One of many some ways to investigate the crypto market is to match the efficiency of its segments. For the sake of simplicity, main, large-cap ecosystems like Bitcoin (BTC) and Ethereum (ETH) will be seen as a single section of the market whose actions will be considerably totally different from the remainder of the market.

In the meantime, the remainder of the market will be outlined as “altcoins” as a result of their efficiency has traditionally proven a decrease correlation to BTC and ETH.

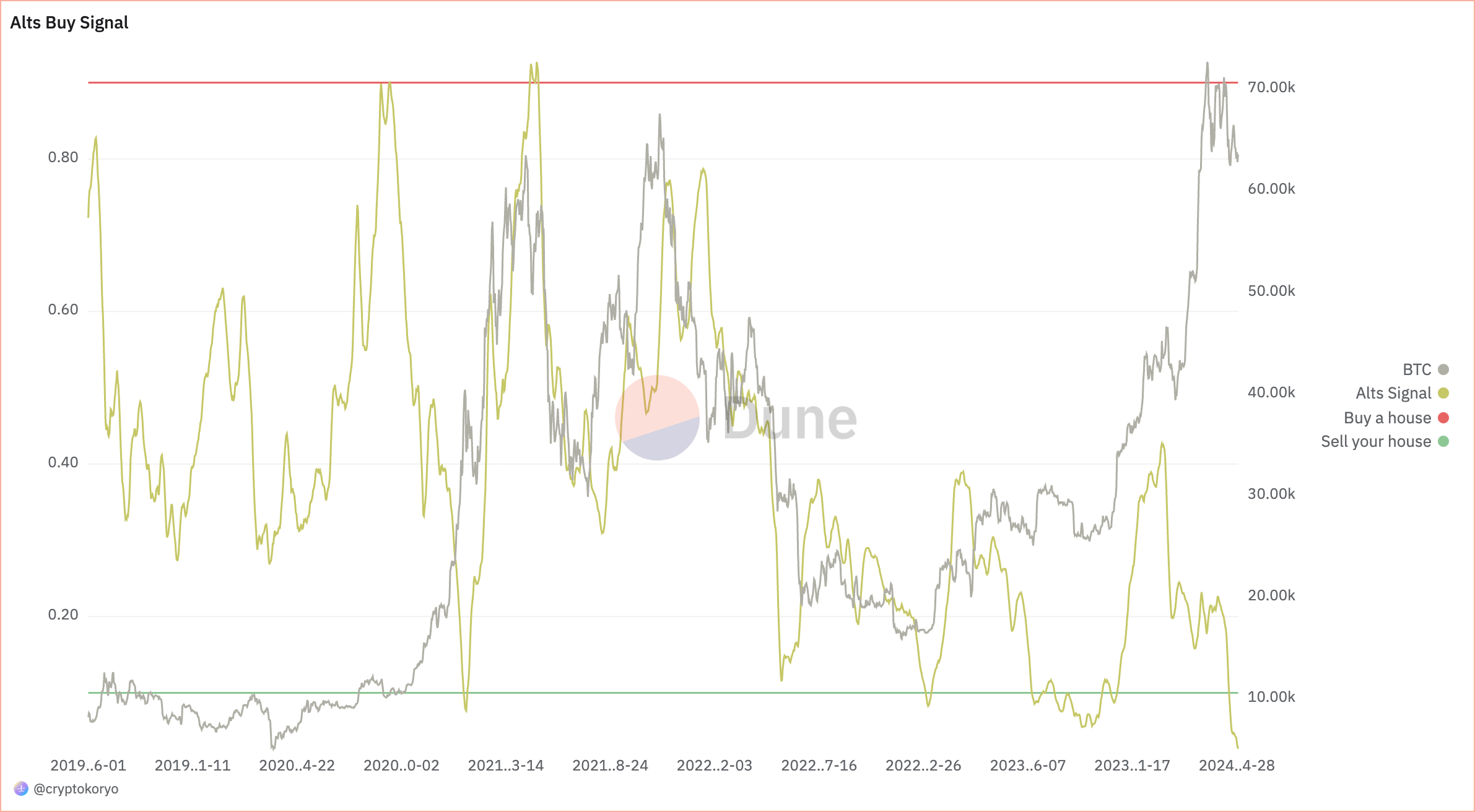

Out of the various instruments out there to investigate these segments, the alts sign stands out as a number one one. Developed as an oscillator, much like conventional instruments just like the RSI, the alts sign affords a granular view by evaluating the market cap of all cryptocurrencies, excluding BTC and ETH, to the whole crypto market cap.

Because it strikes inside a variety of 0 to 1, the sign gives perception into the relative efficiency of altcoins in opposition to the broader market, serving as a barometer for his or her strengths or weaknesses.

The sign’s utility lies in its capacity to outline particular market situations. Every situation exhibits totally different market situations and opens up potential methods for merchants and buyers. These situations vary from bullish to bearish.

Within the first situation, each BTC and the alts sign are rising, indicating a transparent uptrend the place each segments are rising. Usually, this happens when Bitcoin’s dominance is secure or declining, which indicators a broad-based bull rally throughout the market.

On this situation, buyers normally contemplate rising their positions in altcoins, particularly if the alts sign rises extra sharply than BTC — suggesting stronger efficiency within the altcoin sector.

Within the second situation, each BTC and the alts sign are declining, indicating a transparent downtrend throughout the whole market. On this state of affairs, buyers normally look to de-risk by reallocating to stablecoins or “blue chip” cryptocurrencies, additional contributing to the downturn.

The third situation sees BTC declining whereas the alts sign is rising. That is much less frequent and happens when Bitcoin loses worth, however altcoins outperform BTC. This would possibly point out a brief alt season, the place buyers usually improve publicity to altcoins, supplied Bitcoin’s decline will not be too steep.

