Bitcoin costs have been trending decrease previously couple of weeks and usually stay inside a bearish formation. Though momentum seems to be choosing up, bulls will not be out of the woods simply but.

Analysts will not be shedding hope and stay overly upbeat, anticipating a surge that might take the world’s most respected coin to new ranges.

Bitcoin Kinds A “Cup And Deal with” Formation In The Weekly Chart

In a publish on X, certainly one of them, MikybullCrypto, mentioned Bitcoin has fashioned a “cup and deal with” reversal sample, suggesting an imminent surge in direction of new all-time highs. This formation is a glimmer of hope for optimistic merchants, particularly now that costs have been shifting decrease and sideways, erasing positive aspects posted in March.

The “cup and deal with” formation is a technical sample chartists use to determine potential reversals and make sure pattern continuations. Within the present setup, as recognized by the dealer on the weekly chart, the “deal with” was fashioned after the latest value drop from all-time highs. The “cup” follows the worth decline in 2022 and the next restoration in 2023.

Associated Studying

Traditionally, if there’s a breakout above the deal with and the rim of the cup, costs are likely to rally to new ranges. Because of this, the analyst says that if patrons press on from spot charges, the breakout above the present vary and all-time highs of $73,800 can be “explosive.”

For now, costs stay in a descending channel with clear resistance ranges marked out within the instant time period at round $66,000 and $72,000. A breakout, studying from the candlestick formation within the every day chart, above these liquidation ranges may spark demand, lifting the coin to new ranges.

Will Miners Dump BTC And Power Costs Decrease?

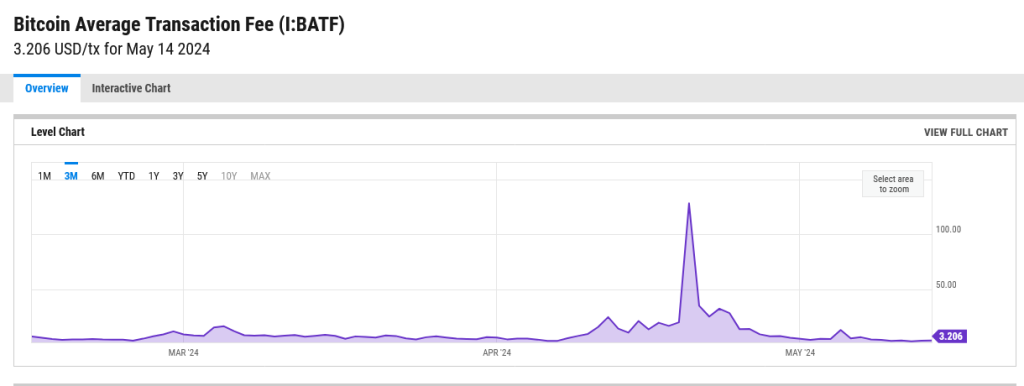

Nevertheless, lurking beneath the optimistic outlook is a possible storm cloud: declining on-chain exercise. After the temporary spike in on-chain exercise on Halving Day as a result of launch of the Runes protocol, transaction charges have been declining.

In keeping with YCharts, it’s presently at $3.206, down from over $128 on April 20. This contraction means miners are getting much less income, heaping extra strain now that there’s extra strain on margins post-Halving.

Associated Studying

Now that miners are feeling the pinch of slashed block rewards and declining transaction charges, it’s possible that they could liquidate a few of their BTC to remain afloat. Their participation, particularly within the secondary market, would heap extra strain on BTC, forcing costs decrease.

Function picture from Shutterstock, chart from TradingView