Ether (ETH), the cryptofuel that powers distributed functions on the Ethereum platform, will likely be issued at a relentless annual linear price through the block mining course of. This price is 0.3 occasions the overall quantity of ETH that will likely be bought within the pre-sale.

Whereas the very best metaphor for ETH is “gas for operating the contract processing engine,” for the needs of this put up, we’ll deal with ETH purely as a forex.

There are two frequent definitions of “inflation.” The primary pertains to costs and the second pertains to the overall sum of money in a system – the financial base or provide. Equally for the time period “deflation.” On this put up we’ll distinguish between “worth inflation,” the rise within the common worth stage of products and providers in an economic system, and “financial inflation,” the expansion within the provide of cash in an economic system as a result of some kind of issuance mechanism. Typically, however not at all times, financial inflation is a explanation for worth inflation.

Although the issuance of ETH is in a hard and fast quantity every year, the speed of progress of the financial base (financial inflation) will not be fixed. This financial inflation price decreases yearly making ETH a disinflationary forex (by way of financial base). Disinflation is a particular case of inflation through which the quantity of inflation shrinks over time.

It’s anticipated that the quantity of ETH that will likely be misplaced every year brought on by transmissions to addresses that are not accessible is estimated to be on the order of 1% of the financial base. ETH could also be misplaced as a result of lack of non-public keys, demise of proprietor with out transmission of personal keys, or purposeful destruction by sending to an tackle that by no means had an related non-public key generated.

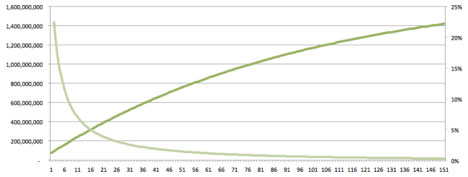

If we assume that Ethereum sells 40,000 BTC value of ETH within the pre-sale, and if we assume that the typical worth is 1500 ETH/ BTC, 60,000,000 ETH will likely be created within the genesis block and assigned to purchasers. Yearly, in perpetuity, 18,000,000 ETH will likely be issued although the mining course of. Bearing in mind each creation of latest ETH and lack of present ETH, within the first 12 months, this represents a financial inflation price of twenty-two.4%. Within the second 12 months the speed drops to 18.1%. By the tenth 12 months, the speed is 7.0%. In 12 months 38, it hits 1.9%. And within the sixty fourth 12 months, the extent of 1.0% is reached.

Determine 1. Quantity of ETH in existence (darkish inexperienced curve) on the left axis. Financial base inflation price (gentle inexperienced curve) on the precise axis. Years on the horizontal axis. (Tailored from Arun Mittal with thanks.)

By roughly the 12 months 2140, the issuance of BTC ceases and since some BTC will seemingly be misplaced every year, the financial base of Bitcoin is anticipated to begin shrinking at that time.

At roughly the identical time, the anticipated price of annual loss and destruction of ETH will stability the speed of issuance. Beneath this dynamic, a quasi-steady state is reached and the quantity of extant ETH not grows. If the demand for ETH continues to be rising at that time as a result of an increasing economic system, costs will likely be in a deflationary regime. This isn’t an existential downside for the system since ETH is theoretically infinitely divisible. So long as the speed of worth deflation will not be too speedy, pricing mechanisms will regulate and the system will function easily. The standard principal objection to deflationary economies, wage stickiness, is probably going to not be a problem since all funds programs will likely be fluid. One other frequent objection, debtors compelled to repay loans with a forex that grows in buying energy over time, will even not be an issue if this regime is persistent, since phrases of lending will likely be outlined to account for this.

Be aware that whereas the financial inflation stays larger than zero for a few years, worth ranges (tracked as worth inflation and deflation) are depending on provide and demand, so are associated to, however not completely managed by the speed of issuance (provide). Over time it’s anticipated that progress of the Ethereum economic system will considerably outpace progress of the provision of ETH, which may result in a rise within the worth of ETH with respect to legacy currencies and BTC.

Considered one of Bitcoin’s nice worth propositions was the algorithmically mounted complete issuance of the forex which mandated that solely 21,000,000 BTC will ever be created. In a time of profligate legacy forex printing in an exponentially doomed try and patch over the truth that there’s an excessive amount of debt within the world financial system (with extra debt), the prospect of a universally accepted cryptocurrency that may serve finally as a comparatively secure retailer of worth is engaging. Ethereum acknowledges this and seeks to emulate this core worth proposition.

Ethereum additionally acknowledges {that a} system meant to function a distributed, consensus-based utility platform for world financial and social programs, should strongly emphasize inclusiveness. One of many some ways we intend to foster inclusiveness is by sustaining an issuance system which possesses some churn. New individuals within the system will be capable of buy new ETH or mine for brand spanking new ETH whether or not they’re residing within the 12 months 2015 or 2115. We consider we now have a achieved a superb stability between the 2 objectives of fostering inclusiveness and sustaining a secure retailer of worth. And the fixed issuance, particularly within the early years, will seemingly make utilizing ETH to construct companies within the Ethereum economic system extra profitable than hoarding speculatively.