An analyst has defined how profit-taking seems to be to have completed for Bitcoin in what has been a “very wholesome reset” for the market.

Bitcoin SOPR Suggests Revenue-Taking From Buyers Has Cooled Off

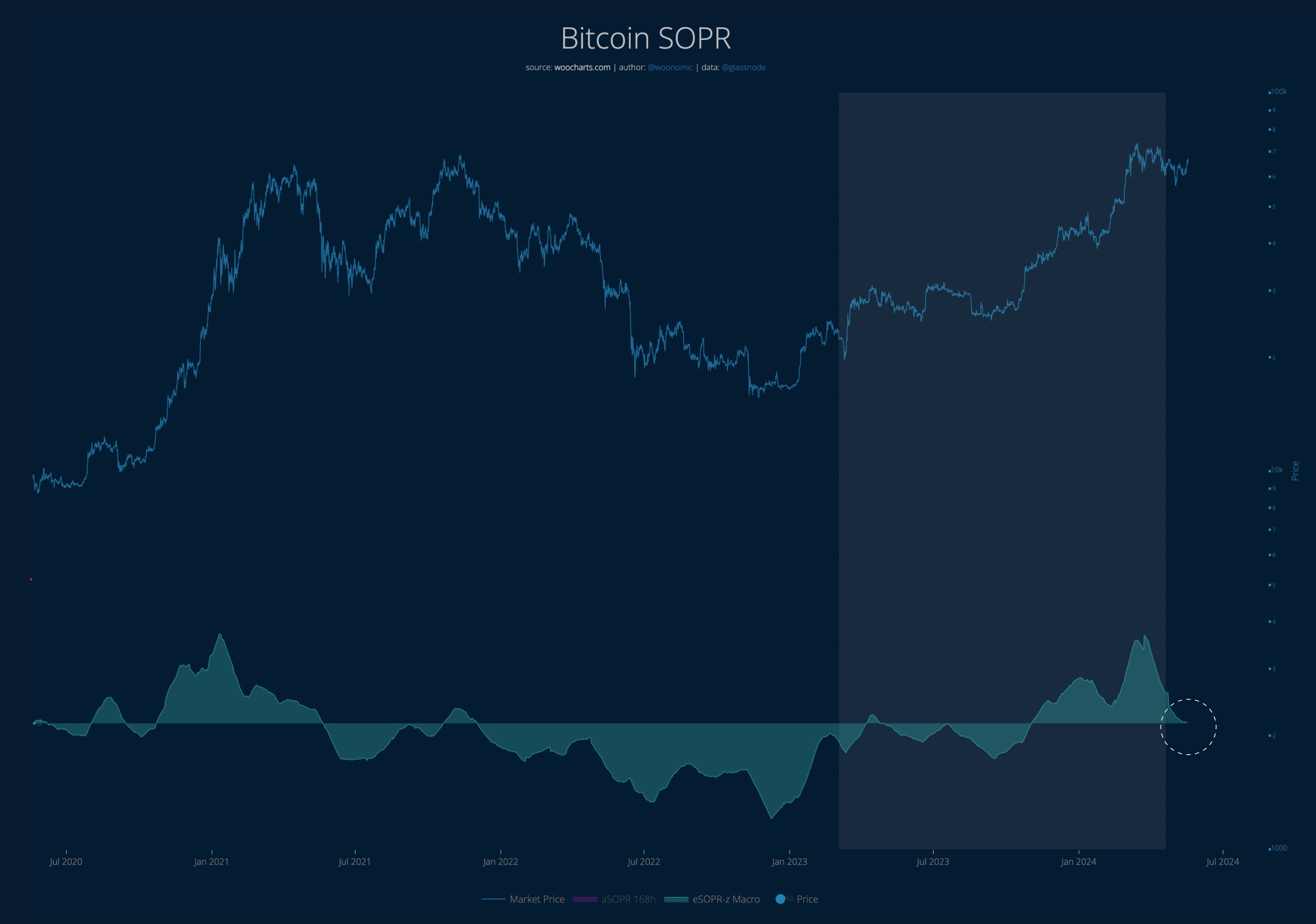

In a brand new put up on X, analyst Willy Woo has mentioned concerning the newest pattern occurring within the Bitcoin Spent Output Revenue Ratio (SOPR). The SOPR is an on-chain indicator that mainly tells us about whether or not the Bitcoin buyers as an entire are promoting their cash at a revenue or loss proper now.

When the worth of this metric is larger than 1, it implies that the typical holder within the sector could possibly be assumed to be shifting cash at some web revenue at the moment. Then again, the indicator being detrimental implies loss realization is the dominant mode of promoting available in the market.

Associated Studying

Naturally, the SOPR being precisely equal to 1 suggests the whole income being realized are precisely equal to the losses for the time being and thus, the buyers are simply breaking-even on their promoting.

Now, here’s a chart that reveals the pattern within the Bitcoin SOPR over the previous couple of years:

The worth of the metric appears to have been impartial in current days | Supply: @woonomic on X

As is seen within the above graph, the Bitcoin SOPR had spiked to extremely optimistic ranges earlier when the cryptocurrency’s worth had noticed its rally in direction of a brand new all-time excessive (ATH).

