Bitcoin (BTC) has printed a sudden 7% bounce following knowledge from the Bureau of Labor Statistics (BLS) revealing that inflation knowledge cooled in April.

Based on the BLS, the Shopper Worth Index (CPI), which is a measure of the common change over time within the costs paid by city shoppers for a market basket of client items and providers, elevated by 0.3%, barely lower than what was forecasted.

Each Bitcoin and inventory markets responded properly to the info, with the S&P500 reaching new all-time highs above the 5,300 degree, and BTC rebounding to $65,152.

With Bitcoin’s halving now within the rearview, analysts are ready to see how the BTC mining ecosystem will react to its rewards being reduce in half, and the impact it may have on the main crypto asset by market cap.

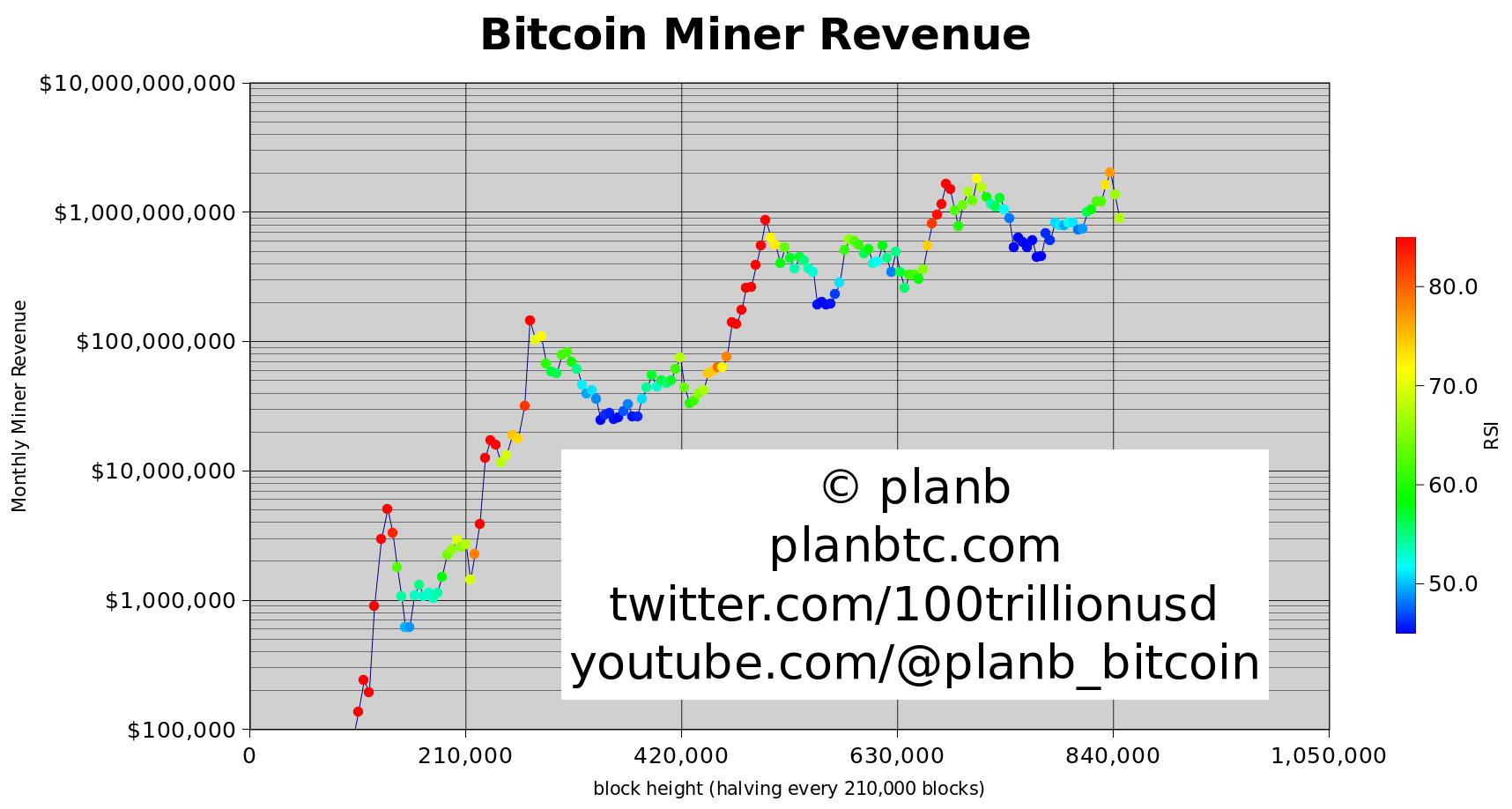

Quant analyst PlanB says that based mostly on the historic correlation between miner income and worth motion, BTC ought to go “vertical” later in 2024 because the trade’s income recovers from the halving.

“Traditionally, bitcoin miner income recovers 2-5 months after a halving, and after that Bitcoin worth goes vertical.”

On-chain analyst Willy Woo says that the mining trade may consolidate to fewer, stronger miners who’re much less prone to promote as a consequence of having bigger margins and extra environment friendly enterprise fashions, thus easing promote stress on Bitcoin.

“Thesis:

Inefficient miners get culled on the halving.

They dump their BTC earlier than dying.

Solely the sturdy ones survive.

They function on fatter margins so don’t have to promote.

Miner promote stress gone.

Takes 2-5 months for the brand new provide/demand to replicate in worth.”

Fundstrat’s Tom Lee can be optimistic about Bitcoin miners, saying that miners have the “leverage” to pump the worth of BTC additional.

At time of writing, Bitcoin is buying and selling at $64,980.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/johavel/maksum iliasin