Because the crypto market reveals indicators of a burgeoning altseason, crypto analyst Alex Wacy has shared a strategic forecast together with his 175,000 followers on X. Wacy predicts a selective but explosive progress section for altcoins, emphasizing the essential nature of asset choice and market timing.

Crypto Market Outlook And Asset Choice Technique

Wacy’s current thread underscores the anticipation of an enormous altseason: “Solely ~15% of altcoins will convey 10-100x on this hyper progress. Asset choice issues greater than ever. One slip-up, and also you’re out.” His evaluation highlights the doubtless selective nature of the upcoming market section, suggesting vital disparities in efficiency amongst altcoins.

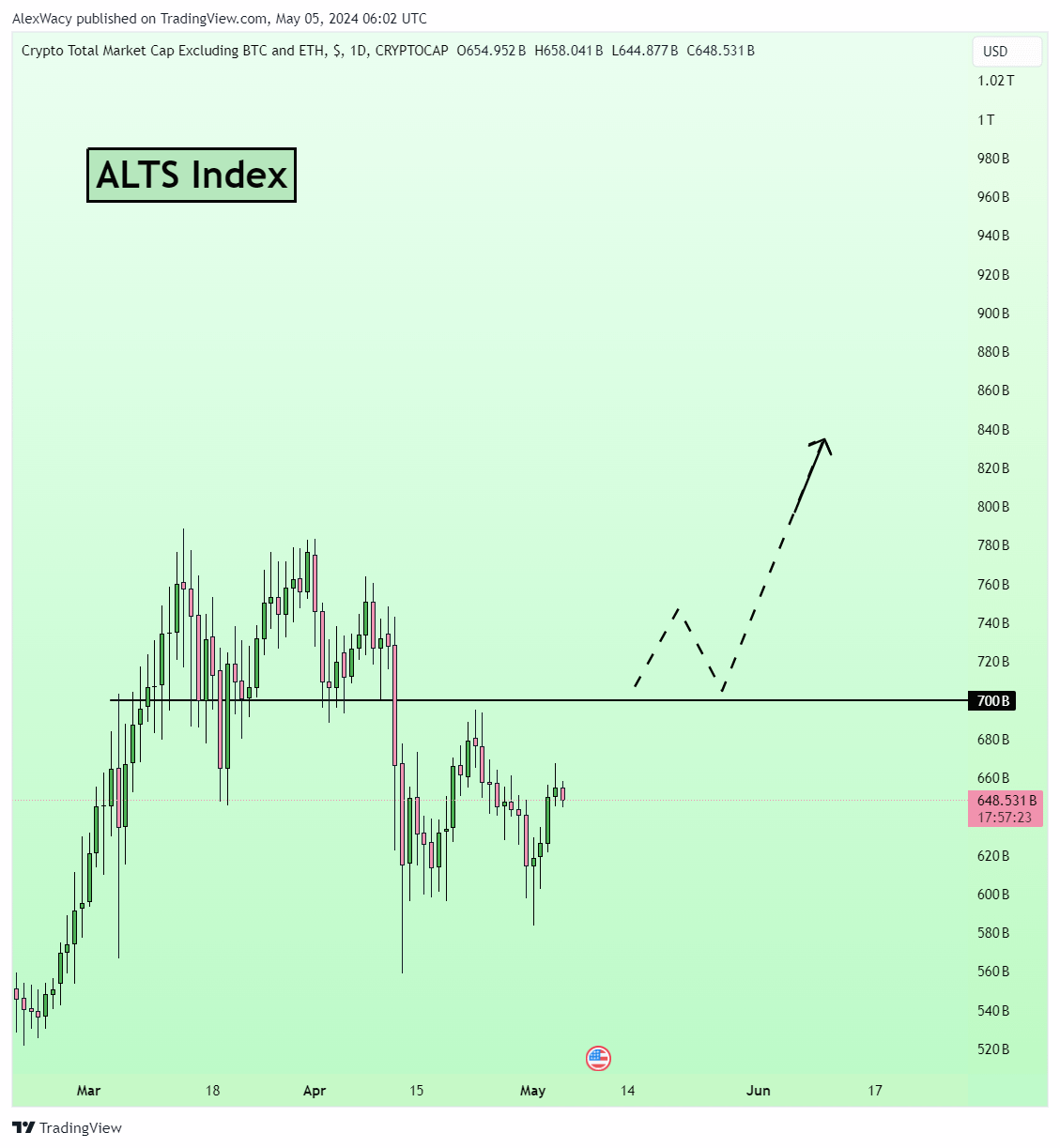

Wacy believes the market is presently undervalued and primed for a big uptick. He means that the consolidation of the full altcoin market cap above $700 billion would affirm the bull development, signaling the onset of altseason. This angle is rooted in present market behaviors the place sentiment stays largely bearish, presenting a contrarian alternative for progress.

He categorizes the present sentiment into three varieties of capitulation—value, time, and progress—indicating various investor behaviors that usually precede market recoveries. The prevailing concern of additional drops, based on Wacy, will possible filter out weak fingers, setting the stage for a supercycle pushed by Concern of Lacking Out (FOMO) and subsequent sturdy shopping for actions.

