Because the Bitcoin (BTC) Halving occasion concluded for the fourth time, the cryptocurrency market witnessed notable modifications in key metrics.

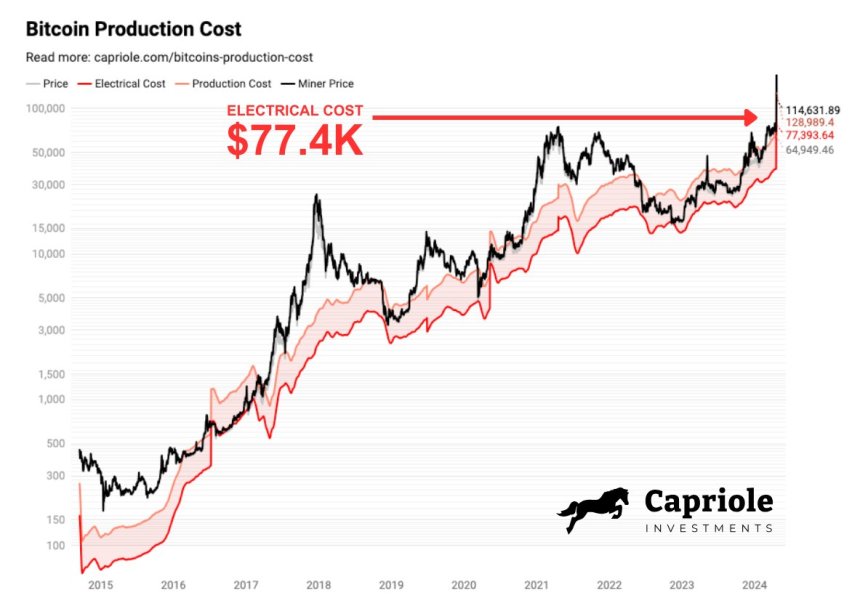

These developments have led Charles Edwards, a market skilled and founding father of Capriole Make investments, to challenge daring predictions that trace at a paradigm shift within the BTC market.

Bitcoin Buying and selling At ‘Deep Low cost’

One of many key metrics highlighted by Edwards is the staggering electrical price related to mining a single Bitcoin. Edwards reveals that this price has now reached an astonishing $77,4000. This determine represents the uncooked electrical energy bills required to energy the Bitcoin community for each newly mined BTC.

One other important metric that Edwards attracts consideration to is the Bitcoin Miner Worth, which soared to $244,000 on Saturday. This metric encompasses the block reward and costs miners obtain for each Bitcoin they efficiently mine.

Notably, this surge in miner value coincided with transaction charges skyrocketing to $230, marking a four-fold improve in comparison with the earlier all-time excessive of $68 set in 2021.

Contemplating the metrics above, Edwards means that BTC at present trades at a “deep low cost.” It is because BTC’s value is decrease than {the electrical} prices of mining it.

Usually, this case solely lasts for just a few days each 4 years, suggesting that the value will solely take a short while to catch up and surpass this value degree, which is barely under BTC’s all-time excessive (ATH) of $73,7000, reached on March 14th.

Edwards outlines three potential outcomes within the wake of those developments. First, he anticipates a state of affairs through which the value of Bitcoin experiences a big surge.

Secondly, there’s a probability that roughly 15% of miners could also be compelled to close down on account of unfavorable economics. Lastly, Edwards means that common transaction charges are anticipated to stay considerably increased.

Based mostly on the evaluation of those metrics and the potential situations, Edwards boldly predicts that Bitcoin’s days below the $100,000 mark are “numbered.” Whereas it stays to be seen which of the three outcomes will prevail, Edwards expects a mixture of all three elements to contribute to Bitcoin’s value appreciation.

Optimum Shopping for Alternative?

Bitcoin has demonstrated important value consolidation above the $60,000 mark since Friday, following momentary drops under this threshold amid mounting anticipation for the Halving occasion.

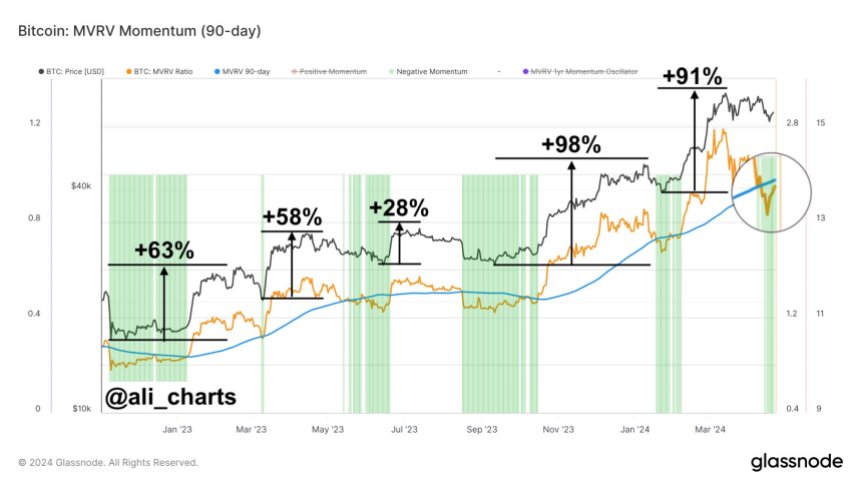

Crypto analyst Ali Martinez not too long ago analyzed Bitcoin’s present value state, suggesting {that a} potential backside might have fashioned above these ranges, rising the probability of surpassing higher resistance ranges shortly.

In accordance to Ali Martinez’s evaluation, Bitcoin strives to determine the $66,000 value degree as an important help zone. Knowledge reveals that roughly 1.54 million addresses collectively bought 747,000 BTC at this degree. If Bitcoin efficiently secures this help, it could pave the way in which for additional upward motion.

Martinez identifies Bitcoin’s subsequent important resistance ranges, between $69,900 and $71,200. These ranges signify important value boundaries for BTC bulls, and Bitcoin might encounter promoting strain at these ranges.

As well as, the analyst factors out that the Bitcoin MVRV ratio, a metric that compares the market worth of Bitcoin to its realized worth, has proven a promising sample, as seen within the chart under.

Martinez highlights that every time the MVRV ratio falls under its 90-day common since November 2022, it traditionally signifies an optimum shopping for alternative for Bitcoin. Apparently, such shopping for alternatives have resulted in common positive factors of roughly 67%.

In keeping with Martinez, based mostly on present market situations and an evaluation of the MVRV ratio, now could also be an opportune time to think about shopping for Bitcoin. The historic information and the potential for important value appreciation help this view.

BTC is buying and selling at $66,100, up 1.6% up to now 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal threat.