This is able to counsel that the buyers had been collaborating in some aggressive profit-taking throughout this run. From the chart, it’s seen that such a pattern was additionally noticed across the begin of the 2021 bull run.

With the consolidation, the asset has gone by for the reason that ATH, the indicator’s worth has additionally seen a cooldown. As Woo has highlighted within the chart, the metric has now approached the impartial mark.

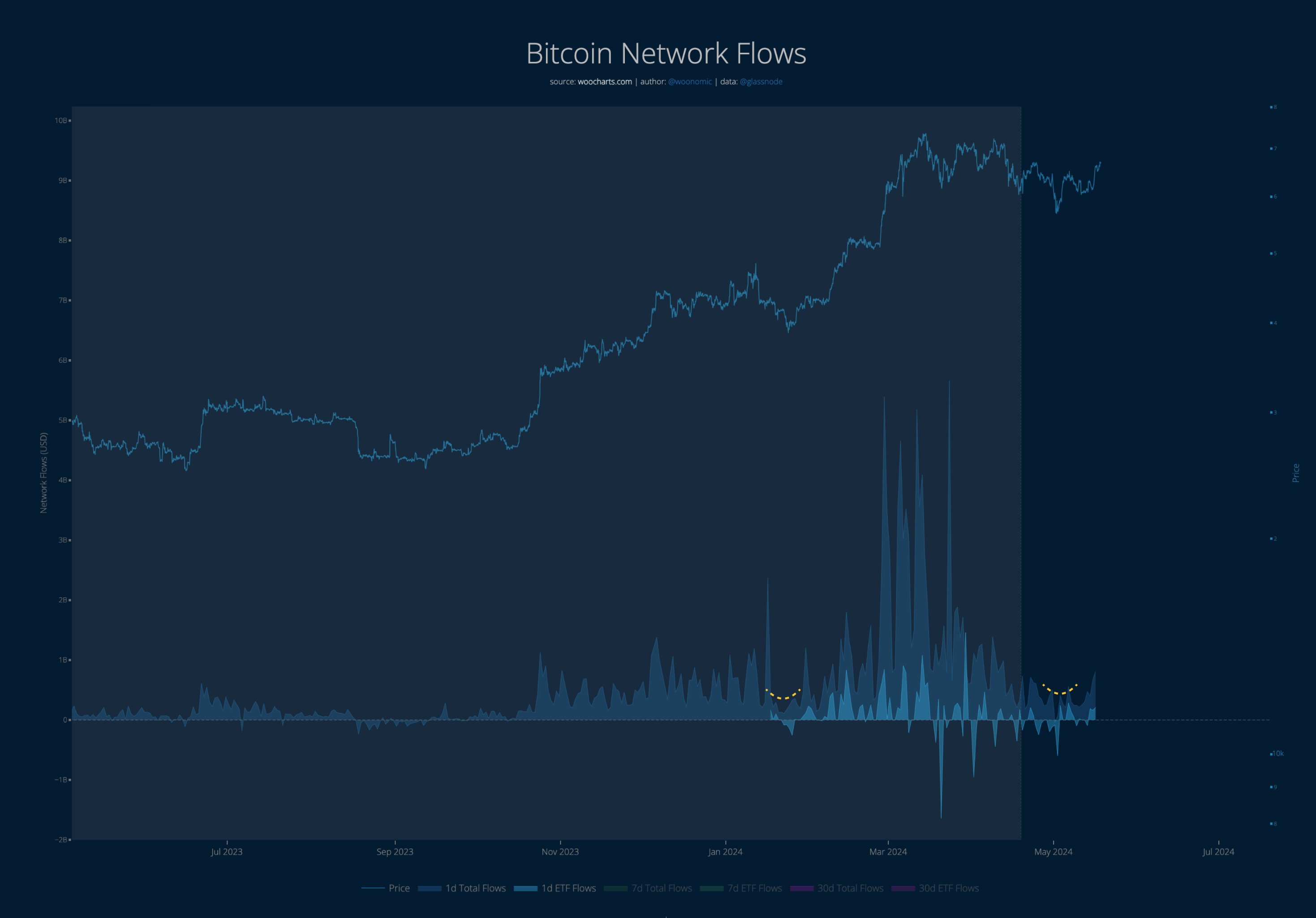

It will seem that two months after the profit-taking peaked, the urge for food for harvesting beneficial properties has doubtlessly lastly disappeared among the many buyers. The analyst says this can be a very wholesome reset for the cryptocurrency, particularly because the capital inflows have as soon as once more been choosing up for the coin.

Seems to be just like the indicator has gone by a turnaround just lately | Supply: @woonomic

From the chart, it’s obvious that the Bitcoin community flows had been following an total downward trajectory earlier when the consolidation was going down, however just lately, capital injections into the coin have as soon as once more been on the rise.

Associated Studying

This can be a related pattern to what was noticed earlier within the yr through the crash following the approval of the spot exchange-traded funds (ETFs). The turnabout in capital inflows again then was what led into the rally that took the cryptocurrency to the present ATH.

BTC Worth

Bitcoin had seen a pullback beneath $66,000 yesterday, elevating worries that the restoration surge had already fizzled out. This drop solely lasted briefly, although, because the coin has returned above $67,000 at this time.

The worth of the asset seems to have been consolidating sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, woocharts.com, chart from TradingView.com