Prime 6 Altcoins With The Most Potential

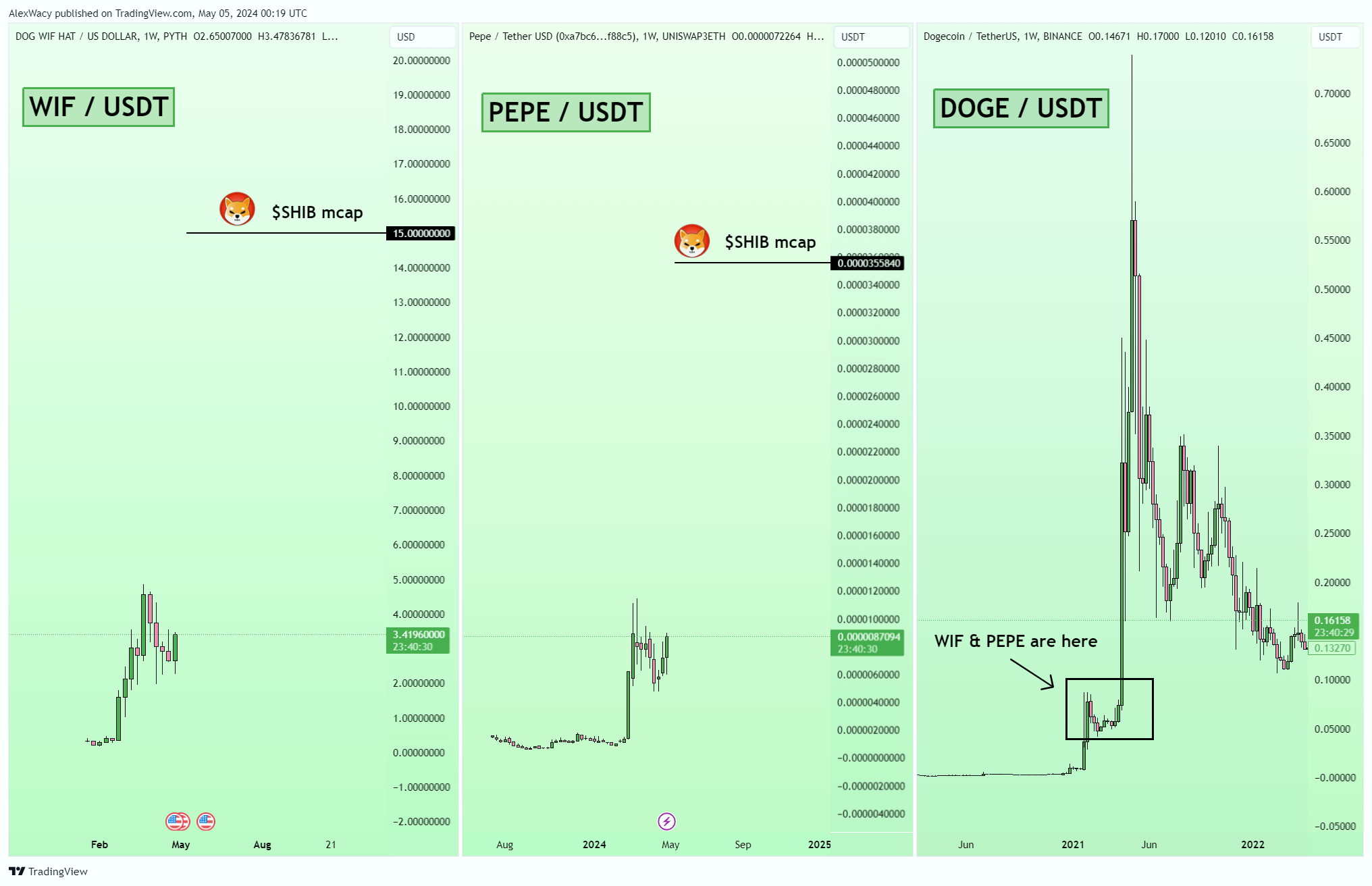

#1 And #2: WIF in addition to PEPE are the memecoins highlighted by Wacy as potential early movers within the anticipated altseason. “Have a look at WIF and PEPE, structurally much like DOGE throughout its meteoric rise. These cash have cultivated a neighborhood and meme attraction that might very effectively parallel SHIB’s market cap within the earlier cycle,” Wacy asserts. He notes that PEPE seems significantly poised for a breakout, whereas WIF, although presently weaker, has the potential for fast shifts in market sentiment.

#3 Ondo Finance (ONDO): This Actual World Asset (RWA) targeted coin is characterised by its strong purchase assist throughout value dips. Wacy sees ONDO as an undervalued asset with a big upside. “ONDO has a resilient purchase ground; even slight retractions to round $0.64 may supply profitable entry factors forward of considerable upward trajectories,” he advises. His first goal is the $1.62 value zone.

#4 Arweave (AR): Identified for its decentralized knowledge storage options, Arweave is praised by Wacy for its sturdy market construction and resilience throughout downturns. Furthermore, Arweave is constructing AO, a decentralized laptop community which might be run from wherever. “Arweave isn’t simply storage; it’s a foundational expertise in a decentralized future. A consolidation above $49 would possible be the catalyst for an explosive progress section,” he predicts.

#5 Echelon (PRIME): Wacy discusses PRIME’s multifaceted ecosystem, which encompasses a buying and selling card sport and an AI-powered sport, each of that are gaining traction. “Echelon stands on the confluence of gaming and blockchain expertise, attracting a broad viewers with its revolutionary gameplay and decentralized options,” he remarks. From a technical evaluation perspective, the PRIME value is close to a positive shopping for zone from $14.97 to $17.5. “Hoping that altcoins are already getting into the altseason, wish to see a V-shaped reversal,” Wacy states.

