The next is a visitor put up by Tim Haldorsson, CEO of Lunar Technique.

The candy sounds of upward value alerts hit your telephone continuous. Mega inexperienced candles are seen on each crypto chart. The smells of income are far and wide.

In different phrases, the bull market is again in full swing, and it seems like a digital gold rush has adopted. In the midst of this bullish craziness, everybody out of the blue imagines themselves as enterprise capitalists.

In fact, this raises extra questions than solutions. Why is that this the case? Does the market want extra VCs? Is that this a wholesome signal or a prime sign, a warning of one other bubble?

On this article, we’ll discover that the solutions aren’t as binary as a easy “sure” or “no.”

What Fuels Hype in a Bull Market?

The joy in a bullish market is not only pushed by spectacular income. What actually attracts folks in throughout a crypto bull market are the highly effective psychological and financial components which are set unfastened.

With a surge in market exercise and fixed media hype, a contagious sense of optimism takes maintain. Some may even name it a frenzy, although I don’t assume we’re fairly there but.

In such an energized environment, the excellence between skilled traders and newcomers blurs. Individuals caught up within the fervor begin to view themselves as savvy enterprise capitalists. Each new startup or challenge, regardless of its precise probabilities of success, known as “the subsequent large factor.”

It’s true that this wave of pleasure isn’t baseless. Previous bull markets have proven again and again that fortunes could be made virtually in a single day. Nevertheless, what usually will get missed are the intricate methods that result in worthwhile investments. Seasoned enterprise capitalists convey with them years of experience and distinctive expertise that assist them navigate the unpredictable world of investing with warning.

Psychological Drivers Behind the VC Mindset

One may argue that this widespread mindset faucets into a number of core psychological drivers:

- The concern of lacking out (FOMO);

- A sense of extreme confidence;

- The engaging attract of fast income.

FOMO, specifically, performs a big function. It’s the persistent concept that someplace throughout the huge array of tokens and tasks being launched on the chain, there exists a beneficial alternative that you’d deeply remorse overlooking perpetually.

