Latest tendencies within the crypto market have indicated a notable shift in dealer conduct, notably amongst these investing in Bitcoin.

Utilizing knowledge from CryptoQuant, Bloomberg has revealed that the Bitcoin funding fee—the fee for merchants to open lengthy positions in Bitcoin’s perpetual futures—has turned damaging for the primary time since October 2023.

This alteration suggests a “cooling curiosity” in leveraging bullish bets on Bitcoin, coinciding with the fading influence of main market drivers.

Bitcoin Market Dynamics Put up-Halving

The decline in Bitcoin’s funding fee correlates with a discount in web inflows to US spot Bitcoin Change-Traded Funds (ETFs), which beforehand pushed the cryptocurrency to file highs.

Regardless of the anticipation surrounding the Bitcoin Halving—an occasion decreasing the reward for mining new blocks and theoretically lessening the availability of recent cash—the worth influence has been surprisingly muted.

In keeping with Bloomberg, this subdued response has compounded the consequences of broader financial elements, resembling geopolitical tensions and modifications in financial coverage expectations, resulting in elevated threat aversion amongst traders.

Following the newest Bitcoin halving, the market has not seen the bullish surge many anticipated. As a substitute, Bitcoin has solely seen a correction of over 10%, from its all-time excessive (ATH) in March with costs stabilizing within the $63,000 area, on the time of writing.

As CryptoQuant’s Head of Analysis Julio Moreno identified, the current downturn in Bitcoin’s funding charges to beneath zero underscores a “decreased eagerness” amongst merchants to take lengthy positions.

In keeping with Bloomberg, this development is supported by a big drop in day by day inflows to US spot Bitcoin ETFs and a discount in open curiosity in Bitcoin futures on the Chicago Mercantile Change (CME), which signifies a broader cooling of enthusiasm for crypto investments.

[1/4] Bitcoin ETF Circulation – 25 April 2024 – UPDATE pic.twitter.com/ojRayOFlnu

— BitMEX Analysis (@BitMEXResearch) April 25, 2024

In a Bloomberg report, K33 Analysis analyst Vetle Lunde famous that the “present streak of neutral-to-below-neutral funding charges is uncommon,” suggesting that the market may be coming into a price-consolidation part.

Notably, this era of diminished leverage exercise might probably result in additional worth stabilization, but it surely additionally raises questions in regards to the near-term prospects for Bitcoin’s restoration.

Changes In Mining Issue And Market Implications

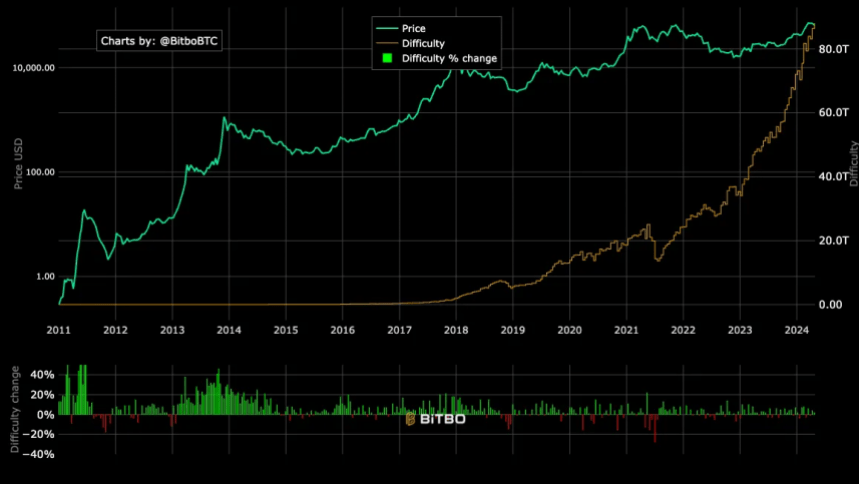

Apparently, alongside these market changes, Bitcoin’s mining issue has elevated for the primary time instantly following the fourth halving.

The issue adjustment, which happens each 2016 block, elevated by 2%, reaching a brand new excessive of 88.1 trillion, in response to Bitbo knowledge.

This adjustment contradicts previous tendencies the place the problem usually decreased post-halving because of diminished profitability pushing much less environment friendly miners out of the market.

This anomaly in mining issue means that regardless of decrease rewards post-Halving, miners stay energetic, presumably buoyed by extra environment friendly mining applied sciences or strategic shifts inside mining operations.

This resilience in mining exercise might assist maintain the community’s safety and processing energy. Nonetheless, it displays the complexities of predicting Bitcoin’s market dynamics solely based mostly on historic halving outcomes.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal threat.