, However Warning Sparkles

A shiny spot for Solana is the continued progress in its Decentralized Finance (DeFi) Complete Worth Locked (TVL). DeFi refers to a set of economic providers constructed on blockchains, and TVL represents the full worth of crypto belongings deposited in DeFi protocols.

Solana’s rising TVL signifies its rising adoption inside the DeFi house, the place customers can lock up their crypto to earn curiosity or take part in different monetary actions. This can be a optimistic signal for the general well being of the Solana ecosystem.

Associated Studying

Nevertheless, a word of warning emerges from technical indicators just like the Cash Stream Index (MFI). This indicator suggests a possible worth correction for SOL, hinting that the present uptrend won’t be solely sustainable.

Mix this with the combined alerts on community exercise and the declining payment construction, and buyers are left with a query mark hanging over Solana’s long-term prospects.

A Blockchain In Excessive Gear, However the Vacation spot Is Unclear

Solana’s spectacular transaction speeds and powerful DeFi presence are plain strengths. Nevertheless, the community’s total exercise and tokenomics increase questions on its long-term viability.

In the meantime, on the time of writing, SOL was buying and selling at $185, up 7.1% and 26.0% within the each day and weekly timeframes, knowledge from Coingecko exhibits. This worth surge, coupled with the community’s breakneck transaction speeds, paints an image of a venture with immense potential.

Nevertheless, for Solana to really turn out to be a dominant pressure, it might want to tackle the questions surrounding its community exercise and long-term sustainability, to not point out add extra gas to its worth.

Featured picture from F1, chart from TradingView