Ethereum, the world’s second-largest cryptocurrency by market cap, finds itself in a curious place. Whereas the value struggles for route, its underlying community is experiencing a surge in exercise.

Ethereum Community Sees Improve In New Customers

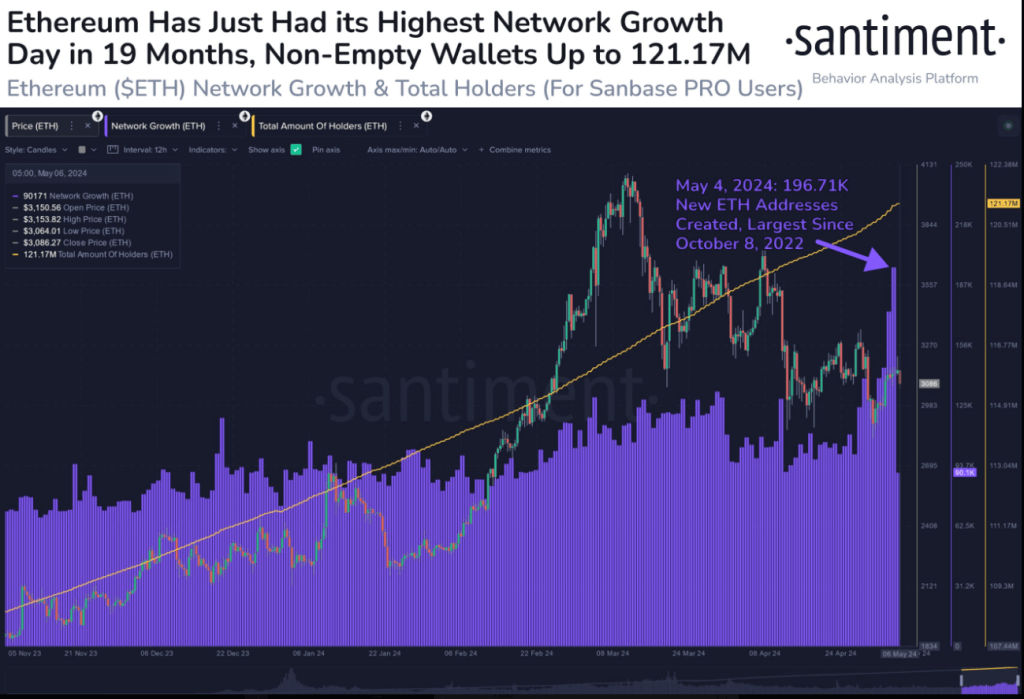

In keeping with crypto knowledge agency Santiment, Could 4th noticed a whopping 200,000 new Ethereum addresses created, marking the very best single-day progress in practically two years.

This surge suggests a renewed curiosity within the Ethereum ecosystem, probably pushed by components just like the burgeoning Decentralized Finance (DeFi) house and the ever-evolving world of Non-Fungible Tokens (NFTs).

📈 #Ethereum rebounded again above $3,200 this weekend, and noticed huge community progress. 196.71K new addresses have been created on the $ETH community on Could 4, 2024, the biggest single day of progress since October 8, 2022. This must be seen as a #bullish signal. https://t.co/l9iFVWCJpE pic.twitter.com/MlHQTvKKN0

— Santiment (@santimentfeed) Could 6, 2024

This community progress is a bullish sign, and signifies robust and rising curiosity in Ethereum, which might translate to important capital inflows when macroeconomic situations turn into extra favorable.

Is The Worth Dip A Shopping for Alternative?

Whereas the community thrives, Ethereum’s worth at the moment sits at $2,995, a 1.8% decline up to now 24 hours. This places it precariously near falling beneath its 200-day Exponential Transferring Common (EMA), a technical indicator usually interpreted as an indication of bearish momentum.

Nonetheless, a more in-depth look reveals a probably bullish twist. The worth decline is accompanied by a drop in buying and selling quantity, which might point out that promoting stress is waning. Traditionally, such a situation has typically preceded a worth reversal, the place patrons re-enter the market, pushing costs upwards.

Complete crypto market cap at the moment at $2.2 trillion. chart: TradingView

Investor Optimism Buoyed By Potential Fed Pivot

The latest weak spot within the US financial system, highlighted by a disappointing jobs report, has sparked hypothesis that the Federal Reserve may think about easing rates of interest. This might inject recent liquidity into the market, probably benefiting riskier belongings like cryptocurrencies.

In keeping with analysts, a dovish pivot from the Federal Reserve could possibly be a game-changer for Ethereum. Decrease rates of interest usually make holding cryptocurrencies extra enticing in comparison with conventional fixed-income investments.

Ether seven-day worth motion. Supply: CoinMarketCap

The longer term path of Ethereum stays unsure. Whereas the community’s fundamentals seem strong, the value faces fast challenges. Navigating this complicated situation would require buyers to fastidiously think about each the on-chain exercise and the broader financial panorama.

Regulation and Innovation: Key Elements to Watch

Regulatory readability round cryptocurrencies will undoubtedly play an important function in attracting institutional buyers, a possible catalyst for important worth progress.

Associated Studying: Cardano (ADA) Buying and selling Exercise Goes Quiet: Will This Drag Down The Worth?

Featured picture from E book My Flight, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal danger.