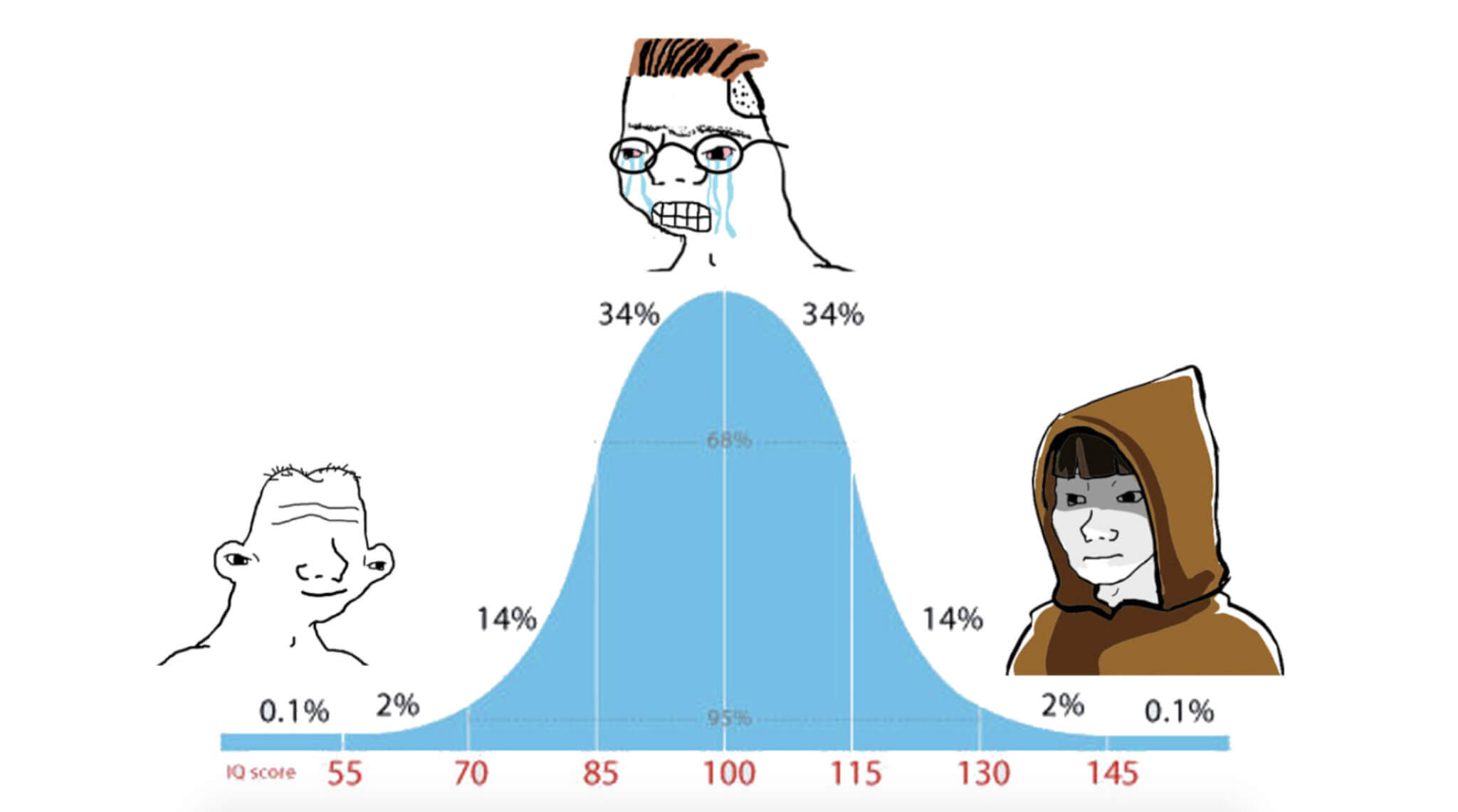

The well-known left-right curve meme encapsulates this mindset completely. On one facet, some people merely comply with tendencies and intriguing narratives with out a lot consideration, holding onto the hope, regardless of how unlikely, that their chosen funding will soar in worth. On the alternative facet are the extra seasoned individuals who excel at recognizing hidden gems among the many bizarre. In between these extremes are those that view the world logically and discover little logic in crypto market dynamics.

Most crypto fanatics, whether or not long-time individuals or newcomers, are likely to gravitate towards both finish of this curve. It serves as a visible illustration of the chance urge for food that drives the ‘VC mindset’ throughout a bullish market interval. Conventional traders are sometimes seen as conservative people who could not align with the final mindset of the crypto market.

So, what drives this extremely esteemed ‘risk-taking’ angle? Many are influenced by overconfidence, fueled by success tales and the seemingly simple income showcased on social media, inflicting them to overestimate their funding expertise. The anonymity throughout the crypto neighborhood additionally emboldens folks to take dangers they’d keep away from in additional typical environments.

Decreasing Entry Limitations

One standout characteristic of the crypto market is its inclusive nature in terms of funding alternatives. In contrast to conventional enterprise capital with closed networks and vital capital calls for that may be daunting for many, the crypto house welcomes everybody with open arms.

Whether or not it’s Preliminary DEX Choices (IDOs), token presales, or NFT launches, getting concerned requires minimal limitations so long as you have got a crypto pockets and a few funds prepared to speculate.

Influencer-driven fundraising is one other intriguing facet of accessibility that has turn out to be synonymous with crypto. It’s no secret that social media influencers maintain sway over market sentiments by their platforms.

Nevertheless, a brand new sort of influencer is rising, opting to have extra private funding by really backing up their phrases with motion. Startups and initiatives are launching packages the place social influencers are given early entry to fundraising alternatives.

Much like conventional enterprise capitalists, these influencers contribute funds together with publicity, making a mutual incentive system the place all events collaborate for the success of the challenge.

Taking part in it Sensible: What Does the Market Need?

The inflow of funds and a spotlight throughout a bullish market can considerably improve the efficiency and worth of crypto tasks. Whereas this presents varied alternatives, it additionally brings a couple of degree of volatility and hypothesis that may be each advantageous and detrimental to the market in addition to its stakeholders. This raises vital issues concerning sustainability in relation to threat.

An more and more ‘threat on’ technique pushed by inexperienced market individuals chasing after excessive returns like enterprise capitalists can result in bubbles and promote unhealthy hypothesis.

Moreover, the abundance of tasks competing for consideration could end in a lower in high quality, with hype usually overshadowing substance. This starkly contrasts with the standard enterprise capital method, which depends on thorough analysis and a long-term perspective to handle dangers and guarantee funding viability.

Regardless of the accessibility and potential for fast income in investing, it’s important for traders to proceed with warning. The saying “DYOR” (Do Your Personal Analysis) holds vital weight in at the moment’s local weather. Anybody getting into the crypto market probably understands its unstable and speculative nature.

Subsequently, conducting thorough analysis, greedy the dangers concerned, and implementing a disciplined funding method are essential. Whereas the bullish market could give a style of enterprise capitalism to many, it might additionally function a stark reminder of the results when impulsive buying and selling surpasses elementary evaluation and prudent decision-making.

In Abstract

It’s tempting to get swept up within the thrill of envisioning oneself as a savvy investor figuring out and backing promising ventures early on. Nevertheless, true enterprise capitalism – whether or not in crypto or conventional markets – includes recognizing potential alternatives and taking measured steps supported by endurance, self-discipline, and threat administration acumen.

Presently, placing a stability between making investments accessible to all whereas emphasizing schooling and prudence is vital to fostering a strong market that advantages everybody concerned.