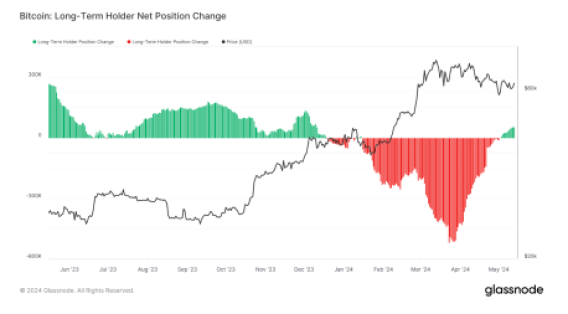

Glassnode knowledge has revealed that Bitcoin long-term holders are profiting from the cryptocurrency’s lower cost to considerably improve their holdings. This accumulation additional strengthens the idea that this group of Bitcoin buyers anticipate a potential upside for Bitcoin regardless of its latest volatility.

Lengthy-Time period Holders Pay $4.3 Billion For 70,000 BTC

Based on Glassnode, long-term Bitcoin holders who had beforehand bought 1 billion BTC within the latter a part of 2023 are accumulating as soon as once more. This shopping for exercise could possibly be interpreted as a possible bullish sign for Bitcoin.

Associated Studying

Historically, Bitcoin long-term holders promote their holdings throughout peak costs and purchase new tokens in periods of correction or substantial declines. When these seasoned buyers purchase cryptocurrencies throughout market lows, it often signifies their expectations of a possible rebound, resulting in income.

Then again, short-term holders are identified to purchase cryptocurrencies throughout sporadic worth surges, usually signaling {that a} cryptocurrency is nearing its peak.

With Bitcoin presently stabilizing above $61,000, long-term Bitcoin holders in all probability see the cryptocurrency’s worth as a prime shopping for alternative. They’ve not too long ago added a staggering 70,000 BTC valued at over $4.3 billion to their holdings.

This sentiment for Bitcoin’s potential rally can be shared by just a few crypto analysts who’ve predicted that the cryptocurrency would surge to new all-time highs throughout the approaching bull market. Earlier in March, earlier than Bitcoin’s halving occasion, the cryptocurrency skyrocketed above $73,000, marking a brand new historic all-time excessive.

With the bull market nonetheless on the way in which, Bitcoin may see additional upsides as market circumstances enhance and investor demand rises. This might doubtlessly result in income for long run holders who had bought the cryptocurrency earlier.

Furthermore, the upcoming United States inflation report, set for launch on Could 15, may be one other major issue driving long-term buyers’ substantial BTC accumulation. With the US Client Worth Index (CPI) remaining traditionally excessive, and the Federal Reserve (FED) unchanged charges, Bitcoin is seen as a doable hedge towards inflationary pressures, defending buyers’ wealth towards decline.

Bitcoin Whales Show Reverse Development

Studies from blockchain analytics platform Santiment reveal that Bitcoin whales are displaying an reverse development from long-term holders.

The analytics platform famous that Bitcoin whales seem like taking a break from accumulating BTC, because the variety of large-scale transactions has been reducing considerably.

Associated Studying

This development coincides with the cryptocurrency’s decreased on-chain actions and its declining worth over the previous few weeks.

Crypto analyst Ali Martinez has additionally shared the same report, emphasizing that Bitcoin’s accumulation development rating is at present displaying a worth nearer to zero, indicating that bigger buyers had been distributing their holdings relatively than shopping for.

Regardless of the downtrend, Martinez has disclosed that Bitcoin’s present TD sequential is signaling a shopping for alternative and the cryptocurrency was poised for a rebound quickly. On the time of writing, the cryptocurrency’s worth is buying and selling beneath $62,000, receiving a lower of about 6.38% within the final month, in response to CoinMarketCap.

Featured picture from StormGain, chart from Tradingview.com