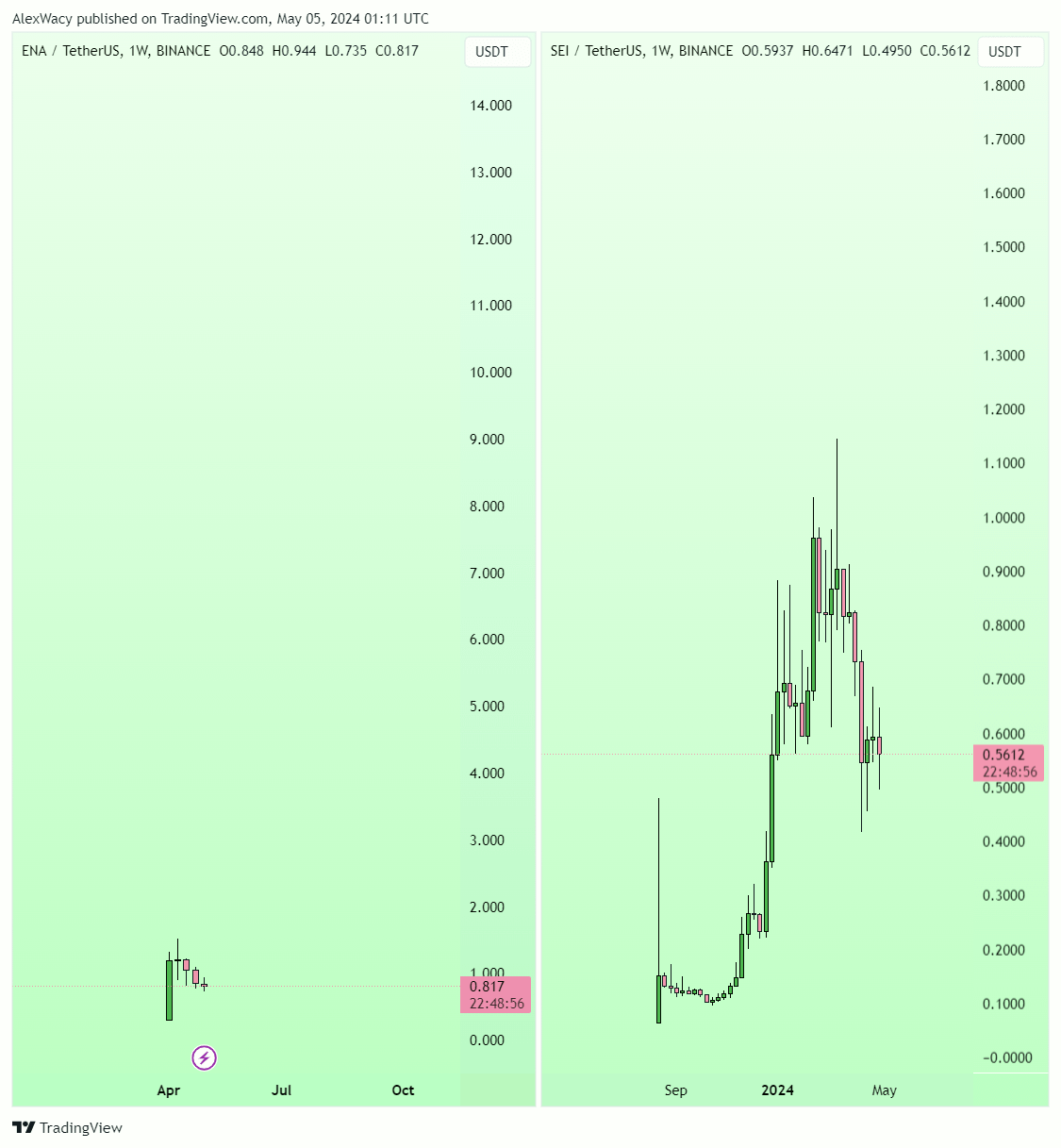

#6 Ethena (ENA): This artificial greenback protocol provides a substitute for conventional banking and is poised for progress. “Ethena’s sample on the weekly charts usually precedes main value actions. With the following main unlock occasion slated for April 2025, the buildup could possibly be substantial,” Wacy explains. He likens ENA’s present value trajectory with the one among SEI.

Strategic Revenue-Taking

Wacy additionally offers strategic recommendation on profit-taking, anticipating that the altcoin market index, TOTAL3, may ascend to between $2 trillion and $2.3 trillion in the course of the altseason. He suggests contemplating partial profit-taking as soon as the market reaches roughly $1.6 trillion. His rationale relies on historic patterns the place many traders fall prey to greed, leading to substantial losses.

The analyst additional advises making ready a profit-taking technique prematurely, advocating for the reservation of 10-15% of positions for potential additional progress past preliminary targets. He warns that the final surge in a progress section typically triggers extreme greed, suggesting that recognizing such indicators could possibly be essential for well timed exits earlier than the onset of bear market circumstances.

At press time, WIF traded at $3.58.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site completely at your personal danger.