Fast Take

The Bitcoin mining sector has confronted challenges with traditionally low hashprices in current weeks following the halving occasion. Nonetheless, hash costs surged to multi-year highs on the day of the halving, buoyed by elevated charges attributed to Runes.

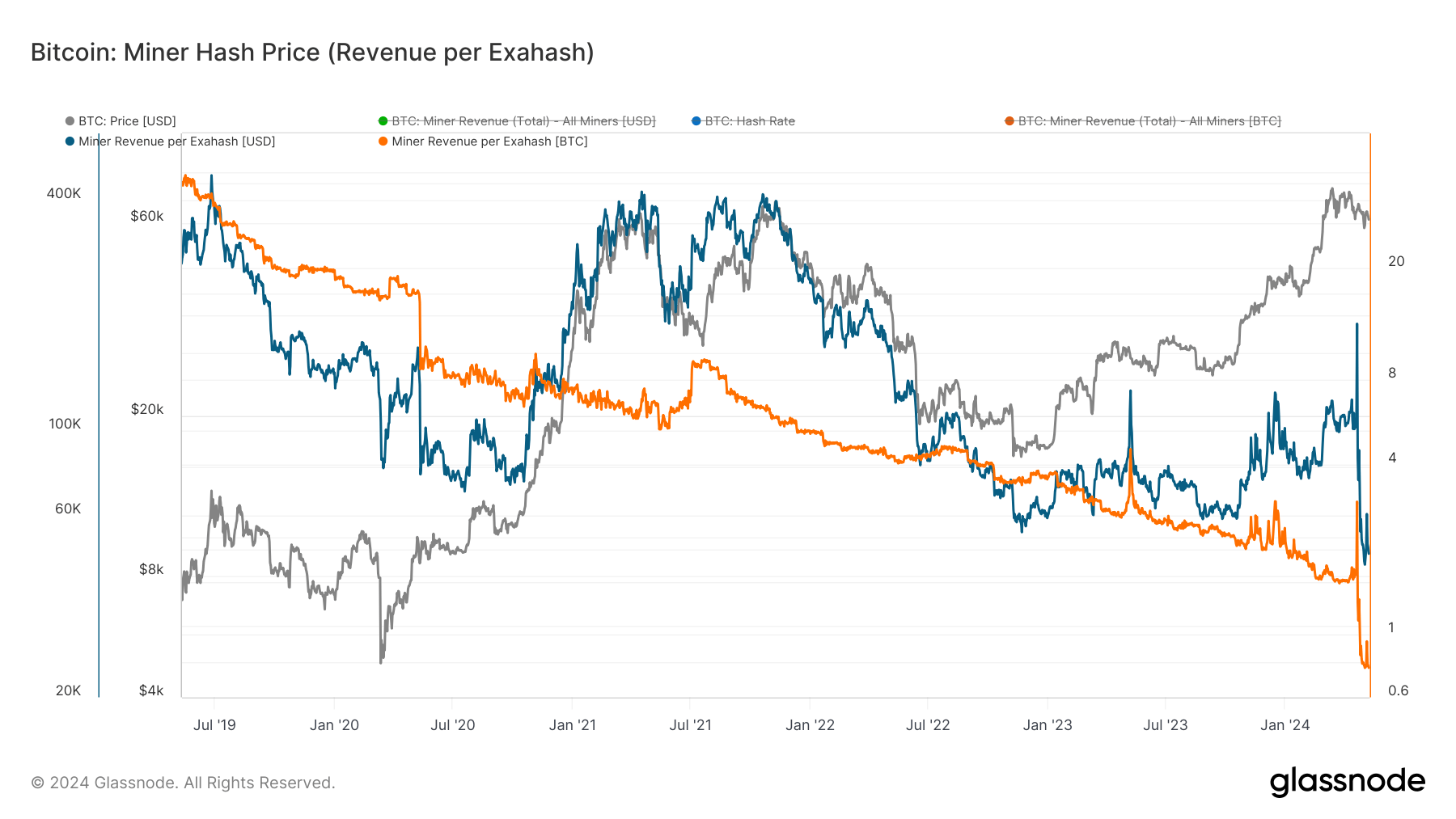

In accordance with Glassnode information, the hash value is $51,915 in USD phrases and 0.84 BTC, nearing all-time lows. Nonetheless, Could 9 noticed a current uptick in hash value as a result of greatest problem adjustment drop since November 2022.

