Fast Take

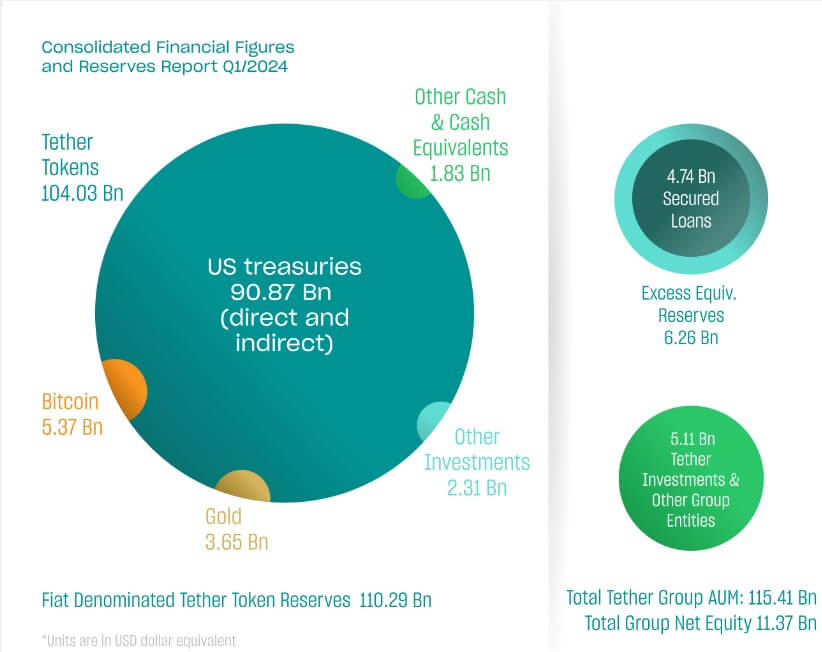

Tether reported a huge $4.52 billion revenue within the first quarter of the 12 months.

Notably, the stablecoin issuer’s consolidated monetary figures revealed that as of March 31, it held a staggering $91 billion in direct and oblique US treasury invoice holdings. In the meantime, the corporate additionally holds a considerable $5.4 billion in Bitcoin.

Based mostly on the Treasury’s March information, Tether is the nineteenth largest holder of US treasuries amongst sovereign nations, nestled between South Korea and Germany.

Nonetheless, the panorama is shifting as main gamers like China have offloaded treasuries, dropping from $869 billion to $767 billion over the previous 12 months. Concurrently, Japan, the most important holder with round $1.2 trillion, might have to promote amid a weakening yen.

| Nation | 2024-03 | 2024-02 | 2024-01 | 2023-12 | 2023-11 | 2023-10 | 2023-09 | 2023-08 | 2023-07 | 2023-06 | 2023-05 | 2023-04 | 2023-03 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Korea, South | 115.9 | 119.2 | 118.6 | 119.0 | 116.0 | 113.9 | 112.9 | 117.8 | 115.7 | 110.5 | 111.4 | 113.9 | 113.9 |

| Germany | 90.2 | 90.8 | 90.2 | 87.3 | 104.5 | 102.3 | 96.4 | 96.3 | 95.5 | 92.0 | 87.4 | 85.5 | 85.5 |

Supply: Treasury.gov

A video clip shared by Radar on X exhibits former Home Speaker Paul Ryan advocating for stablecoin regulation for 2 key causes: elevated demand for treasuries and additional entrenchment of the greenback into the digitizing digital asset ecosystem.

As stablecoins’ treasury holdings improve, their potential to bolster the U.S. greenback within the digital asset area correspondingly strengthens.

The submit Tether holds extra US Treasuries than Germany, ranks nineteenth globally appeared first on CryptoSlate.