Bitcoin rising and the alts sign declining is the fourth situation, which happens if Bitcoin is outperforming the broader market, usually noticed both earlier than a halving occasion or initially of a bull market.

Though the general market is rising in greenback phrases, Bitcoin is gaining worth quicker than altcoins. This situation has traditionally been a very good time to build up altcoins, as a big a part of the market is anticipating a delayed rally.

Because the starting of the 12 months, the alts sign noticed important volatility. Beginning at 0.4230, it initially confirmed a powerful place however dropped sharply to 0.1991 by mid-January and additional to 0.1599 by late February, indicating a shift in the direction of the buildup zone.

By late March, the sign partially recovered to 0.2193, solely to plummet to a generational purchase degree of 0.0301 by the tip of April. This sample means that whereas the market started comparatively wholesome, buyers steadily moved towards heavy accumulation, indicating potential undervaluation or market apprehension.

In distinction, Bitcoin’s value motion throughout the identical interval tells a considerably totally different story. Its value motion aligns completely with the fourth situation, the place it outperforms altcoins at the same time as each segments typically rise in greenback phrases. This situation sometimes signifies a pre-bull market section the place Bitcoin leads a normal upturn, however altcoins have but to totally take part within the rally.

As Bitcoin noticed its value rise this 12 months with institutional adoption pushed by ETFs and the halving, altcoins haven’t saved tempo. This exhibits potential for a brewing interval the place altcoins are poised for important actions as soon as the market sentiment shifts extra favorably towards them. Traditionally, this sample has resulted within the buildup of a extra explosive altcoin market rally.

The alts sign is presently deep within the generational purchase zone, standing beneath 0.1.

Based on knowledge from Dune Analytics developed by analyst @cryptokoryo, this has traditionally been a very good alternative to build up altcoins, with the expectation that their costs will ultimately rally to mirror the broader market beneficial properties.

The submit Alts sign hits new low, hinting at a possible altcoin rally appeared first on CryptoSlate.