Crypto analyst Javon Marks has highlighted a number of metrics which have turned bullish for Ethereum (ETH). The analyst famous that certainly one of these metrics suggests an all-time excessive (ATH) for the second-largest crypto token.

Bullish Metrics For Ethereum

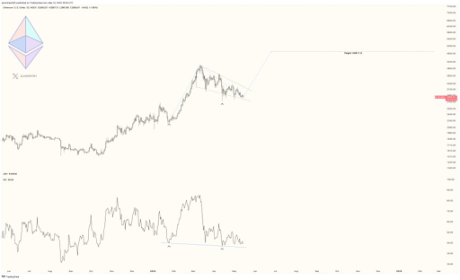

Marks remarked in an X (previously Twitter) put up that the bull flag-like value construction has shaped on the Ethereum chart. He added that greater lows are forming in Ethereum’s value motion, which can also be a bullish sign because it suggests a robust resistance to downward traits. In the meantime, the analyst claims decrease lows within the Relative Power Index (RSI) point out a hidden bullish divergence with Ethereum’s value.

Associated Studying

Marks then raised the potential for Ethereum hitting a brand new ATH, stating that the “bull flag breakout would possibly lead into new all-time highs and be of main service in lots of Altcoin progressions.” Earlier than then, he claimed that Ethereum may quickly expertise a bigger value breakout, making the crypto token expertise a 63% upside to $4,811.

Crypto analyst Michaël van de Poppe additionally not too long ago steered that Ethereum may make a serious transfer quickly sufficient and lead altcoins to make new highs. In accordance with him, this will probably be triggered by the information surrounding the Ethereum ETF, as he expects that to be the “rotation for the Altcoins.”

Nonetheless, Ethereum additionally dangers experiencing a major decline, contemplating experiences that the Securities and Alternate Fee (SEC) would possibly reject the Ethereum ETF purposes. Crypto analyst James Van Straten acknowledged {that a} rejection of the Spot ETF “sends the ETHBTC ratio decrease 0.047 to 0.03 as a long-term projection.”

This was one of many the reason why the analyst acknowledged that “Ethereum seems prefer it’s going to the grave.” He additionally alluded to the truth that ETH has grow to be inflationary with the Decun improve decreasing transaction charges, which has finally diminished ETH’s burn charge.

Issues Aren’t Trying Good For ETH

Crypto analyst Derek not too long ago talked about that “Ethereum dominance and up to date efficiency are heading towards their worst ever.” He famous that focus has turned to Bitcoin as a result of experiences a few potential rejection of the Ethereum ETF and securities standing, which has put stress on funding sentiment. In accordance with him, this has brought about the “imbalance in dominance” to succeed in its worst level.

Associated Studying

Derek additional famous that Ethereum’s unimpressive value motion is affecting different altcoins, as their costs are “depressed.” He additionally claimed that the costs of layer two cash “continued to be underneath stress.” The analyst steered that issues may worsen, because the ETH/BTC chart reveals a downward wedge sample in progress. He claims that altcoins can solely “breathe” if Ethereum can escape this sample shortly.

On the time of writing, Ethereum is buying and selling at round $2906, down within the final 24 hours based on information from CoinMarketCap.

Featured picture from Metaverse Put up, chart from Tradingview.com