Glassnode defines the miner income per exahash metric as a software for gauging every day miner earnings in relation to their proportional contribution to community hash energy. It’s derived by dividing the whole miner earnings (combining subsidies and charges) by the present hashrate (in EH/s). This information is offered each day, providing insights into the every day income earned per 1 EH/s of hash energy contributed by miners to the community.

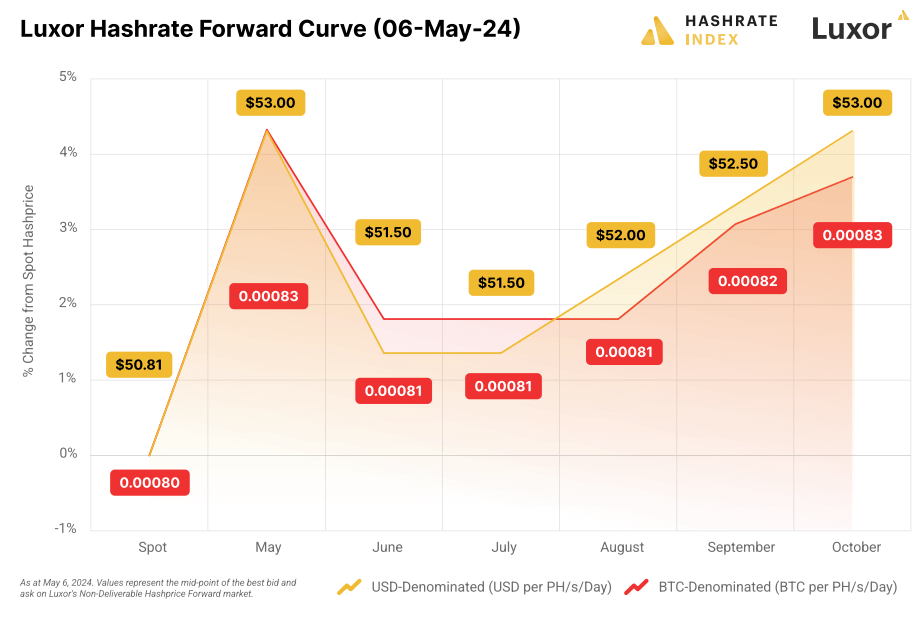

Luxor, a mining pool and hashrate market, launched its Q1 2024 report on the state of Bitcoin mining. The report means that the hash value might have reached its backside, at the very least within the brief time period, and anticipates an increase over the subsequent 5 months. This projection relies on the expectation of both increased transaction charges or a lower in mining problem.

The report says:

“Because of this Luxor Hashrate Ahead merchants anticipate hashprice to extend over the subsequent 5 months by means of both a rise in transaction charges or a lower in Bitcoin mining problem”.

As well as, Luxor’s hashrate forwards are buying and selling above the present spot value by October, also referred to as Contango.

“Luxor’s Hashrate Forwards are buying and selling in contango by October, which implies that the contract costs for these ahead contracts (that are primarily future contracts, though they commerce OTC and never on an change) are buying and selling above the present spot value”.

The report means that hashrate merchants are bullish on transaction charges within the brief time period.

“Hashrate merchants have been bullish on transaction charges, which they’re baking into their expectations for hashprice within the coming months”.

I see two potential eventualities for elevated charges: First, if the Bitcoin bull run continues, we might see elevated adoption and community congestion. Alternatively, one other surge in Inscriptions and Runes might additionally drive up charges.